Bussiness

Tesla (NASDAQ:TSLA) Braces for First Consecutive Quarterly Decline Amid Rising Competition – TipRanks.com

Tesla (NASDAQ:TSLA) is expected to announce its second-quarter deliveries on Tuesday. The EV major’s vehicle deliveries are projected to fall by 3.7%, marking the first consecutive quarterly decline. The company is facing intensifying competition in China and a slowdown in demand for its vehicles.

According to a Reuters report, analysts estimate that Tesla will deliver 438,019 vehicles in the second quarter.

Tesla Is Facing Rising Challenges

Earlier this year, the company warned of lower vehicle deliveries due to challenges following years of rapid growth. As consumers shift to cheaper hybrids, Tesla is left with higher inventory, leading TSLA to slash prices and offer more incentives like cheaper financing and leases.

In China, Tesla faces stiff competition from local companies like XPeng (NYSE:XPEV) and a consumer shift to locally manufactured EVs or hybrid vehicles. Tesla’s revenues from China declined by 6.1% year-over-year in Q1 to $4.6 billion. In the first quarter, China’s share of TSLA’s revenues was more than 20%.

Furthermore, earlier this year, TSLA’s CEO Elon Musk shelved plans for a new, cheaper electric car to focus on robotaxis, raising investor concerns about whether the company will be able to perfect autonomous technology.

Is Tesla a Buy or Sell?

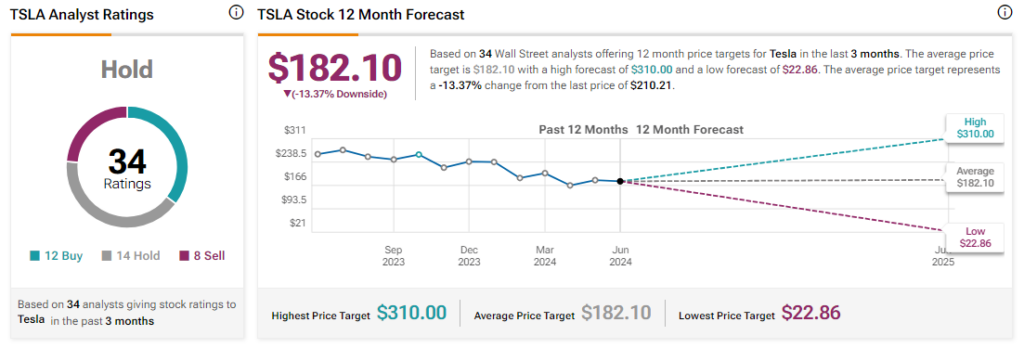

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on 12 Buys, 14 Holds, and eight Sells. Over the past year, TSLA has declined by more than 20%, and the average TSLA price target of $182.10 implies a downside potential of 13.4% from current levels.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)