Bussiness

Notcoin price prediction: These are the next key levels for NOT

- Notcoin regained its short-term bullish market structure.

- The volume indicators of NOT signaled a lack of buying pressure despite enthusiasm in the Futures markets.

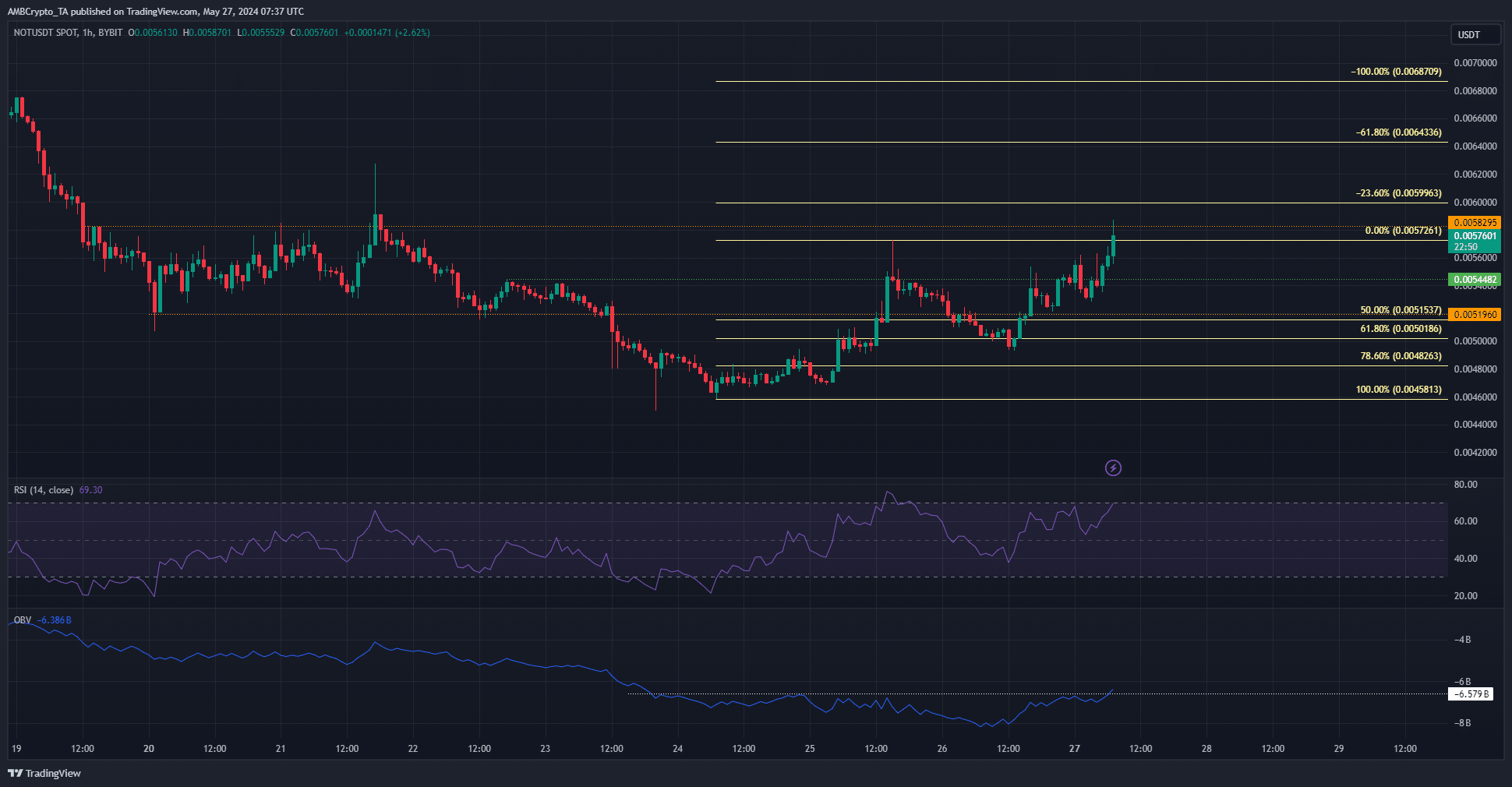

Notcoin [NOT] was trending higher once more. It had a bullish market structure on the lower timeframes and has breached a key resistance zone at the $0.0054 level.

Notcoin had been in a downtrend a week ago but began to shift its trend in the past four days.

A recent AMBCrypto report highlighted that the token was down by more than 50% since its launch on the 16th of May.

The Toncoin [TON] saw a surge in activity after the NOT airdrop, but this flurry of activity slowed down over the past week.

The technical findings showed bullishness

The $0.00544 level was marked in green and highlighted the downtrend’s lower high from the 22nd of May.

Notcoin breached this level on the 25th of May and formed a higher low at $0.00493. In doing so, it hinted at a bullish trend shift.

Since that higher low, NOT has gained 16% and looked to climb higher. The $0.0058-$0.006 region could serve as resistance to NOT. The RSI indicated strong bullish momentum in the one-hour timeframe.

However, the OBV was not able to climb past a local session till the time of writing. A move past it would be a sign of strong buying pressure and a continued rally.

The Fibonacci extension levels at $0.006, $0.0064, and $0.0068 are the next targets for the buyers.

The spot CVD saw the same trouble as the OBV did

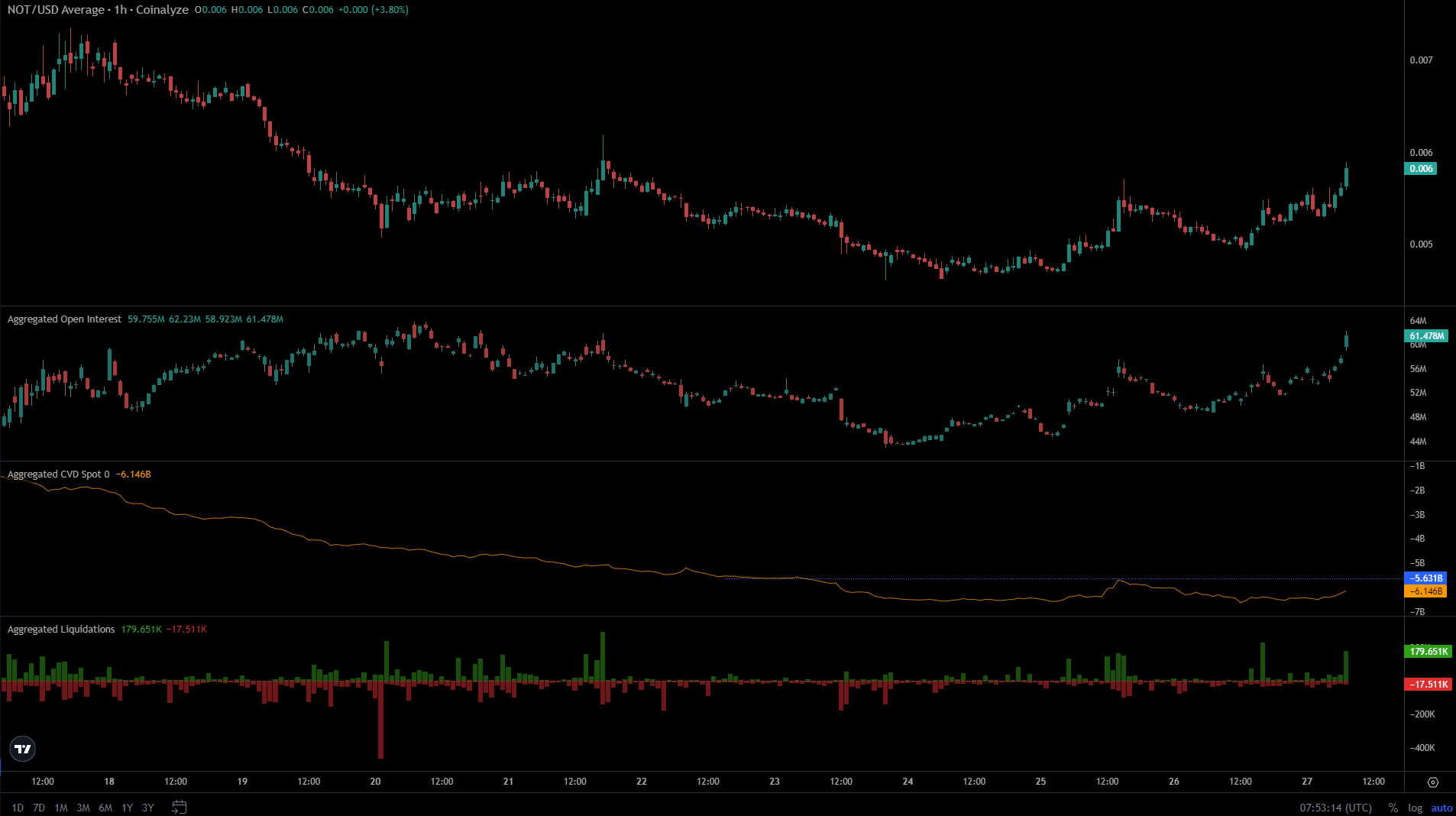

Source: Coinalyze

The Open Interest grew from $44 million to $61 million in the past 24 hours, as prices also rose by more than 10% in the same period.

This was a sign of bullish conviction in the Futures market and showed traders willing to go long.

The recent surge also caused a flurry of short liquidations, which drove prices even higher. However, despite this pressure, the spot CVD was relatively quiet.

Realistic or not, here’s NOT’s market cap in BTC’s terms

It has not embarked on an uptrend like the price, which raised the concern that buyers in the spot market were scarce and a large part of the rally could be driven by derivatives.

This would need to change for a sustainable rally to take place.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)