Bussiness

Solana falls 10%, but a ‘Buy’ signal appears – Will SOL rise?

- Solana’s price dropped by nearly 10% in the last seven days.

- SOL’s metrics looked bullish, but indicators suggested otherwise.

Bears took control of the market last week, pushing several cryptos’ prices down, including Solana [SOL].

Though investors had to bear losses, things for SOL might change soon, as a buy signal appeared on the token’s chart. Does this mean SOL is poised for a bull rally?

Buy signal on Solana’s chart

Last week, Solana investors had a hard time as the token’s price dropped by nearly 10%. At the time of writing, SOL was trading at $144.39 with a market capitalization of over $66 billion.

However, investors must not get disheartened. Ali, a popular crypto analyst, recently posted a tweet highlighting an interesting development.

As per the tweet, a buy signal flashed on Solana’s TD sequential near the $141 mark.

Since the token managed to successfully hold that support level, it indicated that the chances of SOL recovery from its last week’s losses are high.

AMBCrypto’s look at CGFI.io’s data revealed that at press time, SOL’s fear and greed index had a value of 37%, meaning that the market was in a “fear” phase.

Whenever the indicator hits that level, it indicates that a token’s price might soon gain bullish momentum.

Is a bull rally around the corner?

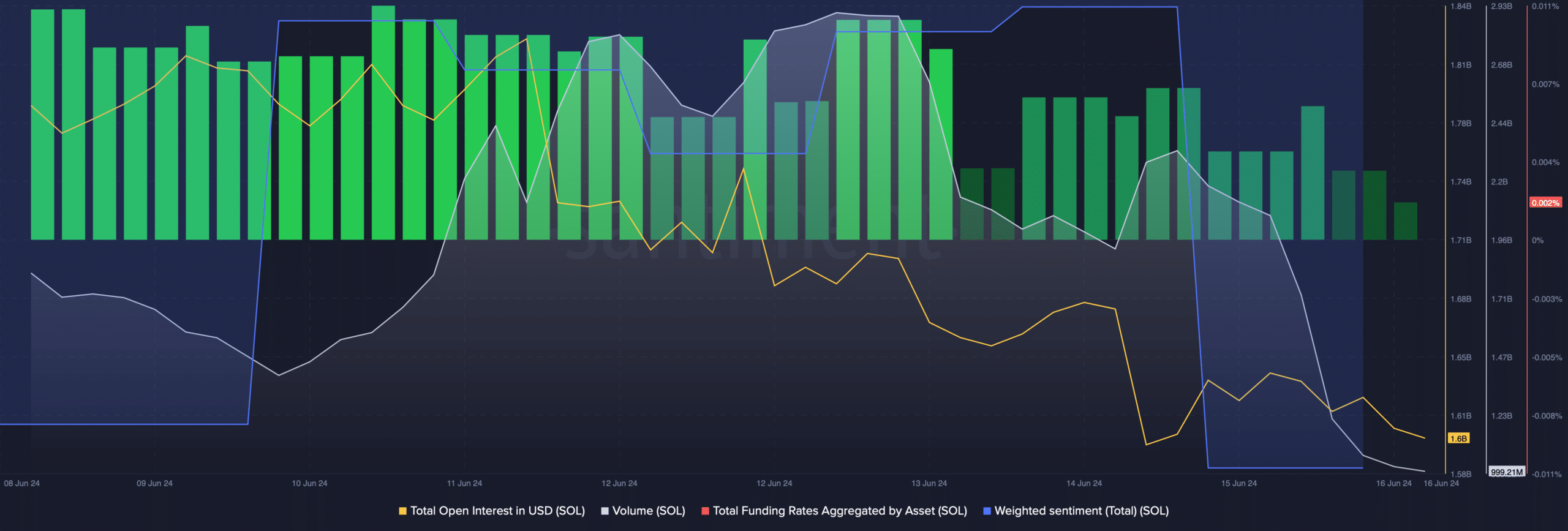

Since the aforementioned data hinted at a trend reversal, AMBCrypto then analyzed SOL’s on-chain metrics to better understand whether a bull rally is possible. As per our analysis, SOL’s Funding Rate declined.

Generally, prices tend to move in the opposite direction from the Funding Rate. Its Open Interest fell along with its price, hinting at a change in the ongoing bearish price trend.

On top of that, SOL’s volume also dropped, further indicating a price increase in the coming days. Nonetheless, investors’ confidence in SOL remained low.

This seemed to be the case as its Weighted Sentiment dropped, meaning that bearish sentiment around the token was dominant in the market.

In fact, market indicators remained bearish. For example, its Relative Strength Index (RSI) registered a downtick. The Chaikin Money Flow (CMF) also followed a similar declining trend.

Moreover, the MACD displayed a bearish advantage in the market, indicating a further drop in the token’s price in the coming days.

Is your portfolio green? Check out the SOL Profit Calculator

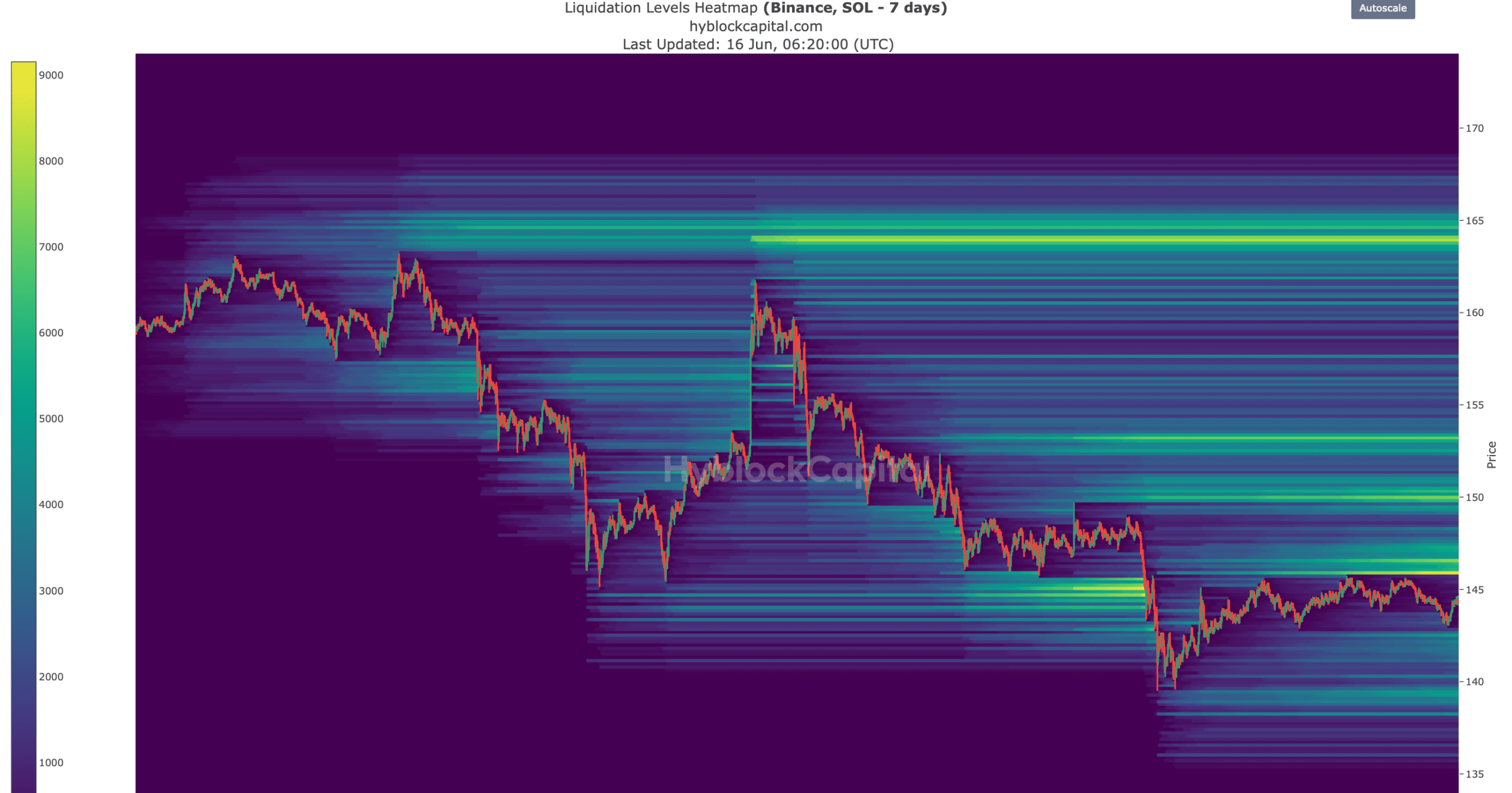

Our look at Hyblock Capital’s data revealed that if the downtrend continues, SOL might drop to $139.

However, if a trend reversal happens, it will be crucial for Solana to go above $145 as liquidation would rise sharply. An increase in liquidation often results in short-term price corrections.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)