(Kitco News) – The gold market had plenty of significant economic data and in-depth Fed speak to digest this week, and the result was one of the most dramatic moves for precious metals markets this year.

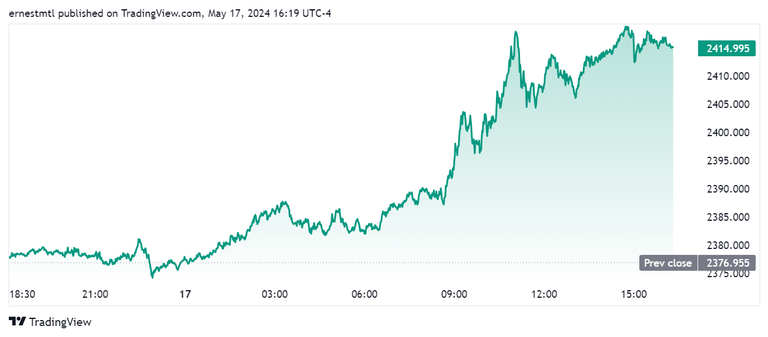

Spot gold kicked off the week trading at $2,361.17 and spent Sunday and Monday treading water while eagerly awaiting the key inflation data to come. Tuesday morning brought a mixed PPI report, but markets took comfort in comments from Fed chair Jerome Powell two hours later when he told the Foreign Bankers’ Association that he was confident the central bank would not need to hike again. Gold prices turned positive on the week early Wednesday morning, and when the April CPI report showed month-over-month improvement, that was all traders needed to begin pushing the yellow metal higher still.

Wednesday evening’s triple top at the $2,400 level stalled momentum in the near term, with spot gold trending steadily downwards through Thursday’s session. But by the North American market open on Friday, the bulls had returned in force, and once they propelled gold decisively through $2,400 per ounce around 10:00 am EDT, they never looked back.

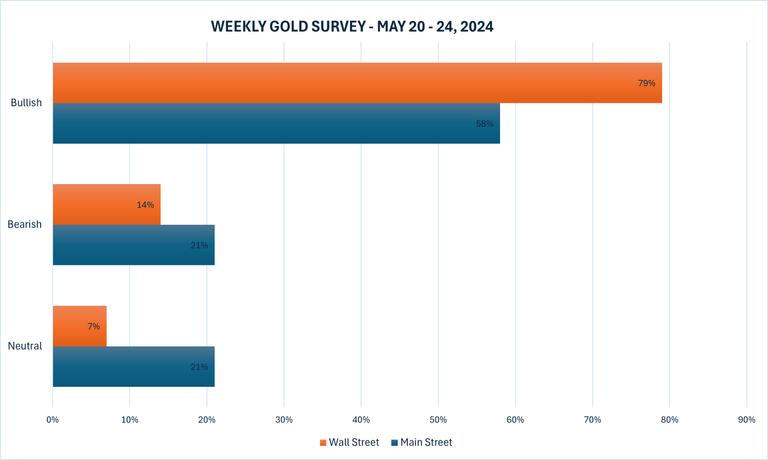

The latest Kitco News Weekly Gold Survey has the overwhelming majority of industry experts believing gold prices could reach or surpass their all-time highs, while retail traders are a little more restrained on the precious metal’s prospects.

“I am bullish on Gold for the coming week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “The US Dollar appears to be backing off a bit along with treasury yields. Also, if it does break out over $2400 resistance, technically that could open the door to a potential run at the $2,500 big round number.”

James Stanley, senior market strategist at Forex.com, also believes gold has further to fly in the near term.

“Bulls put on a show this week and the move was pretty clean for the most part,” he said. “That continued the breakout from the falling wedge/bull flag in the prior week, and this week was all higher-highs and lows with a really strong move on Friday morning.”

“Chasing fresh highs is always a challenge but the 2400 level has quite a bit of reference given the tests last month, and so far on Friday there’s been indications of acceptance above that price,” Stanley added. “This keeps the door open for a possible run up to $2500.”

“Unchanged,” said Adrian Day, President of Adrian Day Asset Management, who expects gold will have trouble holding Friday’s lofty highs. “We shall likely see another attempt to cross $2,400 and then a small retreat. But gold’s resilience has been impressive, and sooner rather than later it will breach that level.”

“Dip buyers showed up in a big way over the past week, and the buzz around gold is building,” said Adam Button, head of currency strategy at Forexlive.com. “There are signs the US economy is slowing; more of that would bring rate cuts forward.”

Button said that this recent move is a continuation of the broader rally, and it’s being driven by the same source.

“This rally started in China, and China continues to show up,” he said, adding that recent data show Turkey and much of the Middle East are also buying bullion.

Button pointed out that this week’s meeting between Russian President Vladimir Putin and Chinese Premier Xi Jinping is also very bullish for gold prices.

“If you’re a gold bull, the picture of Xi and Putin hugging is as good as it gets,” he said. “They’re trying to create a multipolar world, and you can’t do that if you’re relying on the dollar.”

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and after Friday’s breakout, the bullish sentiment was as strong as it’s been this year. Eleven experts, representing 79%, expected to see gold prices climb higher still next week, with only two analysts, or 14%, predicting a price decline. One lone expert, representing 7% of the total, saw gold trending sideways during the coming week.

Meanwhile, 144 votes were cast in Kitco’s online poll, with Main Street investors positive but not to the same degree. 83 retail traders, or 58%, looked for gold to rise next week. Another 30, or 21%, predicted it would be lower, while 31 respondents, representing 21%, expect the precious metal to remain rangebound during the week ahead.

After this week’s inflation data drama, markets will get a bit of a break next week. Wednesday will see the release of U.S. existing home sales for April, along with the FOMC minutes from the April/May monetary policy meeting. On Thursday, markets will receive the S&P Flash Manufacturing and Service Sector PMIs, weekly jobless claims, and April new home sales, and Friday will feature the April durable goods report.

Marc Chandler, Managing Director at Bannockburn Global Forex, sees evidence that gold prices are a little too high after this week’s breakout.

“Gold reclaimed the $2400 level ahead of the weekend and is poised to post a record high close (spot market),” he said. “The momentum indicators give the yellow metal scope to challenge the intraday high from April 12 near $2431.50. A note of caution is from the Bollinger Band, set two standard deviations above the 20-day moving average. Gold is trading above it. Also, I suspect that the US rate adjustment (lower with the 2yr yield bottoming near 4.70%) and softer dollar (euro is up for five consecutive weeks) is over or nearly so.”

Darin Newsom, Senior Market Analyst at Barchart.com, thinks gold may give back some of its recent gains.

“Purely a technical read as June looks to be nearing a potential top of its 5-wave short-term uptrend,” he said. “Daily stochastics indicate the contract is sharply overbought. As of early Friday morning, I have a reversal pattern telling me the trend is set to change, but there is a lot of week left today. We’ll see what happens through Friday’s close or possibly early Monday morning.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, was watching the entire commodity complex catch fire on Friday, with precious metals leading the way.

“We’re at $2,410, we’re back up to high,” he said. “Silver’s caught fire here, copper’s caught fire as an industrial metal, platinum. It’s really been a hell of a ride.”

“You can make an argument that crude’s underperformed, still up a little over 10 on the year, nothing crazy,” he added. “But if that gets going that’s going to bring everything else up. We’ll probably get a real hot summer here.”

Lusk told Kitco News that the combination of high inflation, massive debt issuance, and runaway central bank currency printing is pushing market participants into precious metals and other commodities.

“We’ve just printed too much money, and now you see the result of it,” he said. “Where are they putting all the money? Aside from, buying dips in equities, big money is going into metals as an inflation hedge. And not just us, but even economies around the world are doing the same thing. They’re increasing their holdings, and nobody knows where to be.”

Lusk said that he can’t imagine a better situation than the current one to drive gold prices higher.

“It’s a perfect storm of bullishness,” he said. “You have geopolitical worries. You had the pandemic. And what does our government do right after that? Prints more for all these funding projects that really haven’t started yet. Now you’re in a campaign year, so all those things, as they relate to gold, just create more uncertainties on the back end, and that’s why you continue to run here.”

“It just goes back to the old adage, any time we create more of something, it’s worth less,” Lusk said.

“Gold is headed higher, likely to take out $2,448.8 in the days ahead,” said Michael Moor, Founder of Moor Analytics. “We held exhaustion at $2,288.5 with a $2,285.2 low and rallied $138.5. The break back above $2,302 (+1.6 per/hour) has brought in $121.7 of strength. We took out final exhaustion at $2,385.3.”

And Kitco Senior Analyst Jim Wyckoff sees further gains for gold prices next week. “Higher, as charts firmly bullish,” he said.

Spot gold last traded at $2,414.99 per ounce at the time of writing, up 1.60% on the day and 2.31% on the week.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)