Bussiness

XRP volume drops 53% – So why are analysts confident of a rally to $20?

- XRP’s trading volume has declined by 53%, but the market remained undecided.

- XRP sustained consolidation leaves analysts optimistic of a rally up to $20.

With Bitcoin [BTC] declining by 5.4% to trade at $61,881 in the last seven days, altcoins have suffered the most. In fact, this period has experienced high volatility in the crypto markets.

However, XRP has experienced a sustained consolidation phase without gains or substantial losses. The altcoin was not spared from market depreciation, though, with the trading volume down by 53% in the last 24 hrs.

Despite trading volume drops, analysts are projecting more gains and upward movement. For instance, Egrag Crypto projected a bull run up to $20. In a post shared on X (formerly Twitter), he stated,

“Next target: Fib 0.5! Flip it with conviction, and then we fly to Fib 1.618 ($6.4).”

He added,

“First target is $6.4, and next is $20?”

Prevailing market sentiment

AMBCrypto’s analysis showed that XRP has been consolidating for the last seven days. The trends indicated equal strength between selling and buying pressure, without certainty over the trend.

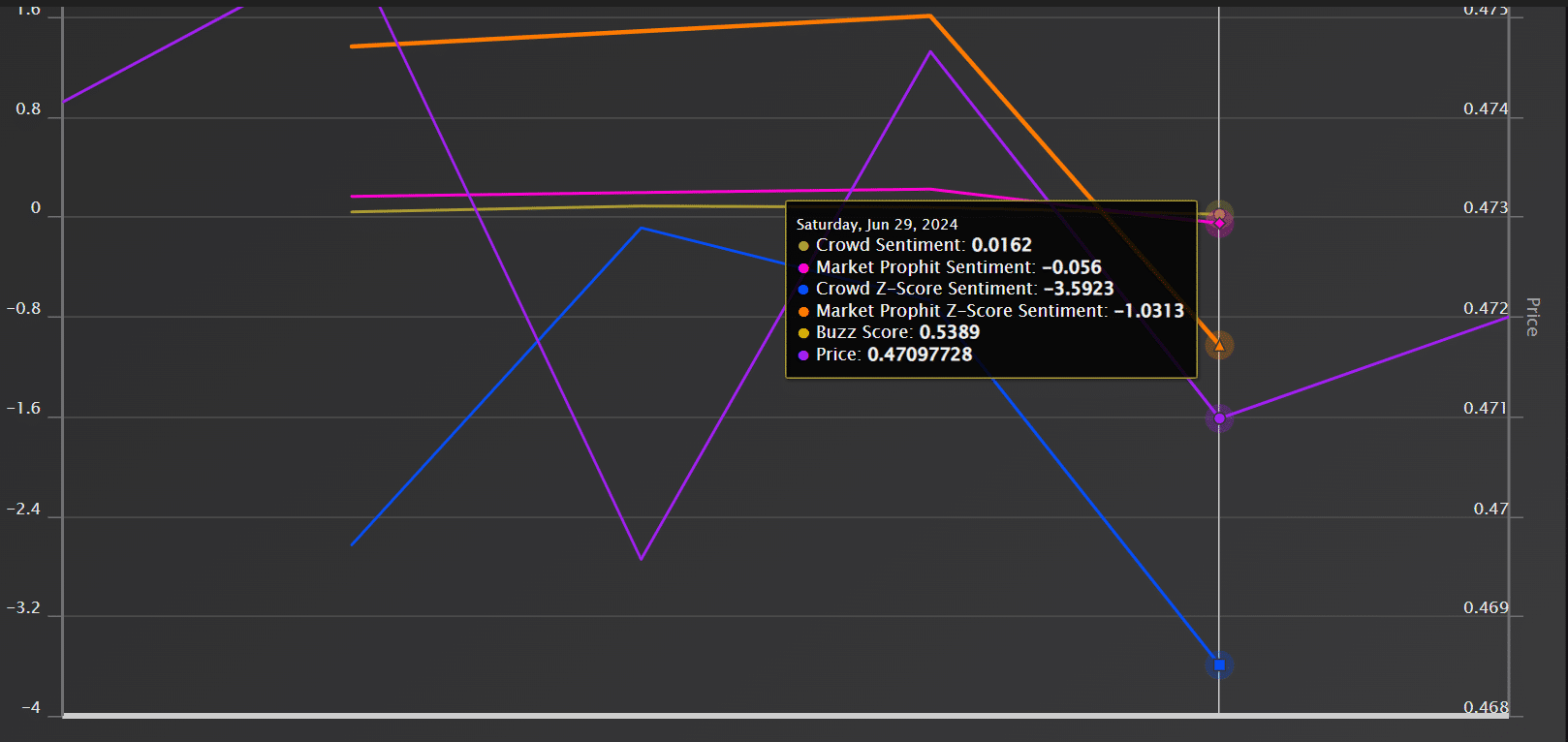

Our analysis showed mixed market sentiment at press time. Crowd sentiment was slightly positive, while Market Prophit was slightly negative, with both reporting a negative Z-score.

What price charts indicate

At press time, the Money Flow Index (MFI), the indicator that measures the strength of money flow, was at 45.

This MFI showed a balanced market; experiencing relative stability between selling and buying pressure without dominance from either side, implying a consolidation phase.

Also, the simple moving average (SMA) touched on the price, which showed market equilibrium. Based on SMA, there was market stability with a narrow price range.

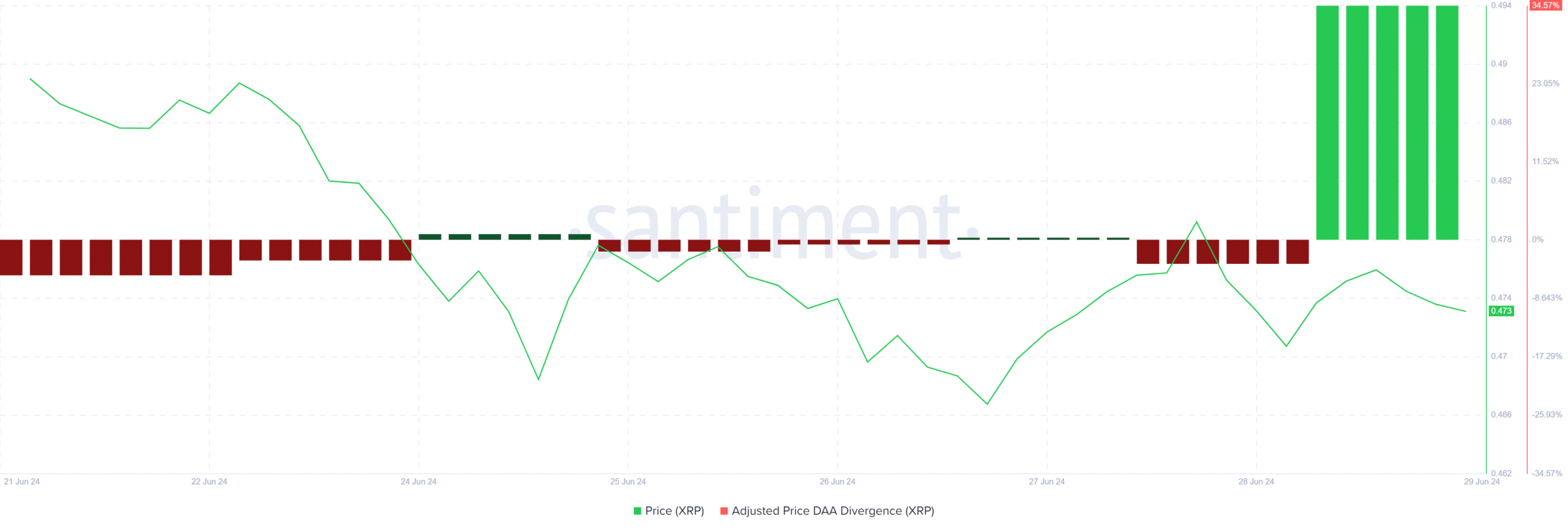

Additionally, XRP’s adjusted price DAA divergence was 34.57%. This indicated a moderate difference between price rise and daily active address.

A higher DAA divergence implied that prices were rising because of speculative buying. Thus, a moderate DAA divergence showed a slight difference between daily activities and price increases.

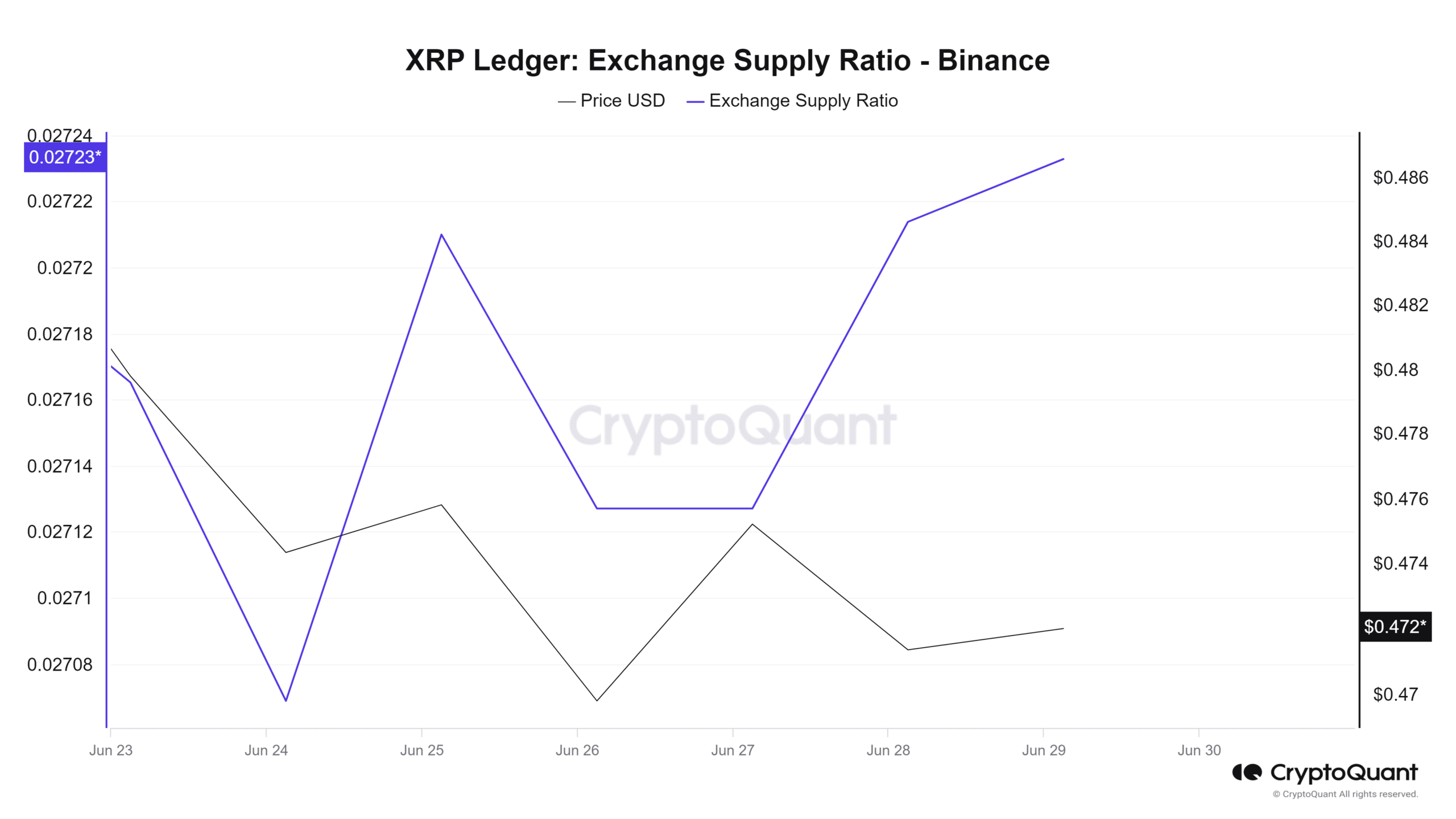

Finally, AMBCrypto’s analysis of CryptoQuant showed a slight increase in the exchange supply ratio for the last few days. During this period, the exchange supply ratio has slightly increased from 0.0270 to 0.0272.

The exchange supply ratio has remained at the equilibrium with stable supply and demand for the altcoin.

XRP at a crossroads

Notably, consolidation phases always precede a breakout. XRP traded at $0.4721 at press time, a 0.75% decline in 24 hrs.

Is your portfolio green? Check out the XRP Profit Calculator

Sellers have broken the critical support level by around $0.466, and $0.47 remains for the whole month as the support level, which shows the prevailing demand and selling pressure.

Thus, if bulls win the battle, a slight bullish reversal would drive prices to the next significant level, around $0.499. However, a slight break below this critical level will trigger a massive sell-off, pushing prices to $0.43.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)