Bussiness

Global markets on alert for Biden exit as Trump-win trades mount

(Bloomberg) — The red-hot Washington debate over whether President Joe Biden will scrap his run for re-election is spilling into Wall Street, where traders are shifting money to and from the dollar (DX=F), Treasurys and other assets that would be impacted by Donald Trump’s return to office.

Most Read from Bloomberg

The recalibration of portfolios kicked off at the end of last week after Biden’s disastrous debate with Trump heightened concerns the 81-year-old Democrat is too old to serve another term. The trading action afterward was most acute in the bond market, where yields on benchmark 10-year Treasuries jumped as much as 20 basis points across the following days.

With speculation now mounting rapidly that Biden could drop out of the race — betting markets see less than a 50% chance he remains a candidate — investors are hastily making contingency plans to react to such an announcement during Thursday’s Fourth of July holiday and the subsequent weekend.

One fund manager, speaking on condition of anonymity given the sensitivity of the topic, said he was heading into the vacation stretch biased toward the dollar and short-term debt as hedges against the spike in risk he reckoned would be sparked by a Biden withdrawal. No president has opted against seeking a second term since Lyndon Johnson in 1968 and the election is just four months away.

“Markets have already been repricing election odds since the debate, so the news over the past 24 hours has really only added fuel to the fire,” said Gennadiy Goldberg, head of US rates strategy at TD Securities in New York.

The consensus among traders and strategists is a re-election of Trump, a 78-year-old Republican, would spur trades that benefit from an inflationary mix of looser fiscal policy and greater protectionism: A strong dollar, higher US bond yields and gains in bank, health and energy stocks.

Even some 10,000 miles away, in Sydney, they’re bracing. Rodrigo Catril, a strategist at National Australia Bank, said “everyone” is preparing trading plans in case Biden ends his campaign.

“Either way, the market is betting on Trump winning the election,” said Catril. “It seems Democrats are stuck with very difficult choices, none of them easy, and none of them likely to yield a better outcome.”

Here’s how the so-called Trump trade is materializing across markets:

Dollar’s signal

The dollar (DXY) gave one of the earliest signals as to how markets would adjust to a potential Trump victory, gaining in the hours after last week’s debate. While the greenback has gotten a boost this year from the Federal Reserve’s indications that it intends to keep interest rates for higher longer, the currency got a clear bump in real-time as Trump dominated the faceoff with Biden.

Trump has floated cutting taxes and slapping 60% tariffs on imports from China and 10% duties on those from the rest of the world. Goldman Sachs Group Inc.’s chief economist Jan Hatzius said this week that such levies could lift inflation and force the Fed to lift rates about five more times than otherwise.

“A Trump victory raises the prospect of higher inflation and a stronger dollar, given his promise of more tariffs, and a tougher stance on immigration,” said JPMorgan Chase & Co. strategists led by Joyce Chang.

Potential losers in the face of a rising dollar and Trump’s expected support for tariffs include the Mexican peso (MXN=X) and Chinese yuan (CNY=X).

Yield-curve trade

In the aftermath of the debate, money managers in the $27 trillion Treasury market reacted by buying shorter-maturity notes and selling longer-term ones — a wager known as a steepener trade.

A slew of Wall Street strategists have touted the strategy, including Morgan Stanley and Barclays Plc, urging clients to prepare for sticky inflation and higher long-maturity yields in another Trump term.

In a two-day span starting late last week, 10-year yields rose by about 13 basis points relative to 2-year rates, in the sharpest curve steepening since October.

Signs of traders bracing for near-term volatility in the Treasury market emerged Wednesday, through a buyer of a so-called strangle structure, which benefits from a move higher or lower in futures through the strike prices. Along with potential risk over the holiday weekend around Biden’s candidacy, the expiry also incorporates Friday’s US jobs data and testimony next week from Fed Chair Jerome Powell.

Stocks gain

The prospect of a Trump victory has supported myriad stocks that stand to benefit from his perceived stances on the regulatory environment, mergers and trade relations. The broad market has powered higher in the wake of the debate.

The turn in the electoral tide since last week has “meant higher stocks as Republicans are generally viewed as more business friendly,” said Tom Essaye, president and founder of Sevens Report.

Health insurers UnitedHealth Group Inc. (UNH) and Humana Inc. (HUM) and banks stand to benefit from looser regulations. Discover Financial Services (DFS) and Capital One Financial Corp. (COF) are among credit card companies that have risen on optimism over Trump, given that pair’s pending deal and speculation around possible changes to late fee rules.

Energy stocks like Occidental Petroleum Corp. (OXY) rose after the debate, given the former president is seen as having a pro-oil stance. Private prison stocks like GEO Group Inc. (GEO) have reacted to his perceived tough-on-immigration views.

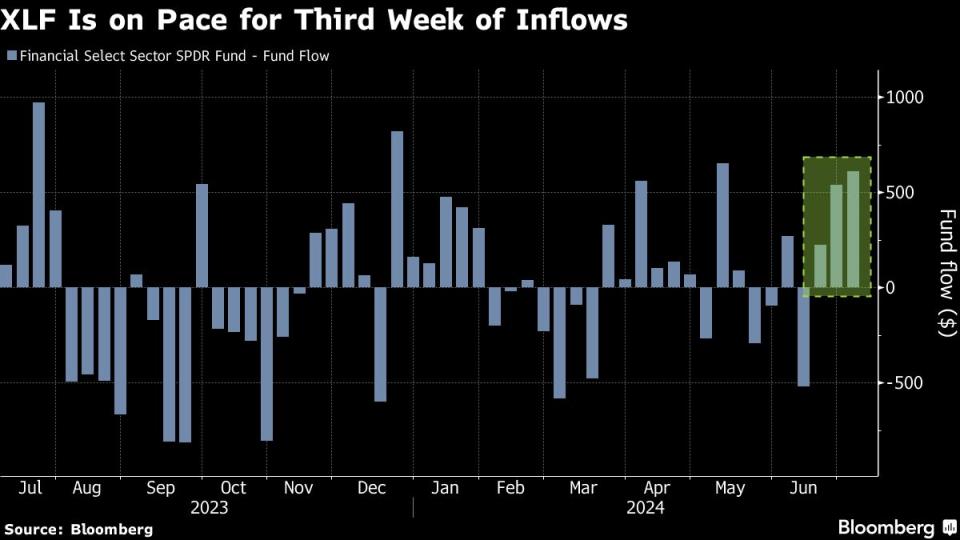

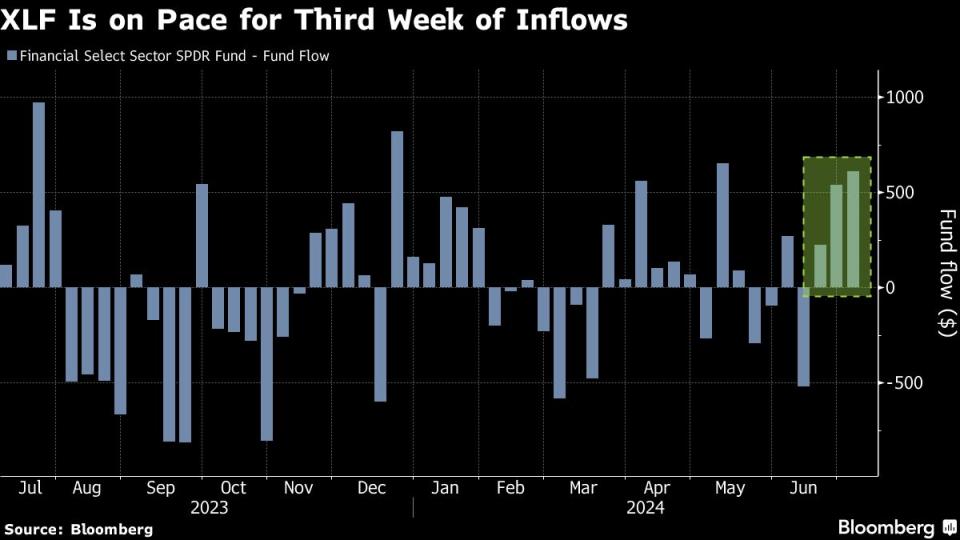

Financials ETFs

The exchange-traded fund market has shown one clear investing strategy of late: Long banks on bets that Trump will spur deregulation and a steeper Treasury curve thanks to his potentially inflationary agenda.

The Financial Select Sector SPDR Fund (ticker XLF), a $40 billion fund, last week saw its largest inflow in more than two months, with investors adding roughly $540 million. So far this week, they’ve added $611 million amid the latest gyrations in the interest-rate market.

Meanwhile, a thematic-investing strategy designed to ride the Trump trade has struggled to gain traction. An ETF that sports the eye-catching ticker MAGA and invests in Republican-friendly stocks has been slow to garner assets and hasn’t seen any material inflows this year, data compiled by Bloomberg show.

Asian impact

Asia’s markets aren’t immune to the speculation either, with US-China tensions simmering and tariffs in play.

“The re-election of Mr. Trump should be a negative factor for China equities as Mr. Trump supports the idea of imposing substantially higher tariffs on US imports from China,” said Tomo Kinoshita, global market strategist at Invesco Asset Management Japan. “In that regard, Japanese stocks with high exposure to Chinese market are likely to be hurt if Mr. Trump wins.”

Crypto support

Trump has shown support for the crypto industry in recent weeks by meeting with industry executives and promising he would ensure all future Bitcoin mining is done in the US.

That makes the Solana (SOL-USD) token — the fifth-largest cryptocurrency with a market capitalization of about $67 billion, according to CoinMarketCap — one potential beneficiary of a Trump return to the White House. Asset managers VanEck and 21Shares have filed for ETFs that would directly invest in the digital currency.

While many consider approval a long shot, the thinking among some market participants is that a newly re-elected Trump would appoint a Securities and Exchange Commission chair who is more crypto-friendly than Gary Gensler has been under Biden. That’s an outcome that would make a Solana ETF — and a corresponding rally in the token — more likely.

The prospect of a shakeup to the Democratic ticket is also likely to boost Bitcoin, according to Stephane Ouellette, chief executive of FRNT Financial.

“The crazier that the US political system looks, the better that Bitcoin looks,” Ouellette said “This is the kind of vibe that Bitcoin would go for. Craziness in the US political system is a pro-Bitcoin factor.”

—With assistance from Emily Nicolle, Katie Greifeld, Edward Bolingbroke, Anya Andrianova, Jan-Patrick Barnert, Natalia Kniazhevich, Ruth Carson, Bre Bradham, Nazmul Ahasan, Winnie Hsu, Carter Johnson, Vildana Hajric, Liz Capo McCormick and Ye Xie.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)