Bussiness

Nvidia (NASDAQ:NVDA) Rallies amid Upgrades from UBS, Wolfe Research – TipRanks.com

Shares of chipmaker Nvidia (NASDAQ:NVDA) rallied on Monday after UBS and Wolfe Research raised their price targets and highlighted the strong demand for its upcoming Blackwell line.

UBS analyst Timothy Arcuri noted that Nvidia could earn about $5 per share in 2025 as the order pipeline for NVL72 and NVL36 has significantly grown. This prompted him to raise his price target from $120 to $150.

Wolfe analyst Chris Caso also upped his price target to $150. In fact, he sees the potential for over 50% growth for Nvidia’s GPUs in 2025, which would be driven by more units and better networking features. Caso added that while it’s too early to predict exact GPU numbers for 2025, there’s a promising outlook for AI server unit growth, which could further boost Nvidia’s performance.

It’s worth noting that both Arcuri and Caso are five-star analysts with impressive track records.

Investor Sentiment for NVDA Stock

The sentiment among TipRanks investors is currently very positive. Out of the 744,489 portfolios tracked by TipRanks, 19.6% hold NVDA stock. In addition, the average portfolio weighting allocated towards NVDA among those who do have a position is 13.48%. This suggests that investors of the company are extremely confident about its future.

Furthermore, in the last 30 days, 6.2% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is NVDA Stock a Good Buy?

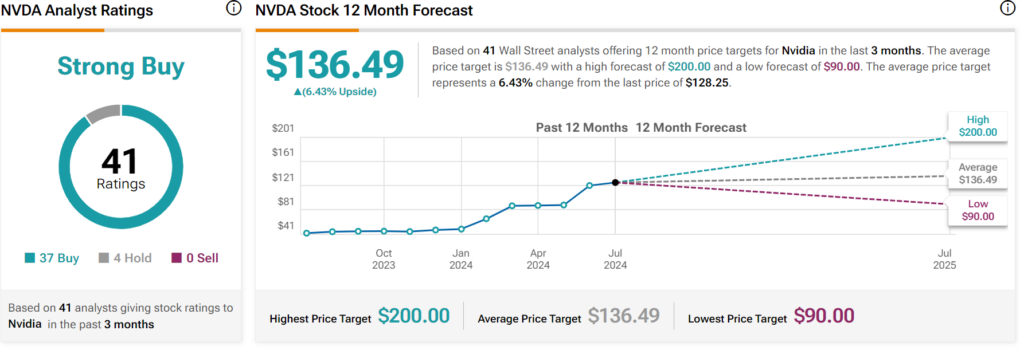

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 41 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 203% rally in its share price over the past year, the average NVDA price target of $136.49 per share implies 6.43% upside potential.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)