Bussiness

Ethereum’s sentiment takes a hit after ETF nod, but it’s not all bad news!

- Ethereum’s funding rate has remained positive despite recent declines.

- The ETH trend has also remained bullish despite the price declines.

After the news of the Ethereum [ETH] spot ETF approval subsided, its weighted sentiment declined as well. Despite this decline, other metrics suggest that Ethereum might be poised for a positive run once spot trading resumes.

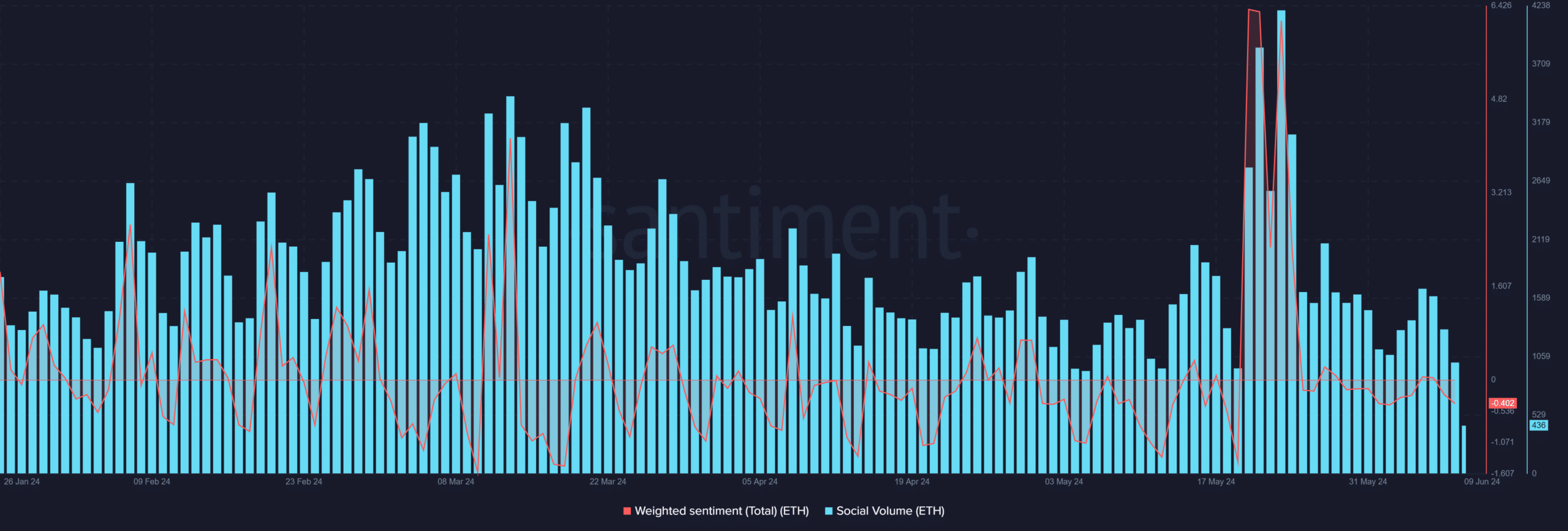

Ethereum’s sentiment and social volume declines

An analysis of the Santiment sentiment chart showed a decline in Ethereum’s sentiment. The chart indicated that weighted sentiment spiked to over 6% on the 20th and 21st of May.

It then briefly declined to around 2% before spiking over 6% again on 23rd May. This spike coincided with the news of the ETH spot ETF approval, reflecting heightened conversation and sentiment during that period.

However, after that spike, there have been declines in the weighted sentiment, which has now turned negative. As of this writing, the weighted sentiment is around -0.4.

This indicates that negative sentiment now outweighs the positive sentiment that Ethereum enjoyed a few weeks ago.

Additionally, an analysis of the social volume showed spikes corresponding to the increases in weighted sentiment. The chart indicated that social volume surged to 4,197 during those periods.

However, similar to the weighted sentiment, it has since declined significantly. As of this writing, the social volume was around 415.

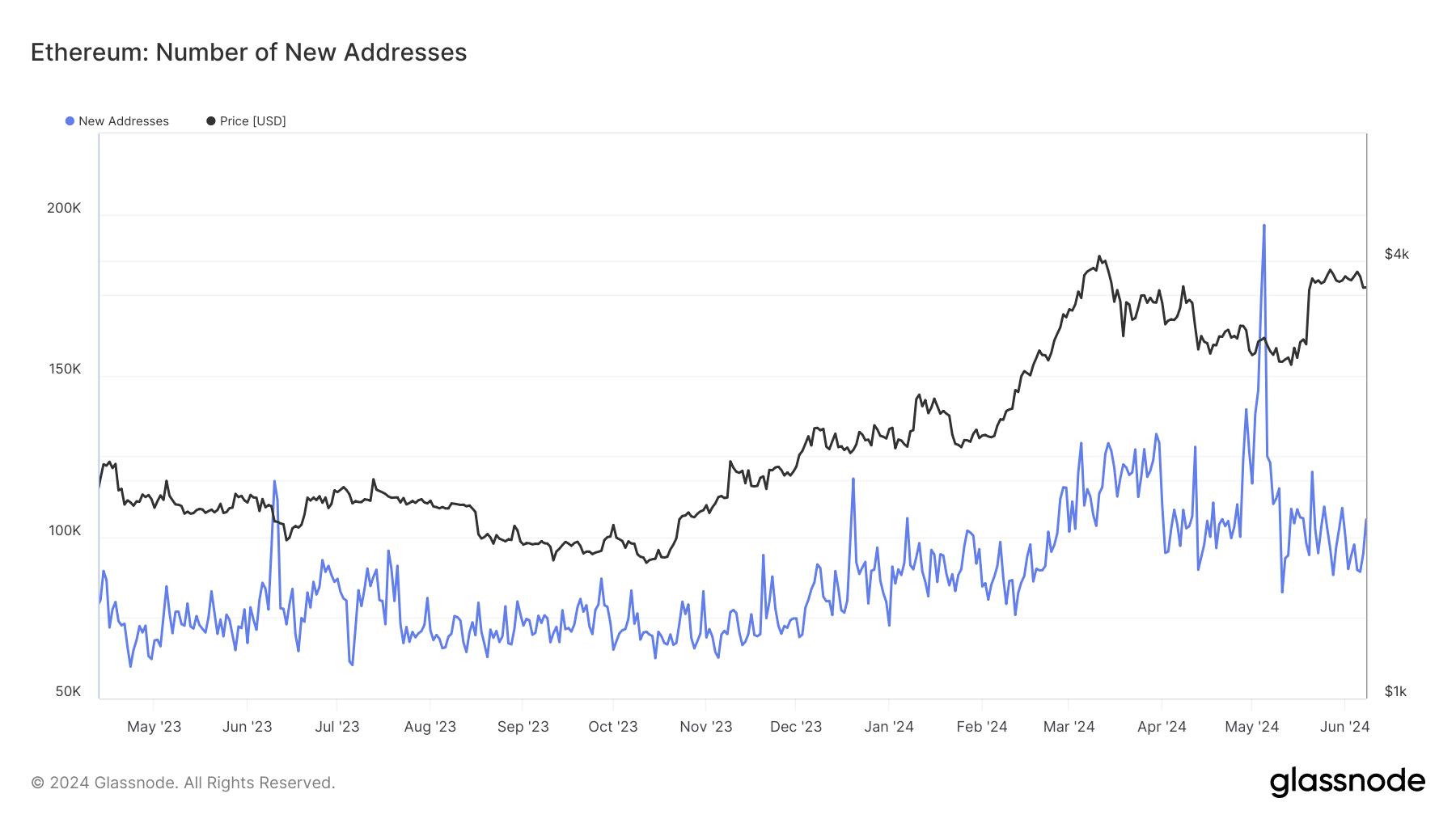

Ethereum’s trend of new addresses continue

An analysis of the new addresses chart on Glassnode revealed that new addresses have continued to flow in despite the weak sentiment. As of this writing, the number of new addresses exceeds 105,000.

Although there were declines at the beginning of the month, an uptrend is now evident. This indicates that more addresses are being created even before the spot ETH trade gets underway.

The number of addresses could further increase once trading starts.

Ethereum remains positive on the derivative side

An analysis of Ethereum’s weighted funding rate on Coinglass showed that it has remained positive despite recent declines.

The chart indicated that the funding rate was around 0.092% as of this writing. This suggests that buyers dominate the market, and there is a strong belief in a future rise in Ethereum’s price.

– Read Ethereum (ETH) Price Prediction 2024-25

ETH sees slight increases

As of this writing, Ethereum was trading at around $3,690 after a 0.4% increase. AMBCrypto’s analysis of its daily time frame price trend showed slight increases over the last two days.

These slight increases followed an over 3% decline on 7th June, which brought Ethereum down from the $3,800 price range.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)