Jobs

STEM job market trends: High-demand skills and top-paying roles

While economic uncertainty and inflation continue to make headlines, the broader STEM job market remains resilient, channeling LL Cool J’s line: “Don’t call it a comeback, I’ve been here for years.” Yes, there have been a wave of layoffs in the tech sector in 2023 and 2024, but the demand for STEM and R&D talent in the U.S. remains strong overall. A recent analysis of more than 5,000 job openings underscores where these in-demand roles are clustered, which skills are most in demand, and what kind of salaries top candidates can command.

The Bureau of Labor Statistics projects continued growth, with STEM jobs expected to increase by nearly 11% by 2032. While the tech sector has embraced remote work more than many others, don’t think that digital nomads dominate the STEM workforce. Our analysis reveals a stubborn geographic reality: opportunities cluster around major research hubs. Boston, San Francisco, San Diego, New York and Chicago still reign supreme, thanks to their potent mix of top universities (think MIT, Stanford, Caltech, Georgia Tech, Princeton, etc.) and industry giants (think Google, Amazon, Takeda, AbbVie).

Geographical distribution

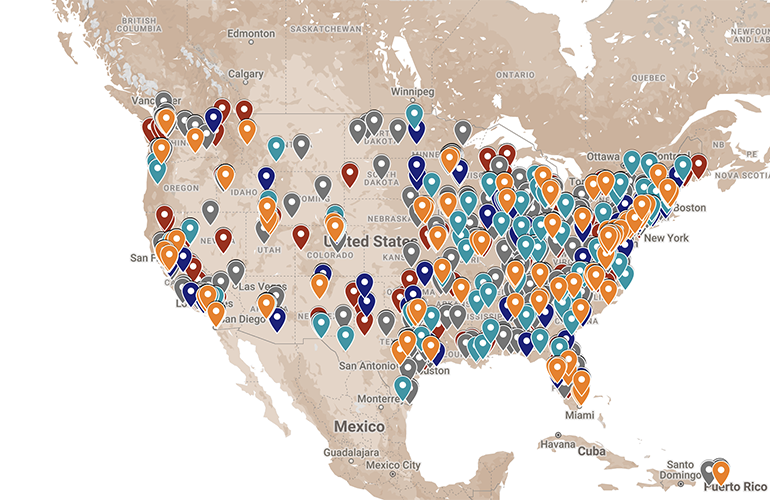

Zooming into the relevant regions in the map below highlights a high number of STEM-related positions in existing hubs like Boston and across much of the Northeast. The map includes more than 4,000 data points, excluding remote jobs and listings with no location information. Although the data focuses on the U.S., a handful of locations outside the country are also included. Although the data was focused on the U.S., the dataset included a handful of locations outside of the country.

A closer look at the top hubs

Greater Boston: This region boasts a concentration of roughly 1,000 biotechs, particularly in the Kendall Square and Longwood areas. It’s no surprise, given the talent pipeline flowing from MIT and Harvard and the strong innovation ecosystem built up over decades. Our data reflects this, with top employers with active job listings including Beth Israel Deaconess Medical Center, Takeda Pharmaceuticals, Vertex Pharmaceuticals and Boston University.

SF Bay Area: Silicon Valley lives up to its reputation with a heavy emphasis on software development and engineering roles. Unsurprisingly, tech giants like Apple and Google are major employers, alongside universities like UC Berkeley and research centers like SLAC National Accelerator Laboratory.

Greater Chicago: While known for a diverse economy, this region’s strength in scientific research is evident in the data. The University of Chicago emerges as a dominant hiring force, as are academic and research-oriented organizations. Positions like Assistant Dean for Research Administration and Director of Research & Intelligence point to the strong academic and research activities in the region.

San Diego County: Biotech and life sciences reign supreme here. Our data reflects this with major employers including UC San Diego and its health system, alongside research heavyweights like The Scripps Research Institute.

New York Metro: Finance might come to mind first in NYC, and indeed, financial institutions like JPMorgan Chase are major employers in our dataset with a strong showing of data and software-related product development. Yet the New York Metro area is diverse, with openings at institutions like NYU Langone Health and a growing number of startups. Tech giants like Google also make an appearance with a number of open roles in the Big Apple.

Other cities that made a strong showing include Washington, D.C. with roles such as Associate Director Global Clinical Program Management and Assistant Director, Office of Human Research. Roles like Coordinator, Public Policy (Hybrid) suggest opportunities in shaping healthcare policies and regulations. Austin, TX also fared well with roles like Application Engineer – Digital and Electrical Engineer, suggesting high-paying opportunities in chip design and embedded systems development. Positions like Data Scientist and Assistant Director of Research Support & Digital Infrastructure were also prevalent.

Clustering reveals a blurring of the lines between data science and other science

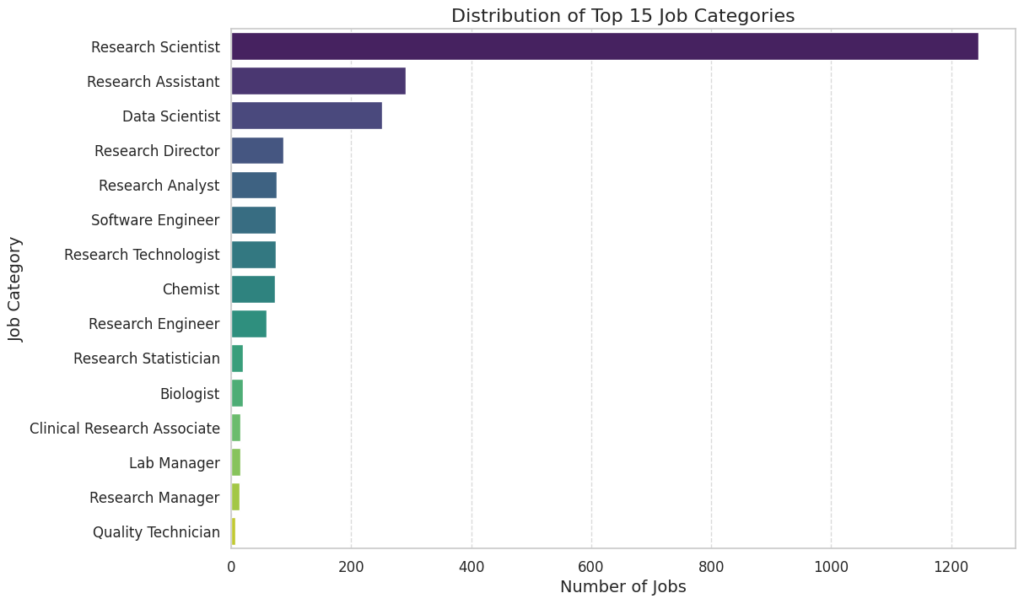

To break down jobs by type, this analysis below used the unsupervised machine learning approach KMeans clustering based on job descriptions. The output from one of those clusters is above, which revealed clusters focused on research support — more entry-level positions, senior-level research jobs followed by engineering-focused roles and finally a mix of specialist data and scientific research roles.

A separate clustering protocol using a similar but distinct approach provided the basis for the color scheme in the map below. Orange relates to predominantly data roles, including data science and data engineers. Red are related to healthcare or life sciences roles, or at least reflect the focus of the hiring organization. Included in this bucket is drug development and medical device engineering. Teal markers reflect a range of research roles excluding those in academia. Gray markers reflect broader engineering positions. Purple positions involve research in academic settings.

Top-paid positions

When assessing the most lucrative STEM-related positions, senior clinical and life science roles came out on top with median salaries for “head of clinical operations” positions surpassing $200,000. The chart below used mapping to categorize job titles, programmatically merging similar titles such as “Research Director,” “Director of Research” and “Head of Research” but treating some titles such as “Head of Clinical Operations,” distinctly.

STEM salary comparison

Comparison of developer and data scientist roles

For job listings that provided salary data, somewhat surprisingly, software developer came out on top — besting data scientist and AI-related titles. The developer profession has faced upheaval recently, with Big Tech companies alone laying off tens of thousands of developers in 2024. The dataset of job openings, however, continues to highlight the need for senior-level titles such as “Principal Software Engineer” and “Lead Software Engineer,” highlighting that many companies continue to be willing to pay top dollar for developers with a proven track record of building and maintaining complex systems.

Many of the job openings for developers were for senior developers as well as those with niche experience in areas such as embedded computing and high-performance computing (HPC). Many job openings were tied to industry giants such as Amazon, as well as with companies focused on emerging technologies such as quantum computing.

The “Data Scientist” category continues to be one of the fastest-growing jobs in the U.S. The Bureau of Labor Statistics (BLS) projects a 35% increase in demand for data scientists from 2022 to 2032, with an average salary of $108,020 annually. Our dataset had a higher median of $123,800 even though the titles in the data set had fewer senior roles but an abundance of generic “Data Scientist” titles.

BLS notes that Software Developers have an average salary of $138,110 with the top 90% making $208,620.

Select highly-paid STEM/R&D job postings

While data scientists are generally well-compensated, they didn’t make it to the top tier of our list. Here’s a glimpse at some of the highest-paying STEM and R&D positions identified in our analysis:

| Position Type | Location | Median Salary |

|---|---|---|

| Associate Professor – Transdisciplinary Research | Augusta, GA | $400,000 |

| Director, Software R&D Verification Testing and Development | Santa Clara, CA | $389,750 |

| Research Scientist – 3D Vision and Graphics | San Jose, CA | $382,500 |

| Vice President, Pharmacovigilance | Alameda, CA | $369,000 |

| Executive Director, Clinical Development | Remote | $348,800 |

| Senior Clinical Director, Immunology | Rahway, NJ | $345,600 |

| Executive Director, Immuno-Oncology, Research | Foster City, CA | $338,715 |

| Director, Molecular Foundry | San Francisco Bay Area, CA | $332,500 |

| Lead Verification Engineer | Daly City, CA | $322,400 |

| Clinical Development Medical Director, Nuclear Medicine | East Hanover, NJ | $322,000 |

| Medical Director, Clinical Pharmacology | East Hanover, NJ | $322,000 |

| Senior Clinical Development Medical Director | East Hanover, NJ | $322,000 |

| Senior Medical Director, Pharmacovigilance and Safety | Boston, MA | $317,550 |

| Senior Medical Director, Patient Safety & Pharmacovigilance | Remote | $315,000 |

| Director, Global Clinical Development, Neurology | Remote | $312,750 |

Most prevalent job opportunities

Remote and hybrid work trend remain strong

According to the data in the analysis, 11.56% of the total job listings in the dataset were remote positions. This aligns with the broader trend of increasing remote work in recent years. As per Forbes Advisor, as of 2023, 12.7% of full-time employees work from home, while 28.2% work a hybrid model. This shift towards remote and hybrid work arrangements is expected to continue, with projections indicating that by 2025, approximately 22% of the American workforce, or 32.6 million people, will be working remotely.

The COVID-19 pandemic has accelerated the adoption of remote work, with companies and employees recognizing the benefits of flexibility and reduced commute times. The data suggests that STEM fields, particularly those involving data science, biostatistics, and clinical research, are more amenable to remote work arrangements. This could be attributed to the nature of these roles, which often involve working with large datasets and conducting analyses that can be performed remotely.

However, the extent to which remote work is feasible varies across industries and job functions. Certain STEM roles, such as those involving laboratory work or hands-on engineering, may require a physical presence in the workplace. Nevertheless, the pandemic has prompted companies to reassess their work models and explore hybrid arrangements that combine remote work with in-person collaboration.

The growing acceptance of remote work is further evidenced by the fact that 98% of workers desire to work remotely at least some of the time, and 93% of employers plan to continue conducting job interviews remotely. Additionally, 16% of companies already operate fully remote, without a physical office. This suggests that remote work is here to stay and will likely become an integral part of the future of work, including in STEM and R&D fields.

What thousands of job postings reveal about STEM work

While the tech sector has seen the biggest string of layoffs since the Dot Com crash, this analysis of thousands of STEM-realted job postings reveals a sector that continues to offer significant opportunity. Yet those who climb the salary ladder aren’t just lucky; they’re strategic.

Location matters. Familiar powerhouses like Boston and the San Francisco Bay Area remain strong, with Research Director salaries reaching a cool $267,000. But the hunt for top talent is playing out on a national stage. Data Scientists are hot commodities across numerous states, earning $104,000 to $143,000 on average. Companies like Takeda Pharmaceutical, Boston Children’s Hospital, Google, and Amazon are on the prowl for skilled professionals, while top universities like Stanford, MIT, and the University of Florida are vying for the brightest minds in academia.

While layoffs remain somewhat elevated this year, companies ranging from Takeda Pharmaceutical to Boston Children’s Hospital and FAANG companies like Google and Amazon continuing to be on the prowl for data- and research-savvy professionals. Want to beat the competition? Think specialization. Senior Research Scientists can earn over $355,000, and niche roles like Quantum Computing Research Scientists at JPMorgan Chase can pull in a $260,000. But even entry-level positions like Research Assistants and Lab Technicians offer competitive pay and a springboard for career growth.

A note on the methodology

The data used in this analysis was sourced from publicly posted job listings that were obtained by searching for a series of defined keywords such as “R&D scientist,” “R&D director” and roughly a dozen other key phrases related to research and development roles across several industries. The raw data was then cleaned using a combination of manual and automated techniques to remove outliers and ensure data quality.

Next, the cleaned job titles were categorized into broader job categories based on a predefined mapping of job titles to categories. To handle the salary data, rows with missing salary information were dropped. For the geographic analysis, the ‘city’ column was geocoded using the Google Maps API to obtain latitude and longitude coordinates. Rows where the geocoding failed were dropped from this part of the analysis as well. Data processing operations were handled in Python — NumPy for numerical operations, Matplotlib and Seaborn for data visualization, scikit-learn for machine learning tasks like KMeans clustering

While extensive efforts were made to clean the data, some outliers or inconsistencies may remain remain owing to the varied and unstructured nature of job listing data.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)