Infra

UTF: Infrastructure Companies Will Benefit From A.I. And UTF Should Benefit Yielding 7.9%

PM Images

I think that most people would agree that the A.I wave is showing no signs of slowing down. Nvidia Corporation (NVDA) just delivered its largest quarter, as they generated $26.04 billion in revenue. This is a YoY increase of 262.12%, as they generated $7.19 billion of revenue in Q1 of 2023. News broke today that Elon Musk is estimating that Tesla (TSLA) will spend up to $4 billion on artificial intelligence (A.I.) chips with NVDA in 2024.

There is currently a race happening for compute, and companies can’t get their hands on enough chips. Whether it’s TSLA or other large-cap technology companies like Amazon (AMZN), the amount of capital being spent on CapEx is staggering. The A.I. story isn’t slowing down, and I believe the Cohen & Steers Infrastructure Fund (NYSE:UTF) is an interesting way to indirectly benefit from the A.I. wave that’s happening.

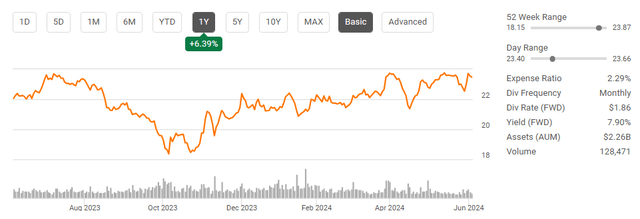

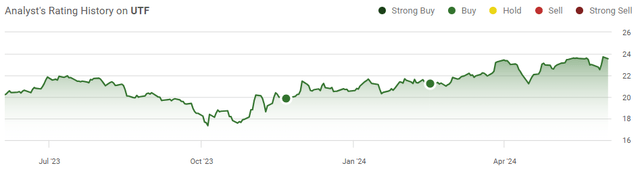

Over the next 5-10 years, the amount of infrastructure that will be needed to support the additional compute should be extensive. There will need to be construction for new data centers, increased grid capacity and utility output, and more oil and gas needed to keep everything going. UTF is one of my favorite alternative ways to benefit from A.I. as there will be a stronger demand for these services as CapEx spending increases, and UTF’s holdings should be direct beneficiaries to this narrative. Today, shares of UTF are yielding 7.9%, and I think we’re going to see further capital appreciation in this closed-end fund (CEF) over the next several years while the distributions keep rolling in.

Following up on my previous article about UTF

I previously wrote an article about UTF on February 16th, 2024 (can be read here). Since then, shares of UTF have appreciated by 8.31%, while its total return after the distributions has been 10.50% compared to the S&P 500, climbing 5.17%. In that article, I discussed why I felt that UTF would benefit from the infrastructure bill and how it was one of my preferred income plays. Now that Q1 2024 is winding down and the Magnificent Seven has reported earnings, I wanted to follow up on UTF with a new premise.

The amount of money being spent on A.I. chips is astonishing, and companies are in a compute race as I write this article. The amount of infrastructure needed for new data centers is going to be immense, and I believe UTF is going to be an indirect beneficiary as its underlying holdings will play a critical role in building and supporting the expansion technology companies are currently undergoing.

Risks to my investment thesis

I could be incorrect on this perspective, and UTF’s holdings, such as Southern Company (SO), NextEra Energy (NEE), and Enbridge (ENB) may not benefit at all from the A.I. wave. Companies may not need to build out as much capacity as I believe they will need, and infrastructure companies may not see a meaningful increase to their revenue. The infrastructure bill could also see some difficulties if a new administration comes in and tries to withhold funding for some projects. We could also see new laws passed that make it harder for fossil fuel companies and utility companies that don’t utilize renewable energy to operate. Just because I am bullish on UTF and believe that there is an indirect benefit that will occur doesn’t mean it will happen. UTF could also reduce its distribution, and its yield could fall under the risk-free rate of return, making it less appealing to income investors.

Why I believe the A.I. wave is going to be bullish for infrastructure

In the Amazon Q1 2024 press release (can be read here), they stated that they are planning to build 2 data center complexes in Mississippi with an estimated cost of $10 billion. This would mark the largest single capital investment in Mississippi’s history. This endeavor is also expected to generate at least 1,000 jobs throughout the surrounding areas of Mississippi. On Microsoft’s (MSFT) earnings call (can be read here), Amy Hood (MSFT CFO) stated that their CapEx, including finance leases, came out to $14 billion to support its cloud demand, which was inclusive of scaling its A.I. infrastructure.

Over the trailing twelve months (TTM), Microsoft has spent $39.56 billion on CapEx expenses. On Meta Platforms (META) Q1 earnings call (can be read here), Mark Zuckerberg discussed how they are scaling their CapEx commitment and energy expenses to compete in the A.I. realm. META spent $6.7 billion in Q1 on CapEx and finance leases and expects to spend $35 – $40 billion on CapEx in 2024.

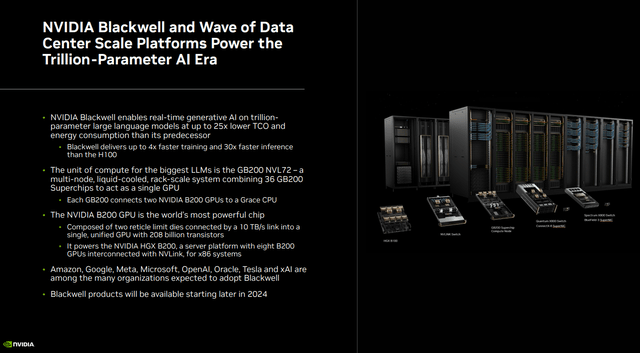

According to Forbs (can be read here), every data center that powers A.I. utilizes the same amount of power as a small city. Currently, data centers account for 1.5% of the global utilization rate in the electric demand, and by 2027, they will require at least 85 terawatt hours and utilize as much power as Argentina. There are some estimates that indicate by 2030, computing and communications technology will consume up to 21% of the global electricity produced. There are some projections that Nvidia will ship 1.5 million A.I. server units per year by 2027, which could consume 85.4 terawatt hours of electricity each year under a full load.

Each year, the amount of chips being purchased and shipped by just Nvidia could add the equivalent of a small country’s demand to the global electricity requirements. Nvidia announced on their recent earnings release that they will be introducing the Blackwell product line, which is expected to be purchased by many of the mega and large-cap technology companies.

I am looking to connect the dots, and investing in technology probably won’t be the only way to benefit from the growing demand in A.I. infrastructure. As companies continue to purchase products, they will need to expand their data center footprint. This should benefit all sorts of companies, from technology infrastructure companies to actual companies that will build the facilities. All types of requirements are needed to build a data center, including heating and cooling, architectural, plumbing, electrical, cement, contractors, steel, networking equipment, security, electric, machinery, and oil and gas. Different types of infrastructure will need to be built, from the actual data centers to offices, and additional infrastructure will require ongoing maintenance and energy.

Why UTF is becoming one of the ways I am indirectly investing in A.I.

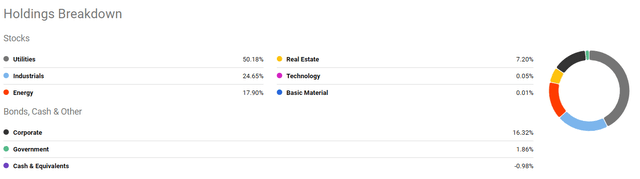

I love investing in technology, and while I wish I could say I am an Nvidia shareholder, I am not. I am invested in Amazon, Meta Platforms, Apple (AAPL), Alphabet (GOOGL), and Palantir (PLTR), which should all benefit from A.I. over the next several years. UTF is made up of companies throughout the infrastructure sector, from utilities to basic materials. I believe that all of these sectors will benefit over the next decade as the demand for their services expand. We are going to need more of everything to fulfill the requirements of tomorrow, and I am individually invested in Southern Company (SO), and Enbridge (ENB), which are in UTF’s top-10 holdings.

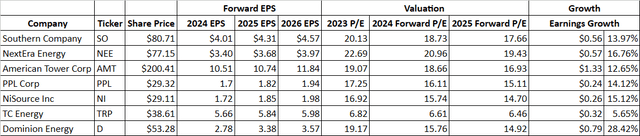

When I look at UTF’s largest holdings, I am seeing a lot of EPS growth over the next several years. These 8 companies are expected to add an average of $0.58 in EPS or 15.24% over the next 2 years and trade at just 17.44 times 2024 earnings. The group trades at an average of 15.03 times 2026 earnings. A.I. could provide tailwinds that allow them to benefit for much longer than 2 years, and this could mean that they all expand their EPS while increasing their dividends. This would allow UTF to appreciate in value and potentially increase its monthly distributions.

Steven Fiorillo, Seeking Alpha

UTF currently pays a $1.86 distribution per share, which works out to $0.16 per month. Since its inception, UTF has distributed $34.21 of income and has never missed a distribution. UTF didn’t cut the distribution during the pandemic, and after going back to a monthly distribution in 2016, they increased the distribution to $0.16 in 2018. UTF went public on 3/28/04 at $20 per share, and since then, it has generated 171.03% of its share price in distributable income. UTF has established a long track record of generating income for its shareholders, and I am going to ride this income wave along with the A.I. wave well after the Fed starts cutting rates.

Conclusion

I don’t think anyone can dispute the A.I. movement, and with the amount of capital the mega caps are spending on A.I. chips, there will be a massive amount of infrastructure spend to harness their power for training A.I. models and advancing technology. I think that UTF has created a strong portfolio of companies that will directly benefit from the infrastructure spending needed to support all of the hardware purchased. I believe that UTF could allow investors to generate capital appreciation while producing yields that outpace the risk-free rate of return. Whenever the Fed decides to cut rates, UTF will probably look even more attractive as the spread between their yield and the risk-free rate of return could expand. Overall, I think utilities and energy companies are undervalued, and UTF is an easy way to invest in a sector with substantial growth on the horizon.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)