Bussiness

Nvidia and Broadcom Announced 10-for-1 Stock Splits. This Nasdaq-100 Stock Is Most Likely to Split Next.

Nvidia shares have surged 760% since the beginning of 2023, and Broadcom shares have surged 205% during the same period. Nvidia has already reset its share price by completing a 10-for-1 stock split on June 7, and Broadcom has a 10-for-1 stock split planned for July 12.

Importantly, Nvidia was the fourth-most expensive stock in the Nasdaq-100 prior to its split, and Broadcom is currently the third-most expensive stock in the index. That’s not surprising. The primary purpose of a forward stock split is to reduce the share price, thereby making the stock more accessible and more liquid.

With that in mind, the Nasdaq-100 stock most likely to split next is the one with the highest price, which is Booking Holdings. However, as my colleague Jon Quast eloquently describes, CEO Glen Fogel opposes the idea of a stock split. So, we can strike Booking Holdings from the list and move on to the next most expensive stock, MercadoLibre (NASDAQ: MELI).

Investors should never buy a stock just because they expect it to split, but MercadoLibre is a worthwhile long-term investment whether it splits or not. Read on to see why.

MercadoLibre is the market leader in e-commerce and retail advertising in Latin America

MercadoLibre operates the largest online commerce and payments ecosystem in Latin America, a region where e-commerce penetration is about half that of the United States. Its marketplace receives nearly four times as many monthly visitors as the next competitor. MercadoLibre is expected to account for 29% of domestic online retail sales this year, up 70 basis points (0.7 percentage points) from the prior year.

MercadoLibre has reinforced its success with adjacent financial services, logistics support, and advertising tools, which make its marketplace more convenient for merchants. The company has been successful on all counts. MercadoLibre is one of the largest fintech companies in Latin America, it operates the fastest and most extensive domestic delivery network, and it accounts for more than 50% of retail media ad spending in the region.

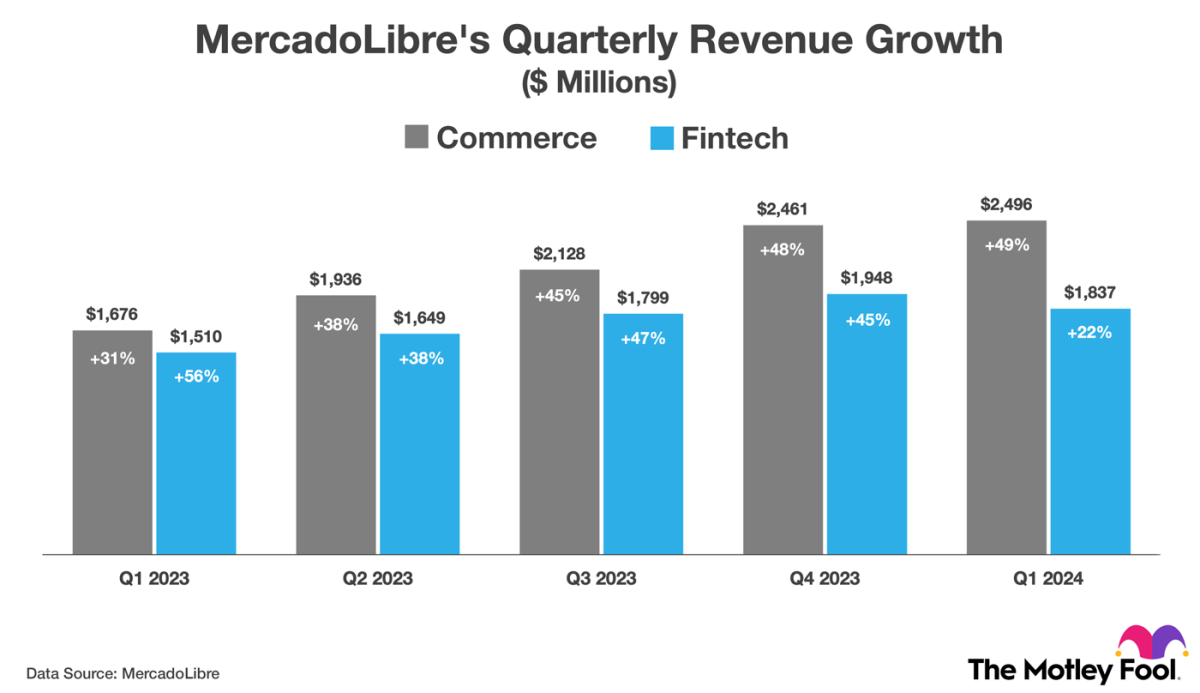

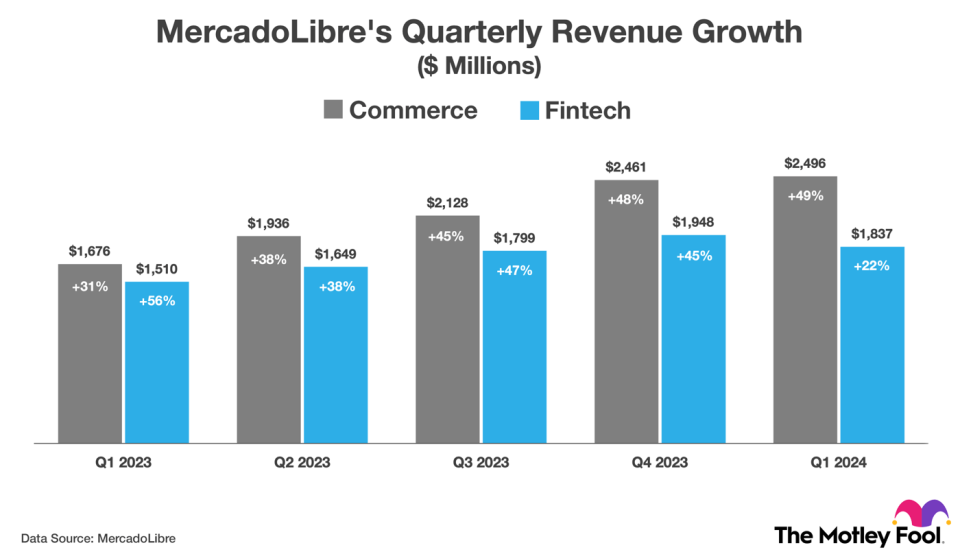

MercadoLibre reported strong financial results in the first quarter, handily beating expectations on the top and bottom lines. Revenue increased 36% to $4.3 billion, reflecting sales growth in the commerce and fintech segments of 49% and 22%, respectively. Meanwhile, GAAP (generally accepted accounting principles) net income increased 71% to $6.78 per diluted share.

During the first quarter, commerce sales benefited from increased adoption of fulfillment and advertising services, indicating that MercadoLibre is more effectively monetizing merchants on its marketplace. Additionally, fintech sales benefited from accelerating growth in total payment volume and increased engagement with credit products.

The chart below shows MercadoLibre’s revenue growth across both segments over the last five quarters.

Given its strong presence in several markets, investors have good reason to believe MercadoLibre can maintain that momentum. The company is steadily gaining share in e-commerce, which bodes well for its fintech and advertising businesses. In fact, MercadoLibre is forecasted to be the fastest-growing ad tech company in the world in 2024.

More broadly, the digital economy in Latin America is expected to expand at 23% annually over the next three years.

MercadoLibre stock trades at a reasonable price compared to Wall Street’s earnings forecast

Wall Street expects MercadoLibre to grow earnings per share at 51% annually through 2026. In that context, the current valuation of 74.2 times earnings appears reasonable, especially when the two-year average is 109.7 times earnings.

Investors should be cognizant of the risks. Most notably, Argentina (MercadoLibre’s third-largest geography behind Brazil and Mexico) is suffering from hyperinflation, such that domestic sales declined 22% in the first quarter, as measured in U.S. dollars, despite surging 239%, as measured in Argentine pesos. That will likely be a headwind for the foreseeable future.

MercadoLibre has historically been a very volatile stock. It carries a three-year beta of 1.59, meaning it moved 159 basis points for every 100-basis-point movement in the S&P 500 during the last three years. Volatility cuts both ways. When MercadoLibre shares are rising, they can rise quickly. But when the stock is falling, it can fall sharply.

Investors comfortable with that type of risk and volatility should consider buying a small position in this potential Nasdaq-100 stock-split stock today.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,525!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,768!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $372,462!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of July 2, 2024

Trevor Jennewine has positions in MercadoLibre and Nvidia. The Motley Fool has positions in and recommends Booking Holdings, MercadoLibre, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Nvidia and Broadcom Announced 10-for-1 Stock Splits. This Nasdaq-100 Stock Is Most Likely to Split Next. was originally published by The Motley Fool

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)