Bussiness

Make Money While You Sleep, 2 Big Dividends For A Retirement Dream

solidcolours/E+ via Getty Images

Co-authored by Treading Softly.

When you were young, do you remember what you used to dream about your occupation? Many of us had unrealistic dreams, like wanting to be some sort of superhero or a career that we ended up not following, but thought would be fun and exciting, like a police officer, a firefighter, or a doctor.

I have one daughter who is convinced that she will be a princess when she’s older. She has already figured out which one of the young princes of England she wants to marry to hopefully join the ranks of the royal family. It thrills her heart to think that in the future, I will have to call her “your majesty.”

When it comes to the market, many of us have goals to achieve for our retirement. Sadly, many of our goals fall short of a real, effective goal to help us achieve an end. If your goal is to save $1,000,000 for your retirement, you’re hit with a “then what question?” You have $1,000,000; what are you going to do with it? Unfortunately, many people run towards the concept of having $1,000,000 and have no clue what to do with it, other than to be afraid that they’re going to run out of money before they run out of breath. I’m a big believer in having a retirement dream that uses the market as a tool to fund your retirement and not as the be-all-end-all goal itself.

My retirement dream is to visit my family, enjoy my hobbies, and, at the end of the day, sit back and relax by the fireplace, drinking a glass of tea. I will reminisce with my wife about the wonderful things we were able to achieve that day.

Today, I want to look at two funds to help you fund your retirement.

Let’s dive in!

Pick #1: OXLC – Yield 19.3%

Shareholders of Oxford Lane Capital Corporation (OXLC) will enjoy a distribution hike starting with the payments from this month. The monthly distribution of $0.09/share is a 12.5% increase over the prior month. What might surprise investors the most is that OXLC’s yield was already over 17%. How is it possible that an investment with such high yields can increase its distribution?

The answer is that CLO equity (Collateralized Loan Obligations) is currently in the “sweet spot” where asset values are recovering, and default rates remain very low.

What is a CLO?

A CLO is an actively managed investment portfolio that invests in bank loans. A CLO manager creates a CLO by acquiring loans and then raises debt capital by selling “tranches” in the CLO. The word “tranche” confuses many people, but at the end of the day, a “tranche” is just a level of the capital structure. Among companies, we would break the capital structure into senior secured debt, senior debt, junior debt, preferred equity, and common equity. The corporate structure has various levels of capital with different seniority.

In a CLO, you also have levels ranked by seniority, and they are called tranches and are labeled with letters that clearly indicate their respective seniority. You know that the AA tranche is senior to the A tranche, which is senior to the BBB tranche. Corporations should use the same system, as it would save investors the trouble of trying to figure out if the senior loan is senior or on the same level as a senior bond. When you read the details, all too often a “senior” bond is junior to some loans.

CLOs provide two major benefits:

- The ability to choose your own risk/reward. The higher your tranche, the lower your yield and the lower your risk. The lower your tranche is, the higher your yield and the greater your risk. Within a CLO, there is a level for everyone.

- A very stable structure. CLOs are super structured in everything they do. Everything is determined at inception. For every payment that is collected by the CLO, there is no question where that money goes. Even when a CLO has a high level of defaults and is unable to pay in full, there is no reason to go to bankruptcy court. It is already predetermined how the tranches will be paid, and in what conditions the senior tranches will be prepaid.

Institutions love the predictability and defensiveness of the senior tranches. That is why they are willing to accept a low yield of SOFR + 150 bps when the underlying loans held by the CLO have coupons over SOFR + 500 bps. They are willing to sacrifice the high return, for the certainty of return.

OXLC targets the equity tranche. It is the “common equity,” a level that doesn’t come with any guarantees. As borrowers repay their loans, the interest owed to the debt tranches gets paid first, and then the equity gets to keep the profit.

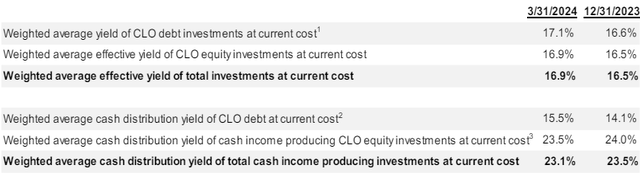

Thanks to low default rates, the return of CLO equity positions has been enormous. OXLC provides us with two yields — the “effective yield” which is a GAAP calculation that includes assumptions of future defaults, and a “cash distribution yield” which is actual cash received. Source.

Note that these yields are calculated based on OXLC’s cost basis, not the fair market value. As a result, OXLC is currently receiving a huge amount of cash flow relative to its NAV (net asset value).

As OXLC is swimming in cash, its NAV has been recovering. OXLC reported in May that its NAV was $5.02-$5.12. This is the highest NAV that OXLC has had since June 2022. CLO equity prices are finally starting to recover and likely have significant room to go.

As prices were low over the past two years, what did OXLC do? They bought the dip. OXLC has increased its assets to approximately $1.7 billion, from $1.2 billion in June 2022. It did this with minimal issuance of debt/preferred going from $483.4 million to $487.2 million. In other words, OXLC has grown its portfolio while meaningfully deleveraging. Even with OXLC’s recent debt issuance, its leverage will be lower than two years ago.

Everything is going OXLC’s way right now. Leverage is down, cash flow is high, defaults are low, and NAV is going up. Just like CLO investors get to choose their own risk/reward, investors in OXLC can choose their own risk/reward. The equity has a nosebleed yield, but if defaults do pick up materially, the common equity is the cushion that will absorb the impact. The term preferred or the bonds offer a lower yield, but are also a very good option for risk-averse investors. As noted above, OXLC’s leverage, which includes preferred, is very low.

Pick #2: HQH — Yield 12.5%

abrdn Healthcare Investors (HQH) is a CEF (Closed-End Fund) formerly known as “Tekla Healthcare Investors.” Aberdeen acquired Tekla and kept the same fund managers in the same Boston office.

One major change that Aberdeen has made with HQH, is an increase in its distribution policy. HQH has a variable distribution policy, where the amount it pays is based on a percentage of NAV (net asset value). HQH has announced that for at least the next year, distributions will be 3% of NAV each quarter (12% annualized)

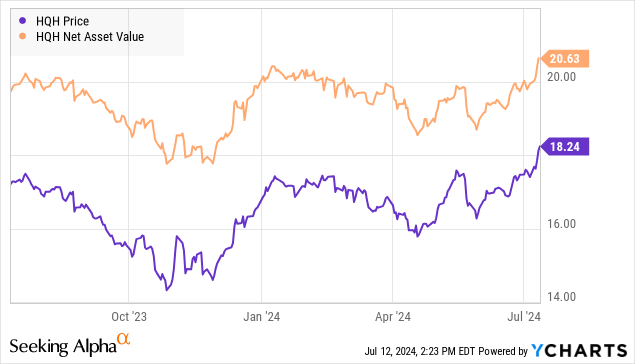

Note that the distribution calculation is based on NAV, not on the share price. So a 12% yield on NAV, is a yield of over 13% based on market price! While HQH’s share price is up a lot since its October 2023 low, this increase has been matched by a recovery in NAV.

The current price is approximately a 12% discount to NAV. Certainly, one of Aberdeen’s goals with this change is to reduce the discount. However, if it doesn’t, it is favorable for shareholders to receive higher distributions when a fund is trading at a steep discount to NAV. The reason is that $1 in NAV is only translating to $0.88 in share price. $1 in distributions is $1 in our pockets.

Since HQH’s distribution policy is variable, the actual size of the distribution will be directly influenced by variations in NAV. If the fund does not grow by 3% for a quarter, then NAV will be lower after the distribution, and that will reduce the future distribution. If the fund can grow by more than 3%/quarter, then NAV will grow despite the distribution, and future distributions will be higher.

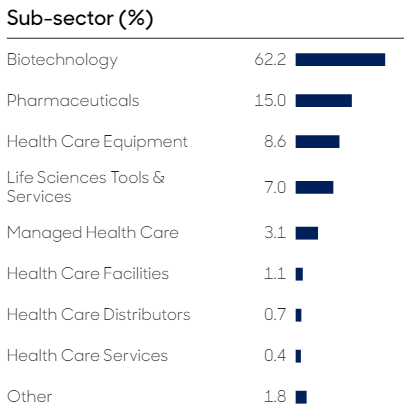

Is 12%+ a reasonable return on HQH’s portfolio? We believe it is very possible. HQH focuses on biotechnology and pharmaceuticals. These two sectors became popular during COVID, but prices have come down as investors rotated out.

HQH Fact Sheet

The fundamentals for these sectors remain strong as medical innovation keeps moving forward and consumer demand for both essential and elective medications is only growing.

There is a lot of reason to believe that from today’s low valuations, we could see double-digit upside from HQH’s portfolio. Meanwhile, we are getting $0.88 in market value converted into $1.00 cash in our pockets.

Conclusion

OXLC and HQH provide us with wide exposure to two very different sectors within the market. One provides exposure to CLOs, allowing you to enjoy income by benefitting from floating interest rates. While rates are high, they provide even higher income. When rates dip, they provide a lower level of income, but are still superior to many other options available in the market.

HQH allows you to enjoy strong exposure to the pharmaceutical sector and healthcare as a whole. The amount of money that individuals are paying towards healthcare continues to increase. As our population ages, our spending on healthcare climbs. It’s said that often in retirement, you trade much of your wealth to try to maintain a piece of your health, especially if you were trading your health to try to gain as much wealth as possible. I can use HQH as a fund to be able to fuel my retirement alongside OXLC. It gives me a 1-2 punch to be able to hit my expenses head-on.

What is your retirement dream? Build your goals to help you achieve that dream, whether it’s the ability to travel and experience the world, or to buy a piece of land in a quiet corner of America and enjoy peace and quiet without traffic noise or bothersome neighbors. Your goal will be as unique as you are, tailored to achieve your unique dreams. You can then use something like our Income Method to help you achieve your goals and fulfill your dreams. With picks like these, you’re making money — even while you’re asleep!

That’s the beauty of my Income Method. That’s the beauty of income investing.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)