Shopping

What Are Merchants in Mexico Doing to Boost In-Store Sales?

Across Mexico, more consumers are turning to digital shopping features that offer savings and improve convenience while shopping in the store. Consumers enjoy walking into brick-and-mortar locations, but they also want the ease of using digital shopping features. Enter Click-and-Mortar™ shopping. PYMNTS Intelligence finds that when merchants in Mexico offer Click-and-Mortar™ features, customers are happier about their experiences.

That means there’s a chance for stores in Mexico to step up their game by both adding digital features and making those already available in the market more visible.

These are just some of the findings in the “2024 Global Digital Shopping Index: Mexico Edition.” Visa Acceptance Solutions commissioned this study, and PYMNTS Intelligence conducted the research and produced the report. For this edition, we surveyed 2,133 consumers and 563 merchants in Mexico to capture trends in consumer behavior and document the rise of Click-and-Mortar™ shopping experiences. We also drew comparative insights from a larger survey of 13,904 consumers and 3,512 merchants across seven countries held from Sept. 27, 2023, to Dec. 1, 2023.

Other key findings from the report include the following.

In Mexico, 83% of consumers prefer in-store shopping, and 37% enhance their experience with digital features or pickup options.

Nearly 2 in 5 consumers in Mexico use the Click-and-Mortar™ resources merchants already have available. This hybrid shopping model combines the benefits of in-store experiences with the savings and convenience of digital aids. For example, consumers in a physical store might use mobile apps for checking prices or product information.

Nearly 2 in 5 consumers in Mexico use the Click-and-Mortar™ resources merchants already have available. This hybrid shopping model combines the benefits of in-store experiences with the savings and convenience of digital aids. For example, consumers in a physical store might use mobile apps for checking prices or product information.

However, Mexico trails other countries’ Click-and-Mortar™ adoption rate, indicating an untapped potential for digital shopping solutions. The report explores how the country’s merchants can use digital features to improve customer satisfaction.

Mexico’s merchants can do more to improve access to digital features.

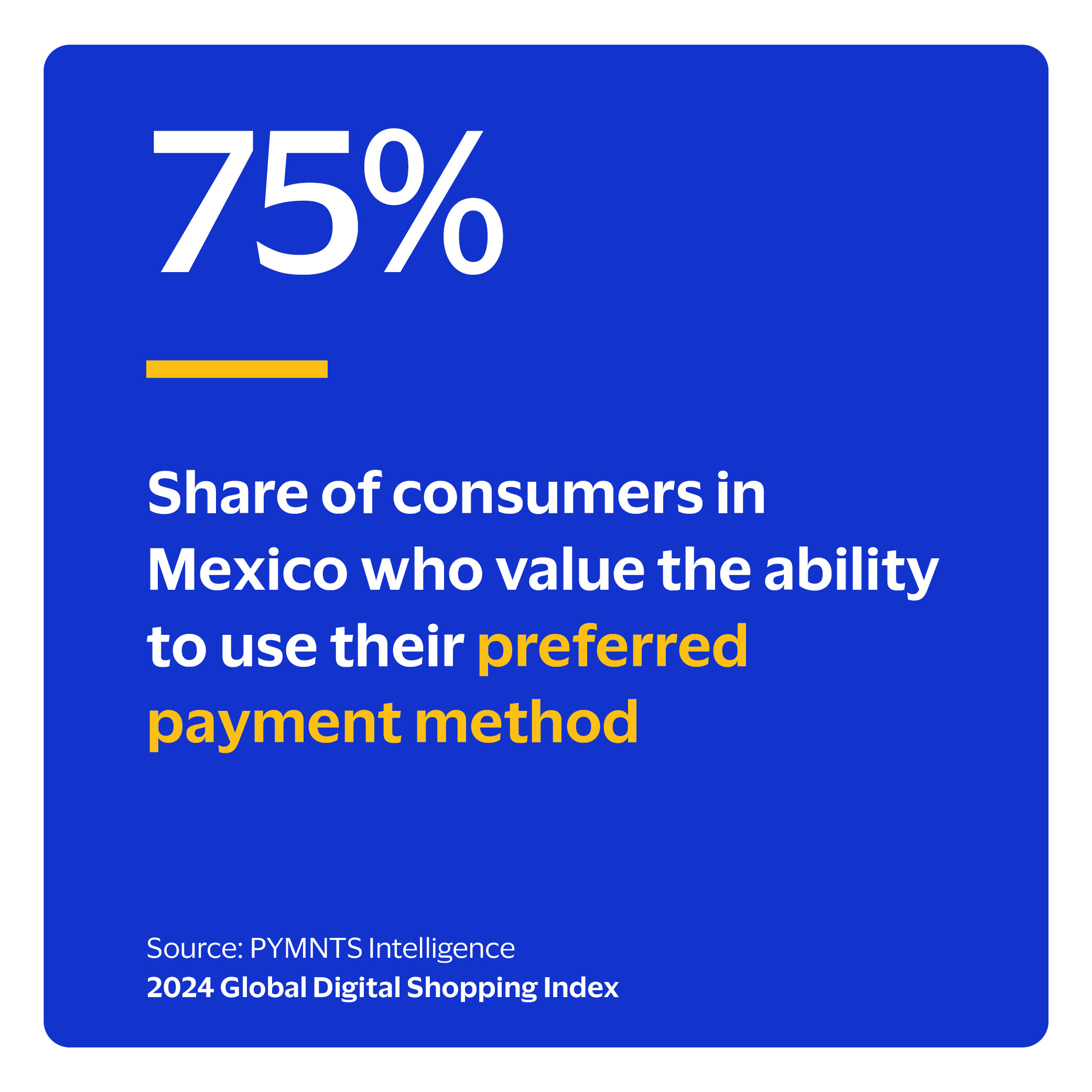

A gap exists between merchants’ supply of digital features and consumers’ demand. The data shows a 17% rise in the share of consumers heavily relying on digital shopping features since last year. Mexico had the highest increase among surveyed markets.

Merchants are not yet keeping pace with this growing demand. Still, Mexico’s feature gap presents an opportunity for merchants to align their feature offerings with consumers’ preferences.

Merchants are meeting consumers’ feature demands for the first time in years.

Mexico’s Click-and-Mortar™ shopping rates have hovered between 32% and 37% in the last three years. Local shoppers have not followed the global trend of increased digital feature adoption. The number of features consumers want but cannot find has remained at 10 since 2022. This suggests that merchants in Mexico have not been as proactive as they could be.

Mexico’s Click-and-Mortar™ shopping rates have hovered between 32% and 37% in the last three years. Local shoppers have not followed the global trend of increased digital feature adoption. The number of features consumers want but cannot find has remained at 10 since 2022. This suggests that merchants in Mexico have not been as proactive as they could be.

To improve their prospects, merchants should introduce features that are in demand but not widely available, like promo codes and price matching, for example. Merchants could gain an edge by providing Click-and-Mortar™ features that align digital enhancements with consumers’ preference for physical stores.

In-store shopping is still the norm in Mexico. Supplementing the brick-and-mortar experience with digital features represents an opportunity for merchants to improve their revenue prospects. Download the report to learn more about trends in consumers’ interest in and use of digital shopping features in Mexico.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)