Fitness

Leadership Change Sparks Xponential Fitness’ (NYSE:XPOF) Stock Surge – TipRanks.com

The appointment of a new CEO has sparked a positive investors’ sentiment on Xponential Fitness (NYSE:XPOF), with its stock surging over 65% in the last month. However, the company has recently faced intense scrutiny and negative press, primarily driven by a report from a short seller, a negatively toned Bloomberg article, and, most significantly, an ongoing SEC investigation, leading to the removal of the former CEO.

Market participants have embraced the news of new leadership, helping the shares of the stock rebound close to its high watermark for the year. Investors might want to monitor the situation and look for confirming signs of further positive momentum in the underlying business before taking a position.

Xponential’s New CEO Is a Potential Catalyst

Xponential Fitness is a global franchising boutique health and wellness brand, operating nine diverse labels across numerous sectors such as Pilates, indoor cycling, barre, stretching, dancing, boxing, strength training, metabolic health, and yoga.

The company announced the appointment of Mark King, who previously served as the CEO of Taco Bell, President of Adidas North America (OTC:ADDYY), and CEO at TaylorMade, as its new CEO, effective June 17, 2024.

He has extensive experience driving positive same-store sales growth while aggressively expanding new franchise locations, including significantly accelerating international growth. His expansive experience in growing global brands and solidifying franchise systems is expected to contribute considerably to Xponential Fitness’s goal of bolstering its global leadership position in the sector, catalyzing its value to greater heights.

Xponential’s Recent Financial Results and Outlook

The company posted mixed results for Q1 2024. Revenue increased by 12% year-over-year to $79.5 million, beating analysts’ expectations of $78.78 million. This rise is largely due to an increase in operating studios and a 9% increase in North American same-store sales.

However, the company fell short of predicted earnings per share, reporting $0.16 against consensus estimates of $0.21. Despite this, the company managed to significantly reduce its net loss, reporting a loss of $4.4m, or $0.30 per basic share, compared to a net loss of $15m, or a $1.38 loss per basic share in the previous year. The improvement is attributed to higher overall profitability and decreased acquisition and transaction expenses.

As of the end of the quarter, XPOF reported having $27.2 million in liquid assets, including cash, cash equivalents, and restricted cash, alongside total long-term debt of $331.4 million. The firm’s operating activities within this period provided a net cash flow of $2.7 million.

Management had offered its guidance for the full Fiscal year of 2024 based on planned expansion, with new studio openings expected to be between 540 and 560. Revenue is estimated to be between $340.0 million and $350.0 million, indicating a potential increase of 8% at the midpoint. Furthermore, Adjusted EBITDA is projected to range from $136.0 million to $140.0 million, implying a 31% increase at the midpoint. This guidance was offered before the arrival of the new CEO, who may exercise other strategies that could impact these targets.

What Is the Price Target for XPOF Stock?

Analysts following the company have been more constructive on the stock since the leadership change announcement. For instance, Guggenheim analyst John Heinbockel raised the price target on the shares from $18 to $20 while reiterating a Buy rating, noting that hiring an experienced and successful new CEO has changed how investors feel and significantly affected the value of shares.

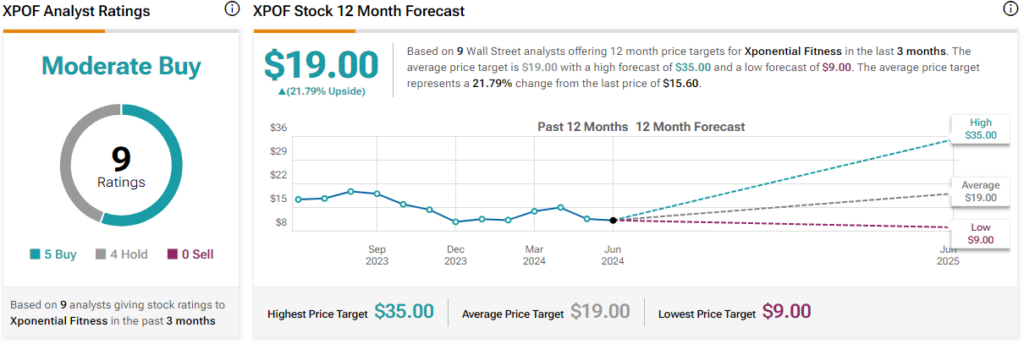

Xponential Fitness is currently rated a Moderate Buy based on the recommendations and price targets recently assigned by nine analysts. The average price target for XPOF stock is $19.00, representing a potential 21.79% upside from current levels.

The stock has been volatile, posting a beta of 1.43, though it has resumed its upward trend, climbing 21% year-to-date. The stock trades in the upper half of its 52-week price range of $7.40 – $24.00 and demonstrates ongoing positive price momentum, trading above its 20-day (13.57) and 50-day (12.52) moving averages. With the recent run-up in price, the shares now look fully valued, with a P/S ratio of 1.8x, which is in line with the Leisure industry average of 1.77x.

Final Thoughts on XPOF

Xponential Fitness offers a diverse portfolio of boutique fitness brands. The company has managed to weather an intense period of scrutiny and negative press, and with a new CEO at the helm, investor sentiment appears to have shifted positively. The new CEO brings a proven track record and is expected to help Xponential Fitness strengthen its leadership position in the sector.

While the stock’s price has been volatile, recent trends suggest upward momentum, making the stock worthy of consideration. However, investors may want to hold off and verify the new CEO’s impact on successfully driving the business forward before establishing a position.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)