Jobs

Why The Jobs Report Could Deliver Fireworks

RomoloTavani

It’s 4th of July Week! Personally, it’s my favorite holiday ever. Something about America’s independence, the establishment of the first modern democratic republic, and the greatest nation on earth appeals to me. Also, I love the fireworks. Speaking of fireworks, we could see fireworks this week, as the highly anticipated jobs report comes out on Friday.

We also have the Fed Chair’s speech, the FOMC minutes, and other crucial data during this holiday-shortened week. Moreover, earnings season is right around the corner, and this could be one of the most exciting seasons we have ever seen.

Despite sky-high AI expectations, we could still see better-than-anticipated Q2 earnings results and higher-than-expected Q3 and full-year guidance from many top tech firms and other companies. Also, inflation has trended lower again recently and should continue moderating, in my view. This dynamic should increase the probability of a September rate cut, which the market should react favorably to.

There’s no denying that valuations are elevated “historically.” However, P/E ratios and other multiples could continue rising as earnings increase. Furthermore, the Fed will probably start introducing an easier monetary environment soon, which could also enable valuations to rise.

Despite the possibility for near-term turbulence due to the overheated technical conditions and relatively high valuations, the bullish dynamic should persist, in my view. Thus, the market could achieve new ATHs in H2 and continue expanding into year-end and 2025. My S&P 500 “SPX” (SP500) year-end target remains 6,000.

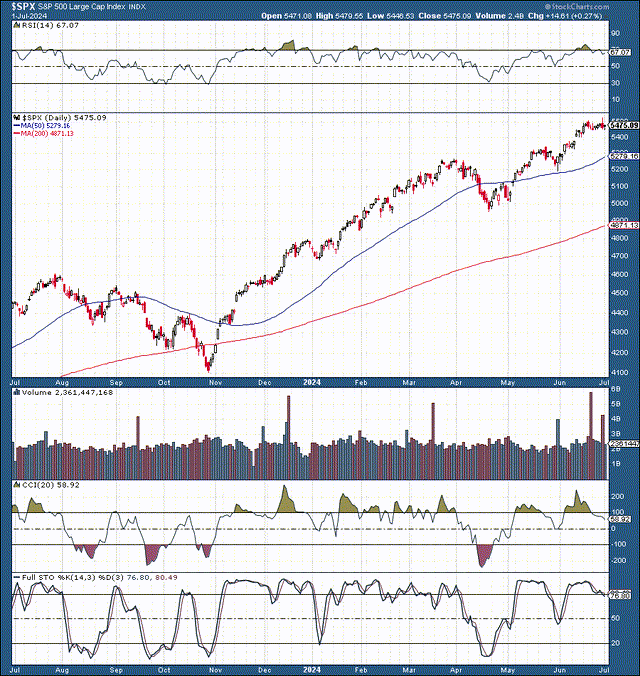

The Technical Image

SPX (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools )

Many stocks bottomed around October 2022 after an epic decline in high-quality tech stocks and other sectors. Therefore, despite the extraordinary gains, this bull market is still relatively young. Thus, the intermediate and long-term images remain constructive. Nonetheless, stocks could still go through a broad market pullback (in the near term).

As my previous market update article discussed, we could see more corrections from many high-flying stocks, leading the major averages to post some temporary losses. Some troubling technical signals include the RSI forming a lower high, the CCI showing deceleration, the full stochastic crossing below 80, implying that momentum is worsening, and more. In a base case scenario, we may see a pullback to around the 5,250 support level, roughly a 5% decline from the recent ATHs.

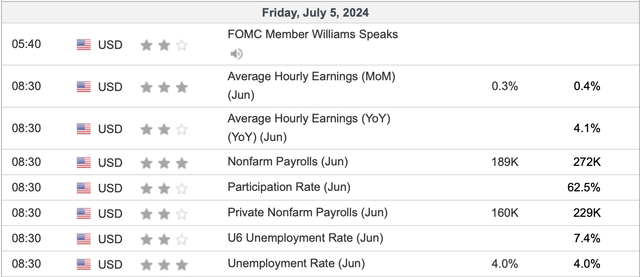

What’s The Ideal Jobs Number?

Jobs data (Investing.com – Stock Market Quotes & Financial News )

The all-important jobs report is coming soon (Friday). The market expects 189K jobs, including 160K private payrolls. Last month’s read was considerably higher than expected. While this dynamic seems constructive for the broader economy, it is not what we want to see concerning the rate-cut probabilities. A higher than expected jobs number would likely decrease the probability of a rate cut in September, possibly pushing out the first rate decrease closer to year-end. Preferably, we will get a “goldilocks” number around 100-150K.

Earnings Season – A Solid Catalyst

Earnings season is approaching fast, with big banks and other bellwether companies starting to report next Friday. Shortly after, Tesla (TSLA), Netflix (NFLX), Microsoft (MSFT), Alphabet (GOOG) (GOOGL), and other tech titans will report Q2 results. Given the AI momentum, improving growth, increased efficiency, and other constructive factors, we will likely see another solid earnings season. Moreover, investors are looking forward to guidance, and provided the excellent momentum and the AI-dynmaic future guidance may be better than expected at many firms.

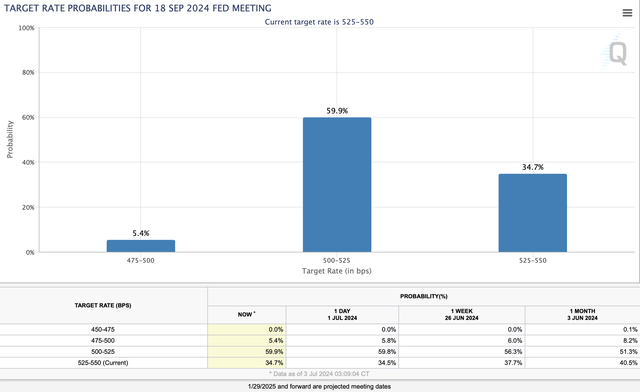

September Is Prime For A Rate Cut

Rate probabilities (CMEGroup.com)

The probability of a September rate cut is about 65%, indicating a strong likelihood that the Fed will begin cutting rates soon. Moreover, the probability for a September rate cut should increase if the upcoming inflation, jobs, and other data come in positively. By positively, I mean that inflation needs to continue cooling, while jobs and general economic indicators can come in around the estimates or even slightly worse than expected.

An easier monetary atmosphere is highly constructive for high-quality stocks and other risk assets. Also, once the Fed starts cutting rates, it’s not just one and done. Instead, the Fed could cut rates all the way down to zero, and we may even see negative rates at some point.

Another factor to consider is that the Fed may “tolerate” higher inflation, as it did in previous cycles. Furthermore, at some point, we may encounter an unforeseen “crisis,” which could lead to rounds of QE in the future. Now, we’re only starting to ease things with rate cuts, but there could be so much more (trillions of dollars) of liquidity down the line, in my view.

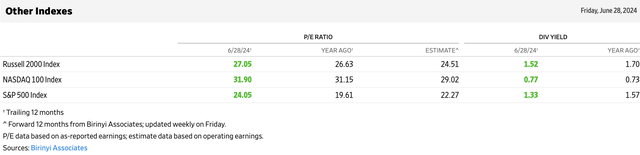

The Valuation Perspective – High, But Not Peak

Major average valuations (WSJ.com )

As discussed in my previous assessment, I believe the best way to measure corporate earnings power is with the non-GAAP P/E ratio. The non-GAAP P/E provides a company’s earnings power without the one-time costs, SBC, and other elements that skew earnings. While a TTM P/E ratio of 24 for the SPX is not cheap historically, it may still be inexpensive in this market. Please, allow me to explain.

The SPX’s forward P/E ratio is around 22 here. The likely decline from a 24 P/E to a 22 P/E ratio signals solid earnings potential. Moreover, many companies could, and in my view, will beat lowballed consensus estimates. This dynamic implies that the SPX’s forward P/E ratio may be around 22-21 or even lower here.

Likewise, the sub-30 forward P/E ratio for the Nasdaq doesn’t seem expensive, provided the AI-enabled increased growth and efficiency dynamic. The R2K appears most attractive, as the mid/small cap index appears cheap, around a 24-forward P/E.

Investors could be pushed toward risk assets and high-quality stocks (particularly) as increased liquidity looks to find a home. In my view, investing in 1-2% or zero-rate bonds will make no sense for many investors, especially if inflation rises. Thus, there is a high probability that earnings and liquidity will increase. Also, inflation will likely rise, and stock valuations could expand to levels higher than expected and may reach new records before this bull market is done.

Additionally, we can’t forget the AI prospects and expansion potential. AI is still in the early stages of development, with likely much more upside ahead, in my view. If comparing the current AI boom to the 1990s internet cycle, we may be around 1995-1996, but not 1999. I also like using the baseball analogy. Over the last two years, I’ve said that we were likely around the 3-4th inning, so now we may be around the 4-5th inning, with a long ballgame ahead.

The increasing liquidity, an easier monetary stance from the Fed, the AI dynamic, and other constructive factors could enable valuations to rise more than many market participants expect. Due to this factor and other favorable elements, I am keeping my year-end SPX target at 6,000. Also, I believe that the robust market momentum could continue into 2025 and beyond.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)