Jobs

Munis underperform USTs post-jobs report

Municipals were slightly firmer, underperforming U.S. Treasuries, which saw gains up to 10 basis points on the short end, after a better-than-expected jobs report kept a Federal Reserve rate cut in September in play. Equities ended up.

While the numbers still suggest a healthy labor market, “this report absolutely keeps the probability of a September rate cut on the table,” said Greg Wilensky, head of U.S. fixed income and a portfolio manager at Janus Henderson Investors. “This still seems like the most likely outcome.”

But, he noted, inflation rates will determine when the Fed cuts rates. “This nonfarm payroll data will neither cause the Fed to take a September cut off the table nor force them to cut rates in September even if the inflation data does not continue to show moderation that we have seen recently,” Wilensky said.

“Net-net this is welcome data for the Fed and will increase their confidence that inflation likely continues to cool in the months ahead,” said Jeff Klingelhofer, co-head of investments at Thornburg Investment Management.

Supply was “pretty much non-existent” this past week, unsurprising given the Fourth of July holiday, said Cooper Howard, a fixed-income strategist at Charles Schwab.

However, the new-issue calendar rises to $9.175 billion next week, with $6.089 billion of negotiated deals coming to market and $3.086 billion of competitive deals on tap.

The Dormitory Authority of the State of New York leads the competitive calendar with $1.3 billion of state sales tax revenue bonds in three series.

The negotiated calendar is led by Harris County, Texas, with a $731.13 million deal, followed by Houston with a $720 million deal and

Muni-UST ratios continue to remain “low,” and Howard does not expect that to change in the near future.

The two-year muni-to-Treasury ratio Friday was at 66%, the three-year at 67%, the five-year at 68%, the 10-year at 67% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 67%, the five-year at 67%, the 10-year at 66% and the 30-year at 82% at 3:30 p.m.

Ratios are in the mid-60s, several percentage points higher than the lows from several weeks ago, Howard said.

Despite this, ratios, when compared to their longer-term averages, are still relatively low, he said.

The strong June performance was driven by the decline in interest rates, with munis seeing gains of 1.53% for the month, Howard said.

This helped push returns closer to the black with munis having returned negative 0.40% for the first half of the year.

The

“My expectation is that we should recover and post positive total returns by the end of the year,” he said.

Even if rates rise another 20 basis points, “we’d still end the year with awesome total returns,” Howard noted.

Fund flows continue to show demand for fixed-income, he said.

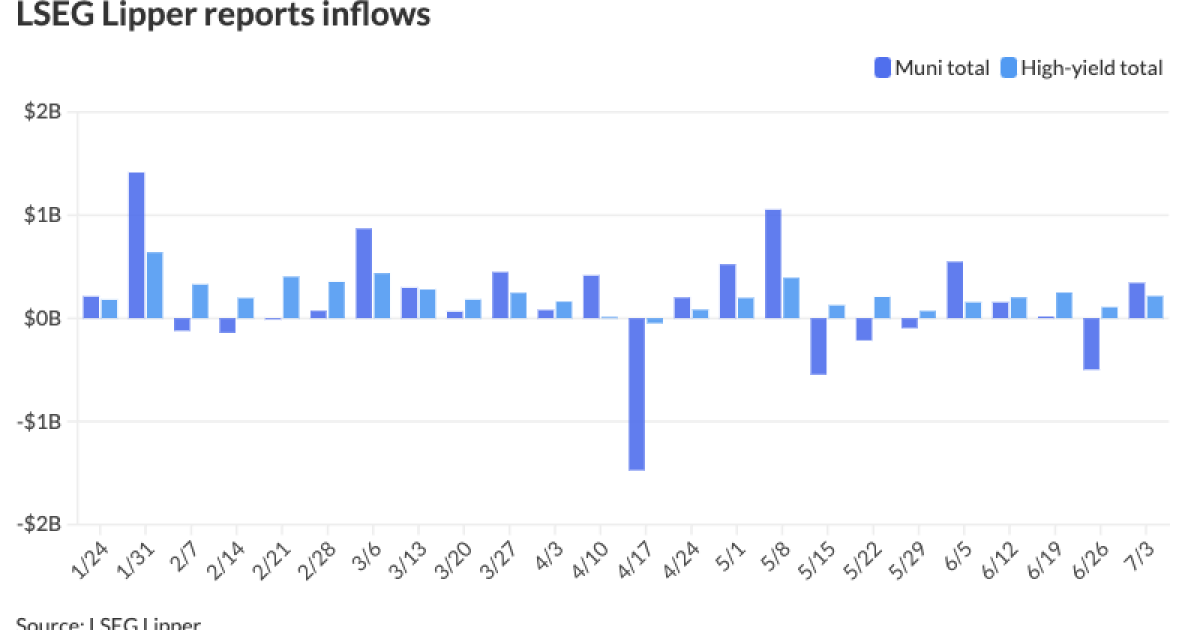

Municipal bond mutual funds saw inflows as investors added $343 million from funds after $498 million of outflows the week prior, according to LSEG Lipper. Inflows this week were led by long-term funds.

High-yield continued to show strength, with inflows of $290 million after $107 million of inflows the previous week.

Fund flows have been “trending positive” but have been “bouncing around” a little bit, as recent figures are below their 2024 averages, Howard said.

Instead, the growth of separately managed accounts is driving the market, especially within 10 years, as many fund managers and portfolio managers tend to allocate assets there.

AAA scales

Refinitiv MMD’s scale was bumped two basis points: The one-year was at 3.10% (-2) and 3.06% (-2) in two years. The five-year was at 2.88% (-2), the 10-year at 2.85% (-2) and the 30-year at 3.73% (-2) at 3 p.m.

The ICE AAA yield curve was bumped two basis points: 3.17% (-2) in 2025 and 3.10% (-2) in 2026. The five-year was at 2.90% (-2), the 10-year was at 2.87% (-2) and the 30-year was at 3.70% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped two to three basis points: The one-year was at 3.16% (-3) in 2025 and 3.09% (-3) in 2026. The five-year was at 2.90% (-3), the 10-year was at 2.89% (-2) and the 30-year yield was at 3.71% (-2) at 3 p.m.

Bloomberg BVAL was bumped one to two basis points: 3.16% (-1) in 2025 and 3.11% (-1) in 2026. The five-year at 2.94% (-1), the 10-year at 2.84% (-2) and the 30-year at 3.74% (-2) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.600% (-10), the three-year was at 4.391% (-10), the five-year at 4.223% (-10), the 10-year at 4.273% (-8), the 20-year at 4.574% (-6) and the 30-year at 4.470% (-5) at 3:30 p.m.

Employment report

Friday’s employment report will allow the Federal Reserve to cut interest rates this year, with analysts generally believing a September rate cut is possible, if not likely. However, the presidential election in November and the panel’s general caution about changing rates around an election to keep a semblance of political neutrality could play a factor in delaying a cut, some said.

“Given the downward revisions to previous job estimates combined with a slight increase in the unemployment rate to 4.1%, the labor market appears to be weakening,” said Bryce Doty, vice president and senior portfolio manager at Sit Investment Associates. “We expect yields to move lower as this report keeps the Fed on schedule to cut rates this year. Our base case is a 50 bp cut after the election.”

“The Fed’s path to a rate cut remains tricky,” noted Giuseppe Sette, president of Toggle AI. A strong jobs market, the S&P 500 at historical highs, and quantitative tightening continuing without an issue suggest there is “no reason for a rate cut,” he said. “The Fed traditionally cuts when it foresees a slowdown, and currently we see no trace of worsening economic conditions.”

Given employment and inflation numbers, “the current situation does not yet necessitate a decisive response by central bankers,” said DWS U.S. Economist Christian Scherrmann, but “the case for rate cuts in the coming months is certainly strengthened.”

And while the likelihood of a September cut “has noticeably increased,” DWS expects “a first cut in December, believing that any unwanted softening can be effectively managed with verbal intervention.”

“Unlike May, this is a report that supports a slowdown in the labor market as the Fed desires,” said Wells Fargo Investment Institute Senior Global Market Strategist Scott Wren. “The Fed wants slower wage growth and higher unemployment rate and the June data delivered to some extent.”

He said the September Federal Open Market Committee meeting remains “solidly in play” for the first cut. “We have two cuts penciled in for 2024 and just one in 2025,” Wren said.

“The combination of this morning’s data along with a grinding trend higher in jobless claims should bolster the case for the Fed to kick off the long-awaited rate-cutting cycle in September, which remains our base case,” said Jeff Schulze, head of economic and market strategy at ClearBridge Investments.

Brian Coulton, chief economist at Fitch Ratings, noted that when combined with recent improved inflation data, “this will help reassure the Fed that they can safely start cutting rates in September.”

“The sharp decline in temporary help may portend future weakness in the labor market this summer,” according to Jack McIntyre, portfolio manager at Brandywine Global.

“This clearly increases the Fed’s confidence level that policy rates are too restrictive, and they need to cut.”

Primary to come

Harris County, Texas, (Aaa//AAA/) is set to price next week $731.13 million, consisting of $100.505 million of permanent improvement refunding bonds, Series 2024A; $219.86 million of unlimited tax road refunding bonds, Series 2024A; and $410.765 million of permanent improvement tax and revenue certificates of obligations, Series 2024. Morgan Stanley.

Houston is set to price Thursday $720.445 million, consisting of $589.41 million of GO refunding bonds, Series 2024A, and $131.035 million of public improvement refunding bonds, Series 2024B. Ramirez.

The Washington Metropolitan Area Transit Authority (/AA//AA/) is set to price Tuesday $625.42 million of sustainability–climate transition second lien dedicated revenue bonds, Series 2024A, serials 2047-2059. BofA Securities.

The Health and Educational Facilities Board of the Metropolitan Government of Nashville and Davidson County, Tennessee, is set to price Wednesday $313.595 million of fixed-rate mode Vanderbilt University educational facilities revenue refunding and improvement bonds, Series 2024. RBC Capital Markets.

The University of Wisconsin Hospitals and Clinics Authority (Aa3/AA-//) is set to price Wednesday $301.425 million of sustainability revenue bonds, consisting of $187.835 million of Series 2024A and $113.59 million of Series 2024B. J.P. Morgan.

The Cedar Hill Independent School District, Texas, (Aaa/AAA/AAA/) is set to price Wednesday $277.695 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2044, term 2049. Siebert Williams Shank.

The District of Columbia Water and Sewer Authority (Aa2/AA+/AA/) is set to price next week $268.795 million of public utility subordinate lien revenue refunding bonds, Series 2024A. Morgan Stanley.

The California Earthquake Authority is set to price Tuesday $250 million of taxable revenue bonds, Series 2024A. J.P. Morgan.

The San Diego Public Facilities Finance Authority (/AA-/AA/) is set to price Wednesday $213.2 million of lease revenue and lease revenue refunding bonds, Series 2024A. J.P. Morgan.

The Cabarrus County Development Corp., North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $204.63 million of limited obligation refunding bonds, Series 2024A, serials 2025-2044. BofA Securities.

The San Diego Unified School District is set to price Wednesday $200 million of tax and revenue anticipation notes, Series A, serial 2025. BofA Securities.

Tallahassee, Florida, (/AA/AA+/) is set to price Tuesday $183.93 million of consolidated utility systems refunding revenue bonds, Series 2024A, serials 2025-2040. BofA Securities.

Honolulu (/AA+/AA+/) is set to price Tuesday $170.15 million of GOs, consisting of $117.6 million of Series 2024A, serial 2025-2049, $18.385 million, Series 2024B, serial 2025-2032, $9.050 million, Series rail, serial 2025-2049, $25.115 million, Series tax, serial 2025-2039. BofA Securities.

The Irvine Ranch Water District, California, (/AAA/AAA/) is set to price Tuesday $165.58 million of refunding bonds, Series 2024A, serials 2025-2040. Goldman Sachs.

The Development Authority of Fulton County, Georgia, (Aa3/AA-//) is set to price Wednesday $102.82 million of Georgia Tech Curran Street Residence Hall Project facilities revenue bonds, Series 2024, serials 2027-2044, terms 2050, 2056. Wells Fargo.

The Delaware State Housing Authority (Aa1///) is set to price Wednesday $100 million of non-AMT senior single-family mortgage revenue bonds, 2024 Series C. J.P. Morgan

Competitive

Baltimore County (Aaa/AAA/AAA/) is set to sell $160 million comprised of $45 million of Metropolitan District bonds, 85th Issue and $115 million of consolidated public improvement bonds, 2024 Series, at 11:15 a.m. Tuesday; and $226.9 million comprised of $102.68 million of refunding Metropolitan District bonds, Series 2024 and $124.22 million of refunding consolidated public improvement bonds, Series 2024, at 10:45 a.m. Tuesday.

Frisco, Texas, (Aaa/AAA//) is set to sell $102.31 million of GO refunding and improvement bonds, Series 2024, at 10:45 a.m. Tuesday; $56.28 million of combination tax and surplus revenue certificates of obligation, Series 2024A, at 11:15 a.m. Tuesday and $9 million of taxable GOs, Series 2024, at 11:45 a.m. Tuesday.

Seattle, Washington, (Aa2/AA//) is set to sell $202.81 million of municipal light and power improvement and refunding revenue bonds, Series 2024, at 10:30 a.m. Tuesday.

Broward, Florida, is set to sell $270 million of tax anticipation notes, Series 2024, at 11 a.m. Tuesday.

The New Hampshire Muni Bond Bank (/AA+//) is set to sell $113.375 million of 2024 Series C bonds, at 10:30 a.m. Wednesday.

The Dormitory Authority of the State of New York is set to sell $430.295 million of state sales tax revenue bonds, Series 2024A, Bidding Group 1, at 10:45 a.m. Wednesday; $437.795 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:15 a.m. Wednesday; and $418.95 million of state sales tax revenue bonds, Series 2024A, Bidding Group 3, at 11:45 a.m. Wednesday.

Gary Siegel and Layla Kennington contributed to this story.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)