Bussiness

The stock market has already chosen a winner in the 2024 presidential election

The U.S. stock market is one of the best predictors of whether the incumbent party will win a presidential election.

That’s important to know because of the widely mixed messages of the electronic prediction markets, to which many until now have turned to get reliable predictions. Many fans of those markets have of late become disillusioned by these mixed messages. For example, a survey of a handful of the best-known prediction markets earlier this week revealed that, depending on your focus, the probability that President Joe Biden will win re-election currently ranges from below 38% to a high of 76%. That’s so wide a range that it’s difficult to place much weight on any of the predictions.

Most Read from MarketWatch

What about other economic, financial and sentiment indicators? To find out, I analyzed the U.S. stock market, the economy as measured by real GDP, the Conference Board’s consumer-confidence index and the University of Michigan’s consumer-sentiment survey. In each case, I focused on their year-to-date changes as of Election Day. Only one — the stock market — was significantly correlated with the incumbent party’s chance of winning (at the 95% confidence level that statisticians often use when deciding if a pattern is genuine).

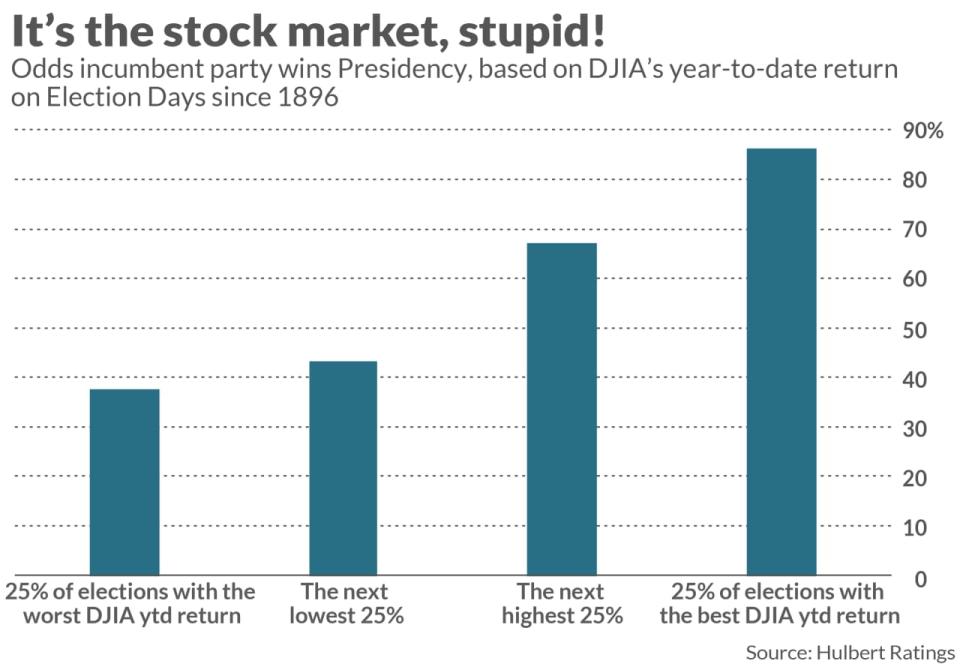

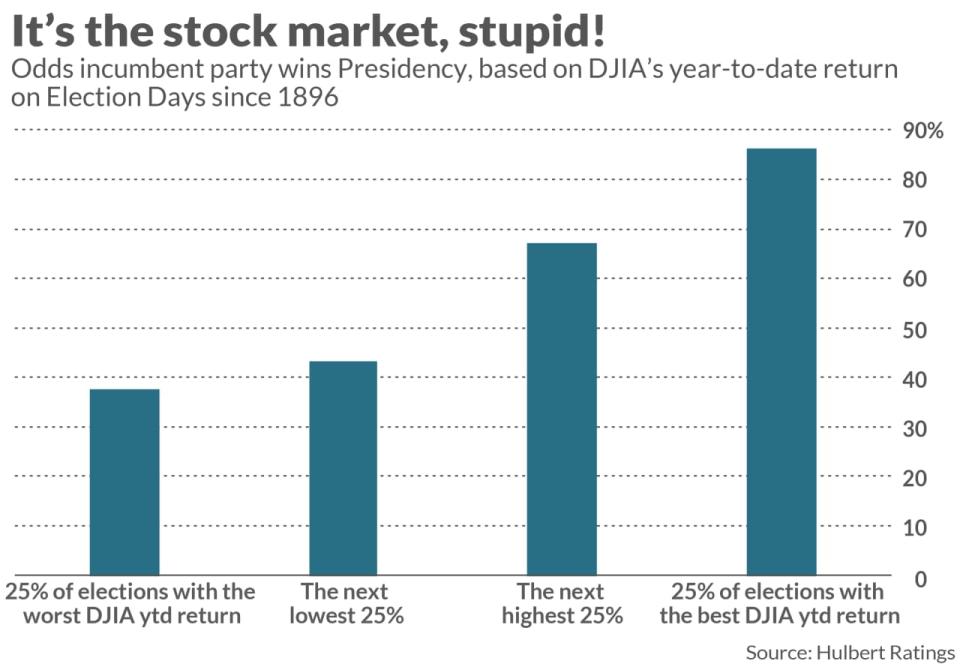

What I found is summarized in the chart below. To construct it, I segregated all presidential elections since the Dow Jones Industrial Average DJIA was established in 1896 into four equal-sized groups based on its year-to-date return on Election Day. As you can see, the probabilities of the incumbent party retaining the White House grow in lockstep with year-to-date performance.

Based on the historical correlations and the Dow’s year-to-date price-only gain of 5.6%, Biden’s chances of winning re-election are 58.8%. Those odds will rise if the stock market gains more between now and Election Day, and fall if the market declines.

Even if the electronic prediction markets weren’t sending such mixed messages, it would be hard to show that their track records are better than the stock market’s. That’s because, without a large sample, it’s very difficult for a pattern to meet traditional standards of statistical significance. The Iowa Electronic Markets (IEM), one of the oldest such instruments, began in 1988, for example. So its track record encompasses just nine presidential elections.

James Carville, former President Bill Clinton’s influential strategist during the 1992 election, famously said, “It’s the economy, stupid.” He used the line to remind Clinton’s campaign staff that all other issues pale in comparison to the economy as a determinant of whether the incumbent party retains the White House. Perhaps we should modify Carville’s line to “It’s the stock market, stupid.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at .

Read on:

Stock gains in the summer are weaker when the market has been strong

Are market-beating fund managers truly skilled or just lucky?

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)