Bussiness

Worldcoin flashes ‘Buy’ signal – Should investors get ready for $3?

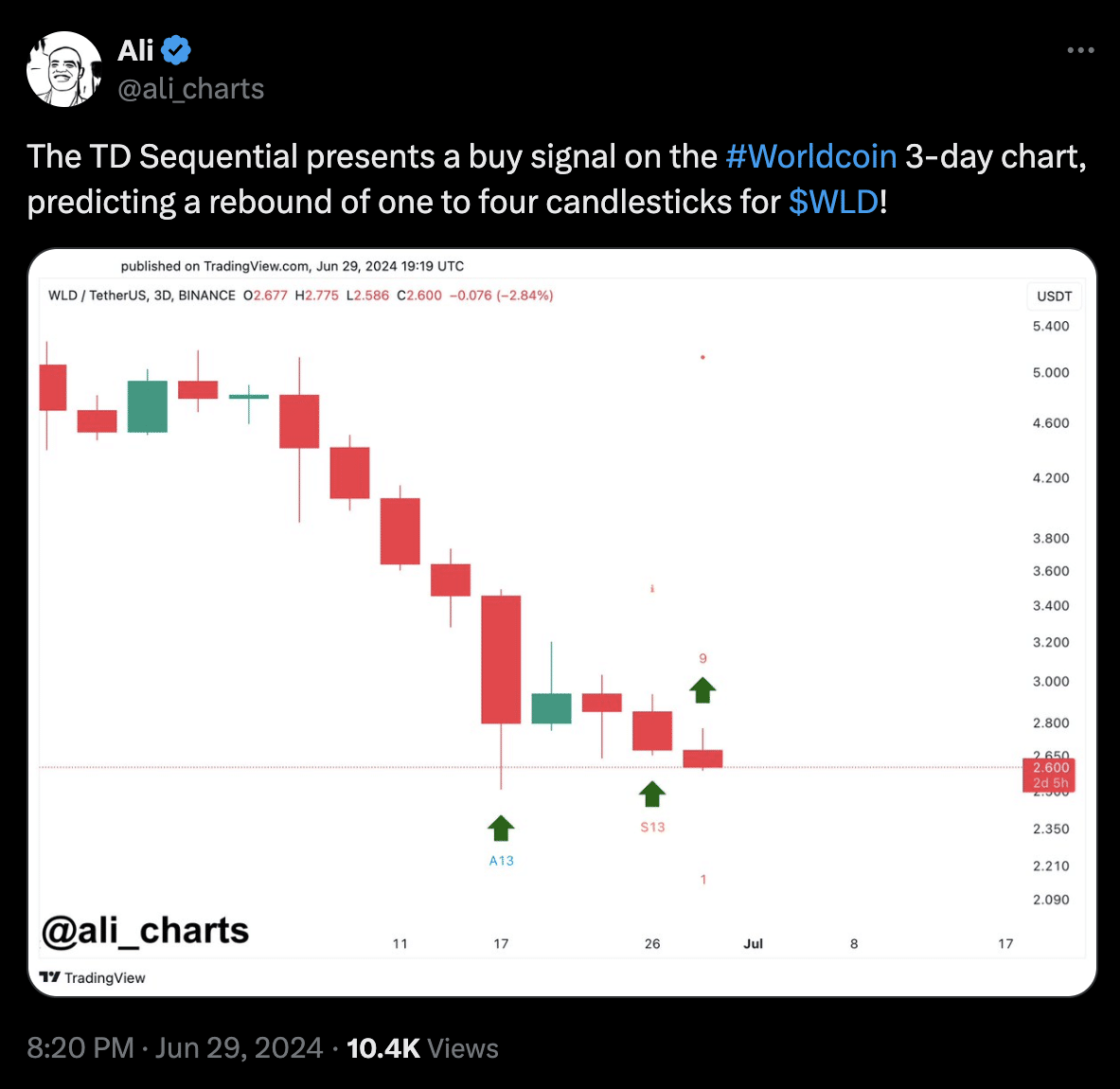

- WLD’s 3-day WLD chart revealed that sellers were exhausted, and the price looked ready to jump.

- Historical analysis of another metric points to a rise above $3.

Worldcoin [WLD], the native token of the open-source digital identification platform, has shown signs of its readiness to trade higher. Crypto analyst Ali Martiniez mentioned this in a post on X (formerly Twitter).

According to Martinez, the Tom DeMark (TD) Sequential on WLD’s 3-day chart flashed a buy signal. The TD Sequential is a technical analysis tool that identifies the exact period of trend exhaustion.

It does this by looking at a two-phase setup. One represents a 9-candlestick phase where it could spot a sell signal after prices have moved up. It established the other, using 13-candlestick countdown.

In this case, it spots a buy signal after sellers are exhausted, and this was the case with Worldcoin.

At press time, WLD’s price was $2.52. This represented a 49.08% increase within the last 30 days.

Therefore, the signal shown on the technical setup imply that the token could be on the verge of saying goodbye to some of these losses. If this happens, the price of Worldcoin could reach $30.5 as its first target.

Another metric that could help validate the price increase is the cryptocurrency’s correlation with Avalanche [AVAX]. Recently, AMBCrypto explained why AVAX’s price could continue to increase.

If this is the case, WLD might also do the same. Evidence reflected in the correlation matrix, which was 0.96. This correlation matrix ranges from -1 to +1.

When it is -1 or close to it, it means that two cryptocurrencies hardly move in the same direction.

However, when the matrix is close to the +1 reading, it implies a strong directional movement. Therefore, seeing a price increase in AVAX and WLD is something that could happen in the short term.

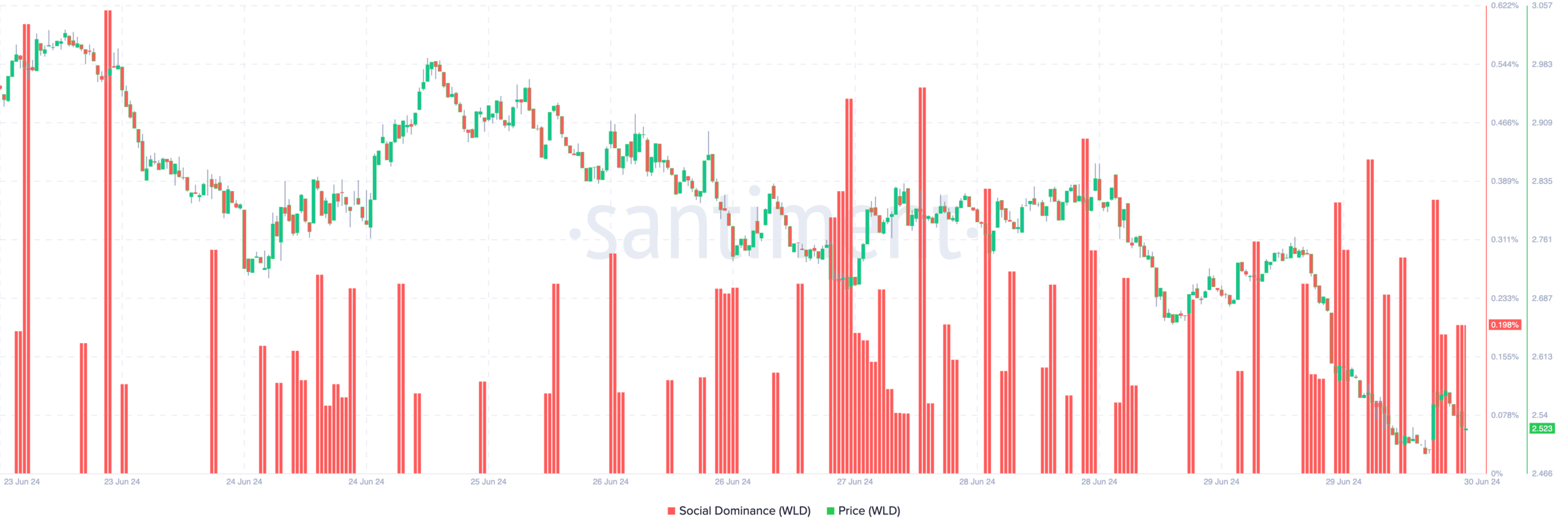

Furthermore, we evaluated Worldcoin’s social dominance. According to Santiment, Worldcoin’s social dominance had jumped to 0.198%.

Social dominance shows the share of discussions in the media that refers to a particular asset or phrase. When it increases, it means discussions about the project has improved.

However, a decrease in the metric implies that the conversations around an asset is falling. Historically, a rise in social dominance helps to create buzz that leads to higher demand.

On previous occasions, this has led to a price increase for WLD. This time, it could be the same. Therefore, the prediction to $3 or above could well in line. But market participants need to watch out.

Is your portfolio green? Check the Worldcoin Profit Calculator

If discussions about Worldcoin get overheated, the social dominance might hit an extremely high level. This could mark a local top for the price, hinting at a likely correction.

However, if this does not happen, WLD might experience a notable rally in the coming weeks.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)