Bussiness

German-Bitcoin sell-off: With BTC worth $551M sold, is the king’s crown slipping?

- Bitcoin’s price increased by more than 3% in the last 24 hours.

- The German government once again transferred BTC worth millions of dollars.

Bitcoin [BTC] finally showed signs of recovery as, after weeks of declines, the king of cryptos’ daily chart turned green. Thanks to that, BTC’s price broke above $57k.

However, not everything was working in BTC’s favor, as a few major players, like the German government, sold BTC while its price surged.

Bitcoin turns bullish

CoinMarketCap’s data revealed that Bitcoin’s price had dropped by more than 9% in the last seven days.

But things got better in the last 24 hours as the king of cryptos’ value increased by over 3%, which gave hope for a further price rise.

At the time of writing, BTC was trading at $57,290.27 with a market capitalization of over $1.129 trillion. While BTC’s price gained bullish momentum, a few of the top players in the crypto space chose to sell their holdings.

Lookonchain’s recent tweet revealed that the German government once again transferred 9,634 BTC, worth over $551 million, to Kraken, FlowTraders, Coinbase, Bitstamp, Cumberland, and B2C2Group.

As per the tweet, the German government has transferred 24,304 BTC, which was worth $1.44 billion since the 19th of June, and still held 28,988 BTC at press time, valued at $1.66 billion.

Apart from this, a whale also deposited a substantial amount of BTC. Another tweet from Lookonchain pointed out that a whale deposited 809 BTC, worth $45.18 million, to Binance.

This increase in selling pressure from a whale and the German government might have a negative impact on the coin’s price action and could result in an end to BTC’s newly launched bull rally.

Will BTC’s bull rally end soon?

Since a few of the players were exerting selling pressure, AMBCrypto checked CryptoQuant’s data to better understand the overall market condition.

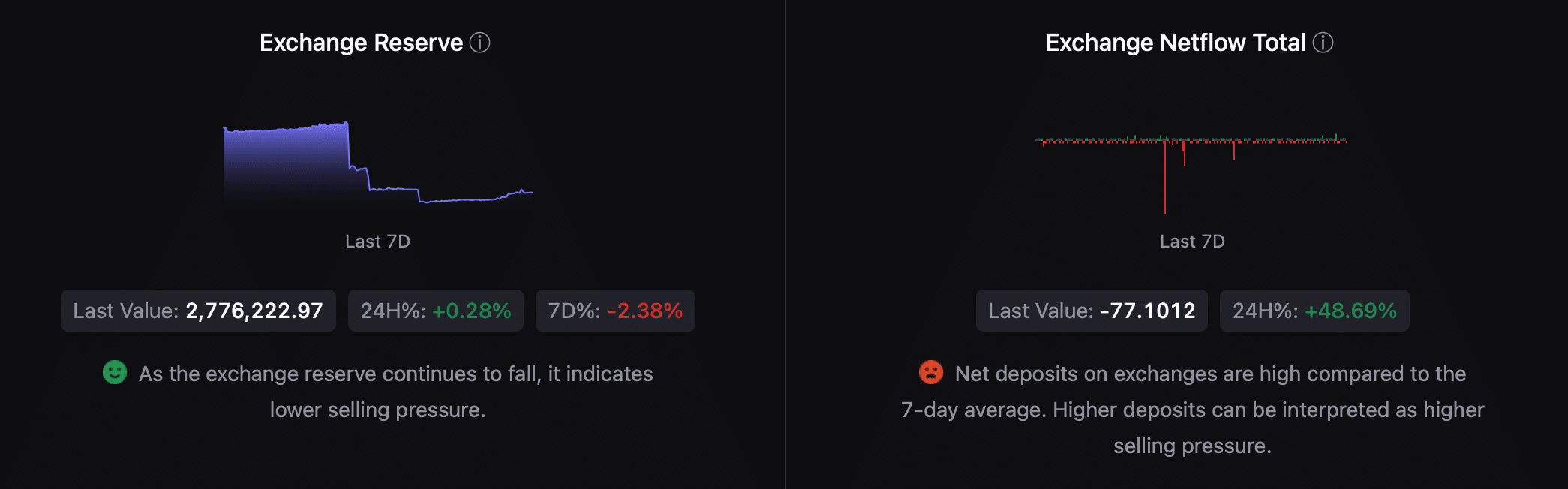

We found that BTC’s Exchange Reserve was decreasing, indicating weak selling pressure.

However, BTC’s net deposit on exchanges was high compared to the last seven-day average, meaning that selling pressure was rising.

Additionally, selling sentiment was also dominant among U.S. investors, which was evident from its red Coinbase premium.

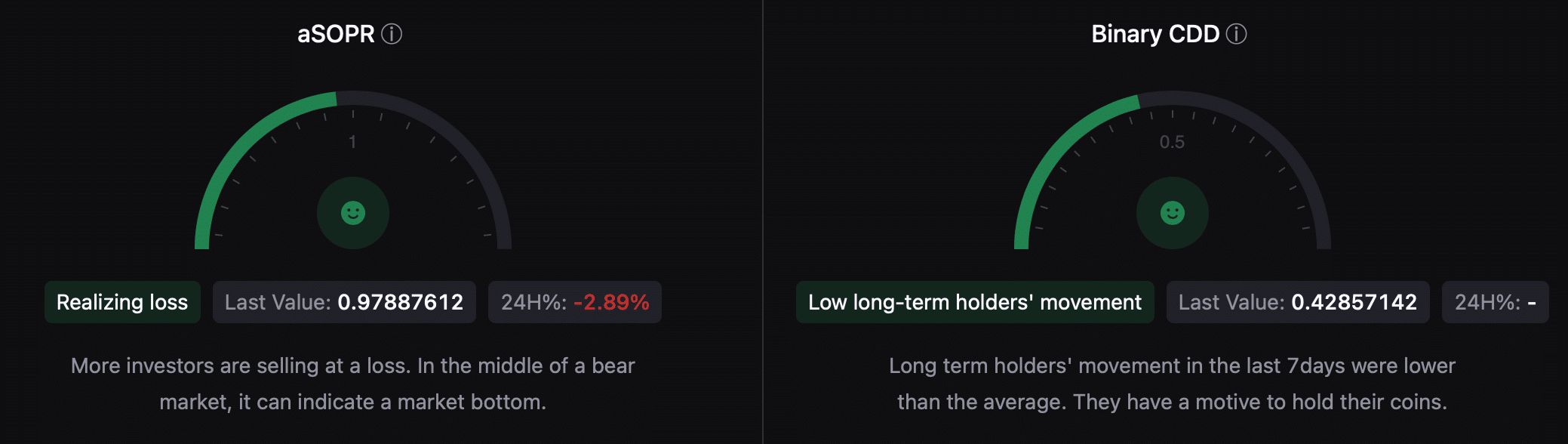

Nonetheless, a few other metrics looked bullish. For instance, BTC’s aSORP revealed that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Its Binary CDD was also green, meaning that long-term holders’ movements in the last seven days were lower than average. They have a motive to hold their coins.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

We then took a look at BTC’s daily chart to see whether indicators hint at a continued bull rally. The technical indicator Chaikin Money Flow (CMF) registered an uptick, hinting at a continued price rise.

But the Money Flow Index (MFI) looked bearish as it moved southward. This could, with the latest transfer from the German government, might put an end to Bitcoin’s bull rally.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)