Bussiness

ONDO trades close to its ATH: Should you invest today?

- ONDO’s price dropped by more than 1.4% in the last 24 hours.

- The buying pressure on the token was high.

While several cryptos showered investors with profits in the last 24 hours, ONDO had other plans. This was the case, as its price declined during that time.

However, investors shouldn’t be disheartened, as ONDO was resting at a crucial level, which could initiate a bull rally soon.

Should you buy ONDO?

According to CoinMarketCap’s data, ONDO’s price turned bearish on 7th July as its value dropped by more than 1.4% in the last 24 hours. At the time of writing, the token was trading at $0.9838 with a market capitalization of over $12.36 billion.

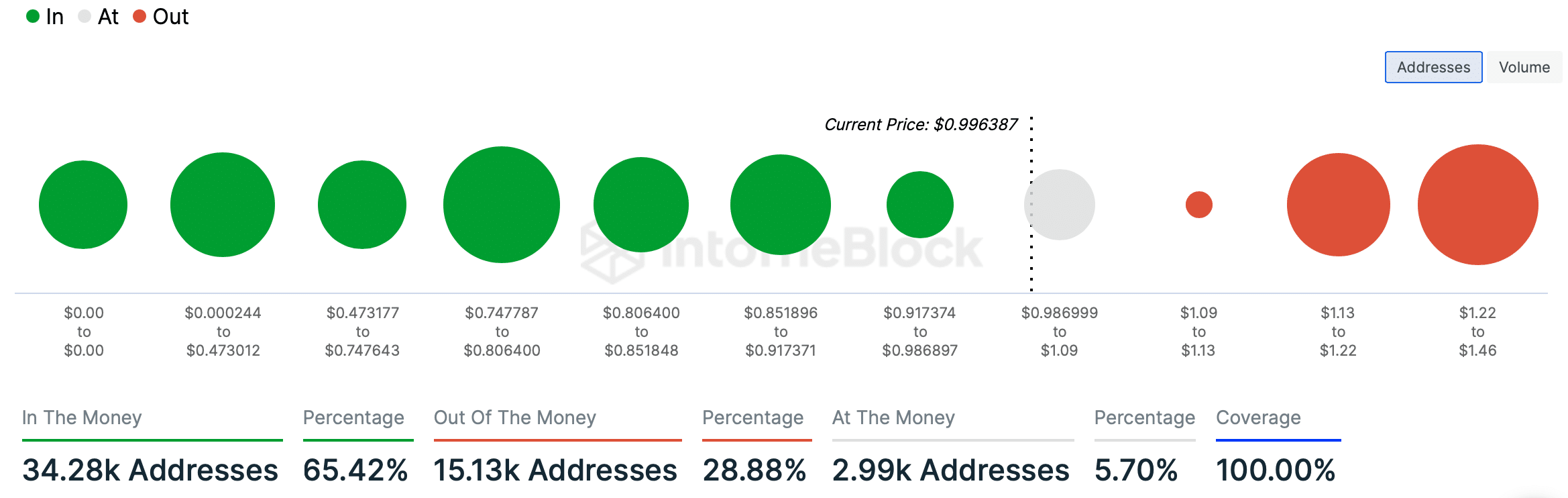

AMBCrypto’s look at IntoTheBlock’s data revealed that 65% of ONDO investors were in profit, which accounted for more than 34k addresses.

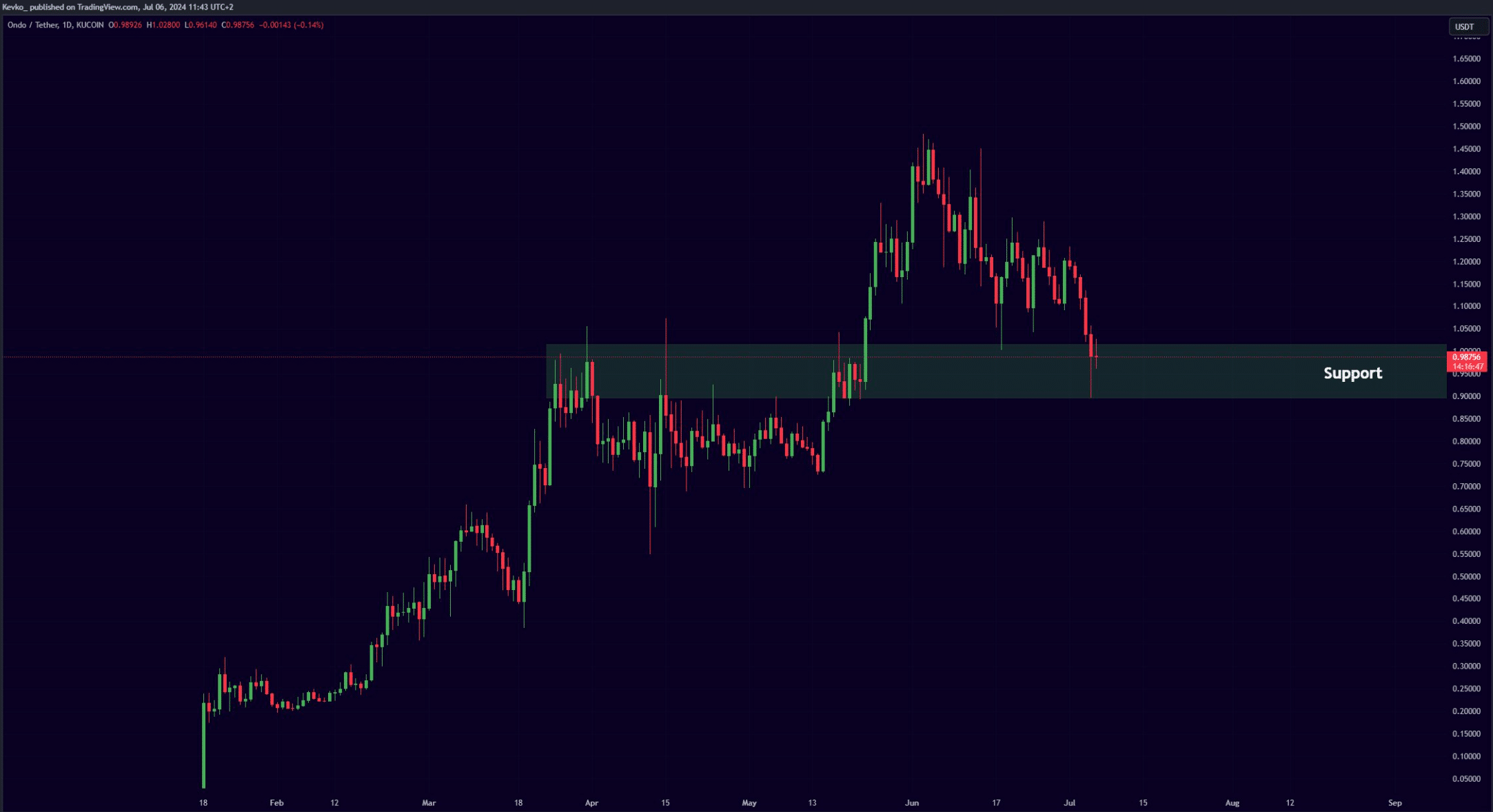

Meanwhile, Mister Crypto, a popular crypto analyst and investor, recently posted a tweet highlighting an interesting development. As per the tweet, the token’s price was resting inside a support range.

A successful test could kickstart a massive bull rally, which might allow the token to retest its June highs. Therefore, this might just be the right opportunity for investors to buy the token while its price is low.

Buying pressure is already high

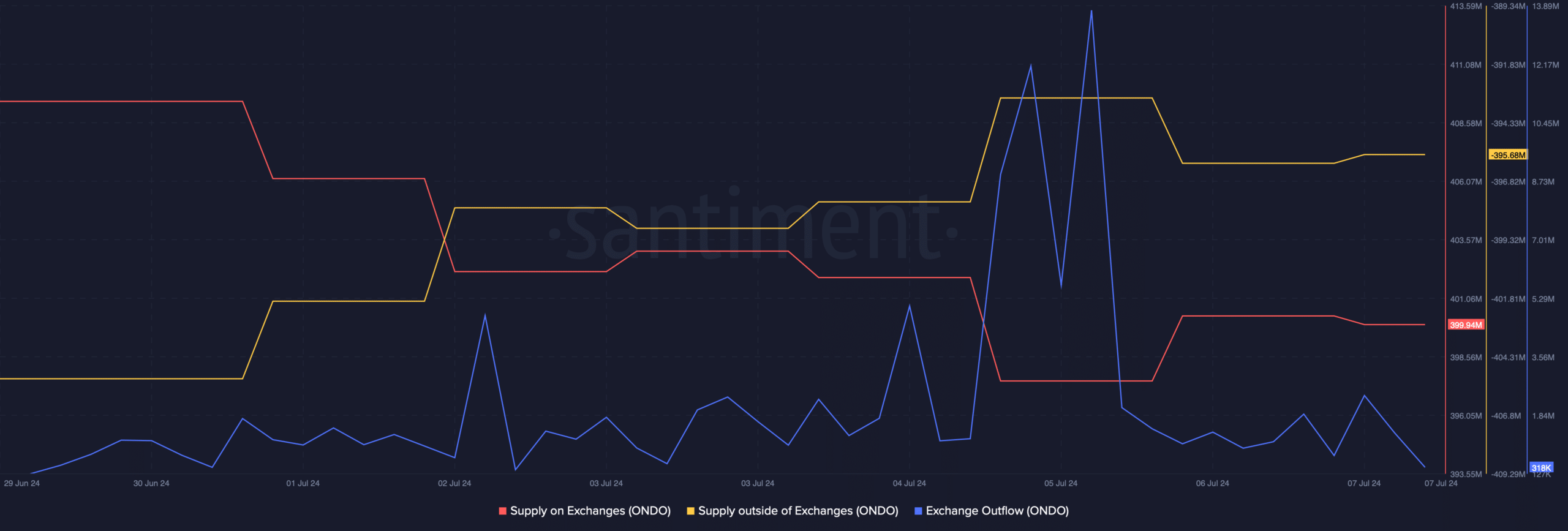

Since this seemed to be a good opportunity to accumulate ONDO, AMBCrypto analyzed Santiment’s data to find out whether investors have already started to buy the token.

We found that the token’s exchange outflow spiked, hinting at high buying pressure.

Additionally, its supply on exchanges dropped while its supply outside of exchanges increased. This further established the fact that investors were stockpiling ONDO.

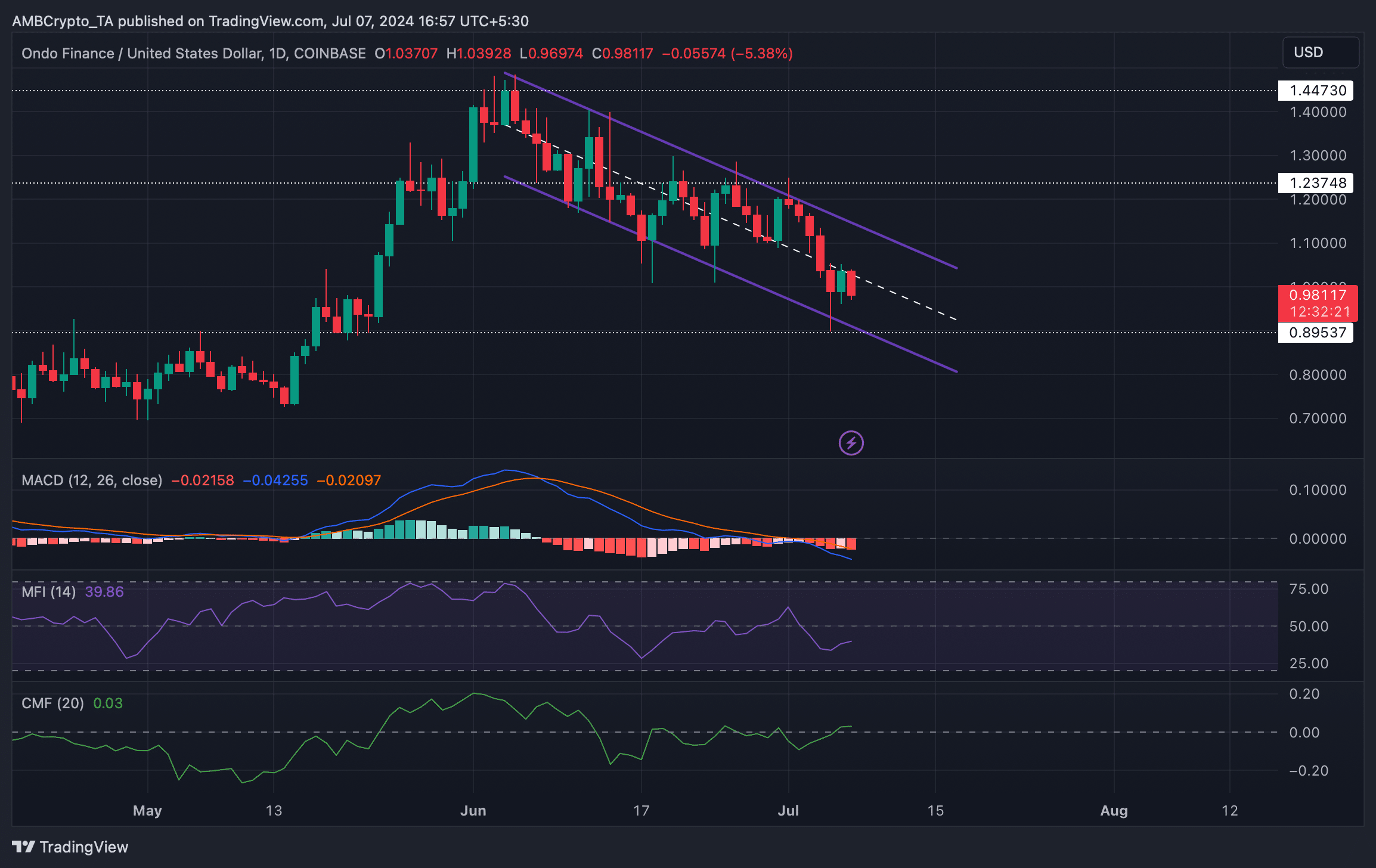

AMBCrypto’s analysis of the token’s daily chart revealed yet another bullish signal. We found that a bullish flag pattern formed on the token’s chart.

After reaching an all-time high in June, the token’s price started to consolidate inside the pattern. A successful breakout might first allow the token to touch $1.237 before its eyes retest its ATH.

The technical indicator Chaikin Money Flow (CMF) registered an uptick. Additionally, the Money Flow Index (MFI) also went northwards towards the neutral mark, indicating the possibility of ONDO successfully testing the bullish flag pattern was high.

Nonetheless, the MACD displayed a clear bearish advantage in the market.

Read ONDO’s Price Prediction 2024-25

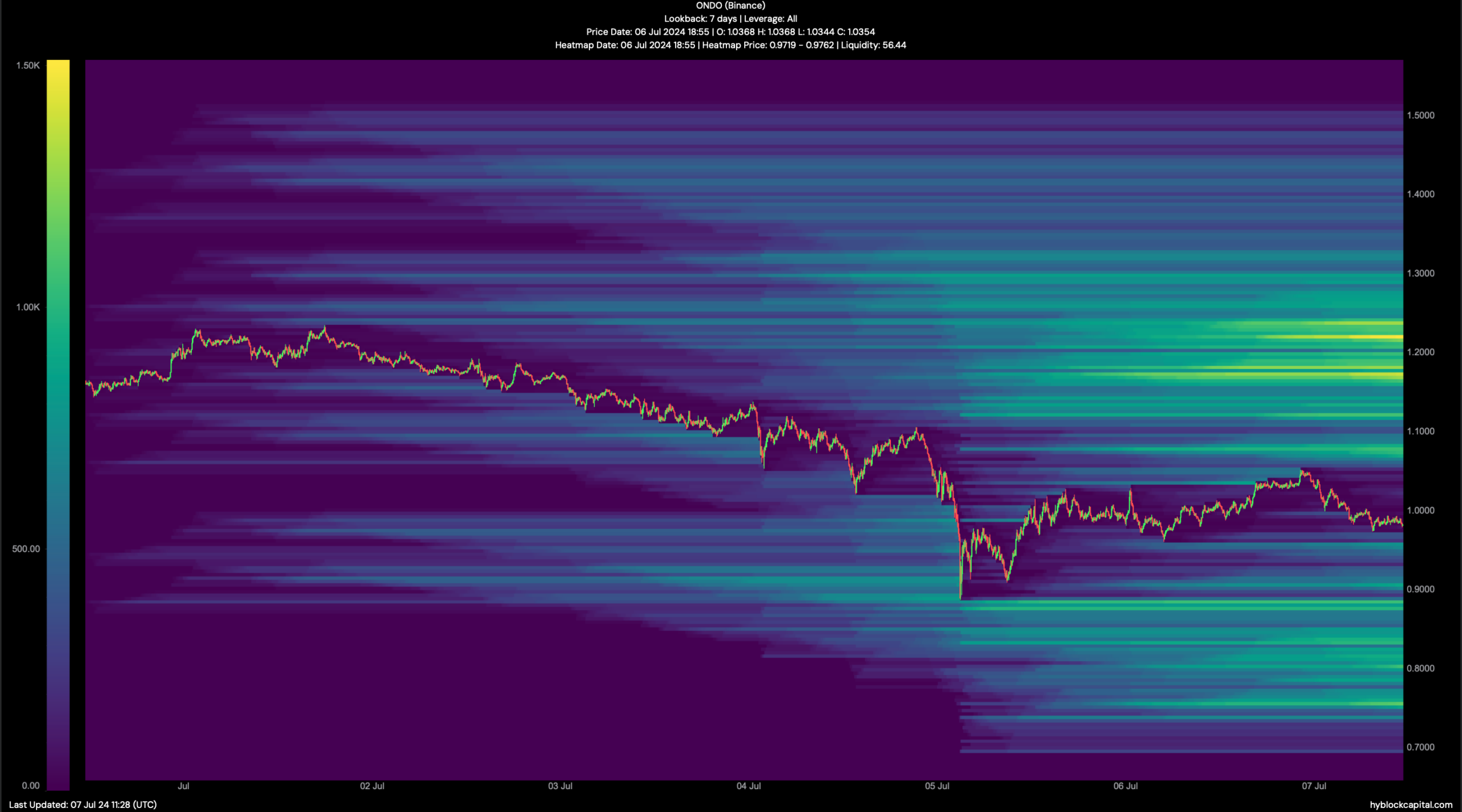

Our analysis of Hyblock Capital’s data revealed that the token’s liquidation would increased near $1.079. Therefore, it would also be crucial for the token to break above that mark, as high liquidation often results in short-term price corrections.

If that happens, then the road towards its ATH would be pretty clear. However, if the bears dominate, then the token’s price might fall to $0.88.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)