Jobs

Powell Said Payroll Jobs Overstated, Labor Report Likely To Confirm Imminent Recession

sasirin pamai/iStock via Getty Images

Payroll jobs could be overstated

Powell said that payroll jobs “may be a bit overstated” at the June post FOMC meeting press conference.

So you put all that together—what you have is still-low unemployment, still 4 percent unemployment—historically low. But it’s moved up a little bit—it’s softened a bit—and, and, you know, that’s an important statistic. But, but more than that, you’ve got strong job creation. You, you have payroll jobs still coming in strong, even though, you know, there’s an argument that they may be a bit overstated but still they’re, they’re still—they’re strong.

The Bureau of Labor statistics uses the business births and deaths econometric model to adjust the monthly payrolls data (establishment survey), and this model is known to be unreliable at the turning points – that’s when the economy is transitioning to a recession.

Specifically, this model fails to account for businesses that go bankrupt at the onset of a recession, and thus it overstates the payroll data – it adds jobs based on the model prediction, while the jobs could actually be lost. Each monthly labor report includes the following statement:

The adjustment comes from an econometric model that forecasts the monthly net jobs impact of business births and deaths based on the actual past values of the net impact that can be observed with a lag from the Quarterly Census of Employment and Wages.

Thus, the fact that Powell specifically mentioned that the payroll jobs could be overstated implies that the Fed is aware that the economy is likely transitioning towards a recession.

In fact, the birth/death model added 363K jobs in April and 231K jobs in May.

The June labor market preview

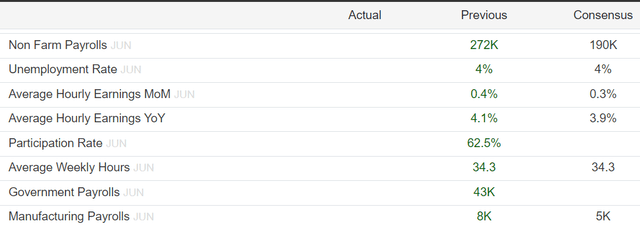

The BLS is set to release the labor market report for June, and consensus expectations are:

- Payroll jobs to come at 190K, below 272K in May

- Unemployment rate to remain unchanged at 4%

- Average hourly earnings to slow to 0.3% MoM, and 3.9% YoY

Trading Economics

The payrolls to come below expectations

Given what we know about the birth-death model, it’s likely that the May payrolls data will be revised lower, well below 272K.

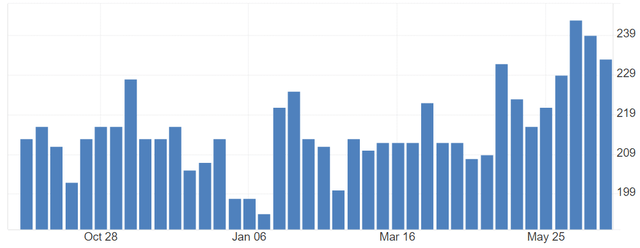

The weekly initial claims data indicates that the labor market significantly weakened in June, with the claims spiking to 243K early in June and holding at a high level for the rest of the month. Thus, the June payrolls data should be weak – well below the 190K consensus expectations.

Initial Claims (Trading Economics)

However, the S&P Global US Composite PMI survey data for June is more positive on the labor market, which suggests that payrolls should still come above 100K.

Business confidence for the upcoming year, particularly in services, and increasing demand leading to higher operating capacity prompted companies to expand their workforce for the first time in three months.

Thus, considering that the payrolls could be overstated, the weakness in the claims, and some positive survey data, my prediction for the June payrolls will come at 120K-150K.

The unemployment rate to increase

The unemployment rate data comes from the household survey, while the payrolls come from the establishment survey. The household survey data is not overstated, and thus, it might be more accurate in describing the true state of the labor market.

While the payroll data was very strong for May (overstated), the household survey was very weak. Specifically, the May household survey showed that:

- the number of employed people decreased by -408K

- the number of unemployed increased by 157K

- the labor force decreased by -250K

- the unemployment rate increased to 4%

- The full-time employment decreased by -625K in May

- The part-time employment increased by 286K in May

Thus, the household survey shows a very weak labor market, with significant job losses, with an increase in part-time employment as the full-time jobs are lost.

I expect that the household survey will continue to show job losses, based on the initial claims data previously discussed. Thus, the unemployment rate is likely to continue to increase above 4%.

In addition, the civilian labor force has declined in May, which limited the increase in the unemployment rate. But if the labor force increases, while the number of unemployed also increases, the unemployment rate could rise at a faster rate towards the 4.5% level. My prediction for June is 4.1% unemployment rate.

Labor market suggests an imminent recession

Yes, the payrolls have been very strong, but the payrolls data overstates jobs at the transition points due to the birth-death model. Powell suggested that payroll jobs could be overstated, which signals that the Fed is aware that we could be at the transition point – or near a recession.

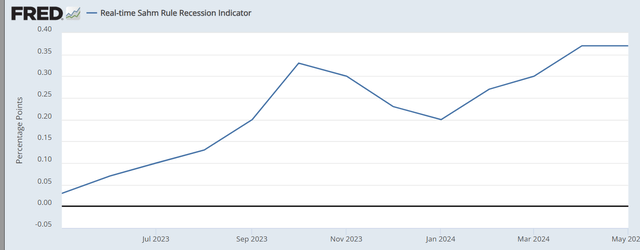

In fact, the unemployment rate is signaling an imminent recession, based on the Sahm rule.

Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

The current real-time Sahm indicator is at 0.37, and it was at 0.30 at the beginning of the 20000 recessions, and 0.40 at the beginning of the 2008 recession. So, we are in the recessionary zone and could be entering a recession soon. In fact, an uptick in the unemployment rate to 4.1% would push the Sahm indicator to 0.5.

Sahm Indicator (FRED)

Even the initial claims date supports the imminent recession thesis – the number has to be 20-30% above the low point to trigger a recession, and we are at the bottom of that range already.

Implications

Powell suggested that payroll jobs are overstated, which signals that the Fed is aware we could be at a transition point for the economy.

The Sahm Indicator is already in a recessionary territory, and with an uptick in the unemployment rate to 4.1%, the Sahm Indicator will officially predict an imminent recession. Based on the recent trends in the household survey, the unemployment rate could uptick to 4.1% in June.

Thus, the S&P 500 (SP500) is facing a recessionary bear market.

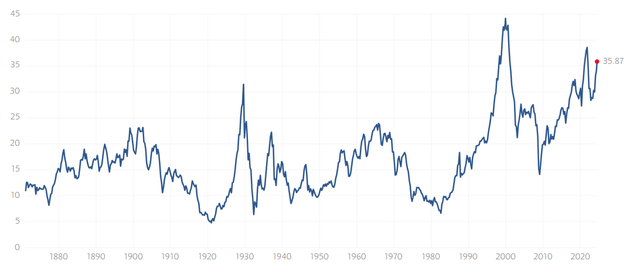

More importantly, the S&P 500 (SPY) is facing a recessionary bear market significantly overvalued with the ttm PE ratio above 24, and the Shiller PE ratio near 36. This implies that the recessionary drawdown could be at par with the 2000 and 2008 bear markets, at -50%+ total drawdown.

In fact, just like in 2008, we currently have a tech bubble, and just like in 2008, we have a housing bubble. Thus, my recommendation is a Sell.

Shiller PE ratio (Multpl.com)

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)