Bussiness

Ethereum stablecoin volume drops: Will it impact ETH prices?

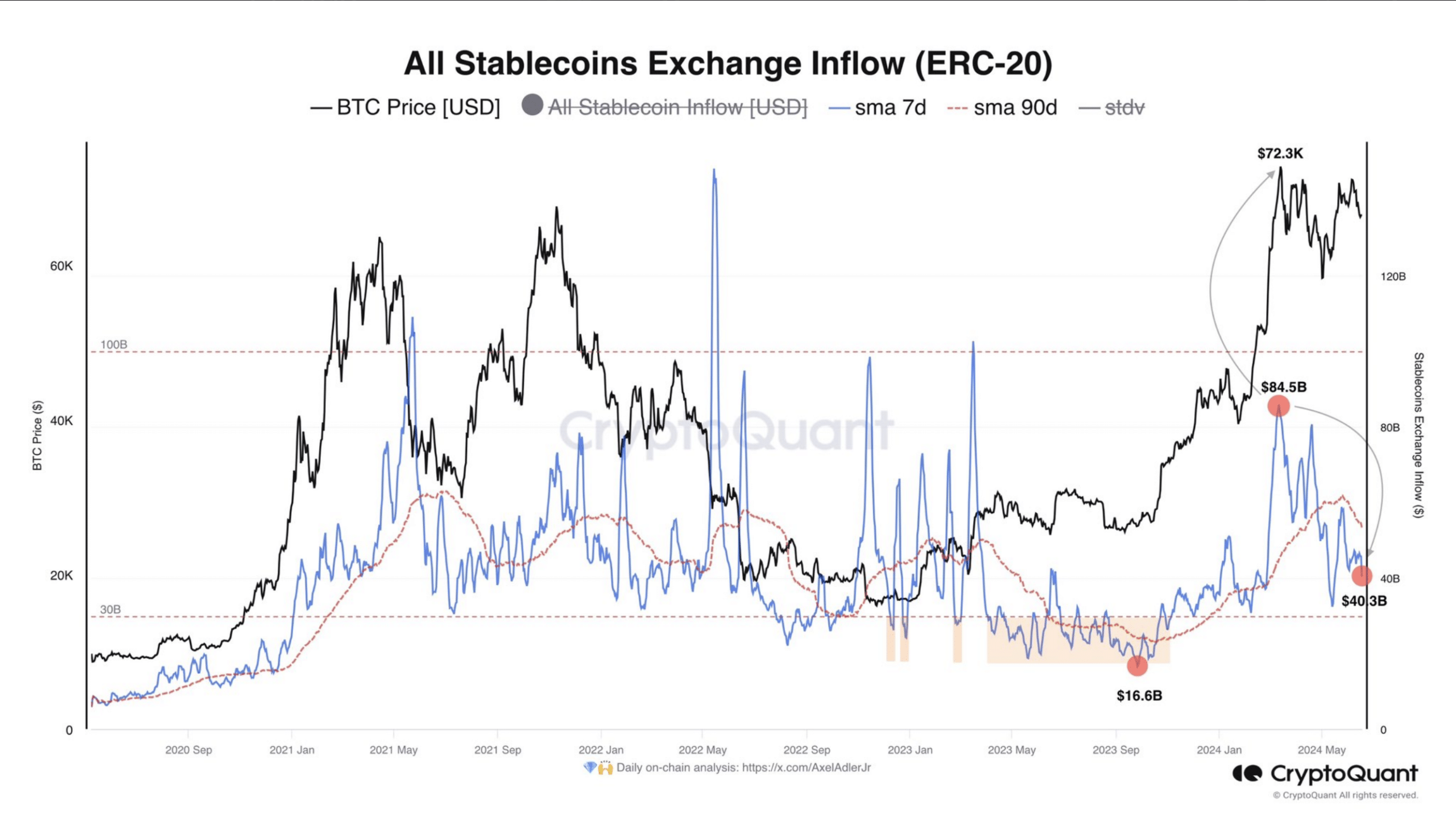

- Stablecoin volume on Ethereum fell to $40 billion, indicating the potential of leading the cryptocurrency to a bear phase.

- The MVRV Long/Short Difference, alongside holders’ sentiment showed that ETH’s price might increase.

Stablecoin volume on the Ethereum [ETH] blockchain has dropped from $84 billion to $40 billion, according to data from CryptoQuant. When the volume of stablecoins increases, it means that demand for tokens on a blockchain might increase.

Also, when this happens, it strengthens the native cryptocurrency of the ecosystem. For Ethereum, the drop in volume indicates that most ERC-20 tokens have been underperforming.

ETH holders don’t believe in bears

ERC-20 tokens refer to the fungible tokens created using the Ethereum blockchain. Historically, if the stablecoin volume plummets to $30 billion, ETH falls into a bear market. Therefore, the risk was present.

At press time, ETH’s price was $3,517, representing a 4.18% decrease in the last seven days. While there have been predictions that the price would revisit $4,000, that has not happened in weeks.

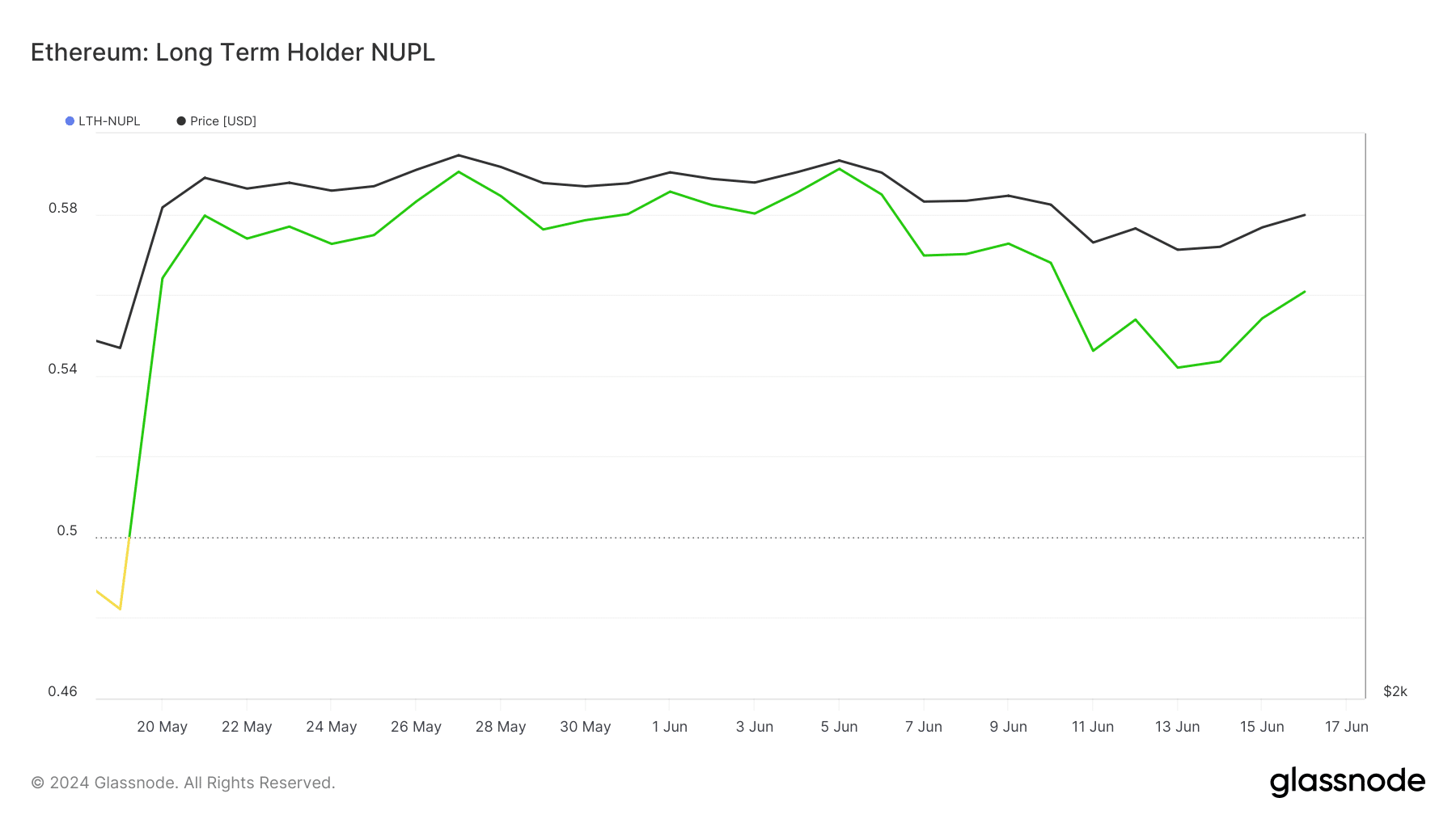

Besides this, AMBCrypto looked at the LTH-NUPL. LTH-NUPL stands for Long-Term Holder- Net Unrealized Profit/Loss. This metric assess the behavior of long-term holders.

Typically, the metric considers UTXOs with at least a lifespan of 155 days. According to Glassnode, Ethereum’s LTH-NUPL was in the belief (green) zone.

This indicates that holders of the token are convinced that the price might increase.

If this conviction remains the same in the coming weeks, then ETH might not fall into a cycle. Instead the price of the token, backed by demand, could be looking at hitting a new all-time high.

Will rising volatility lead the price higher?

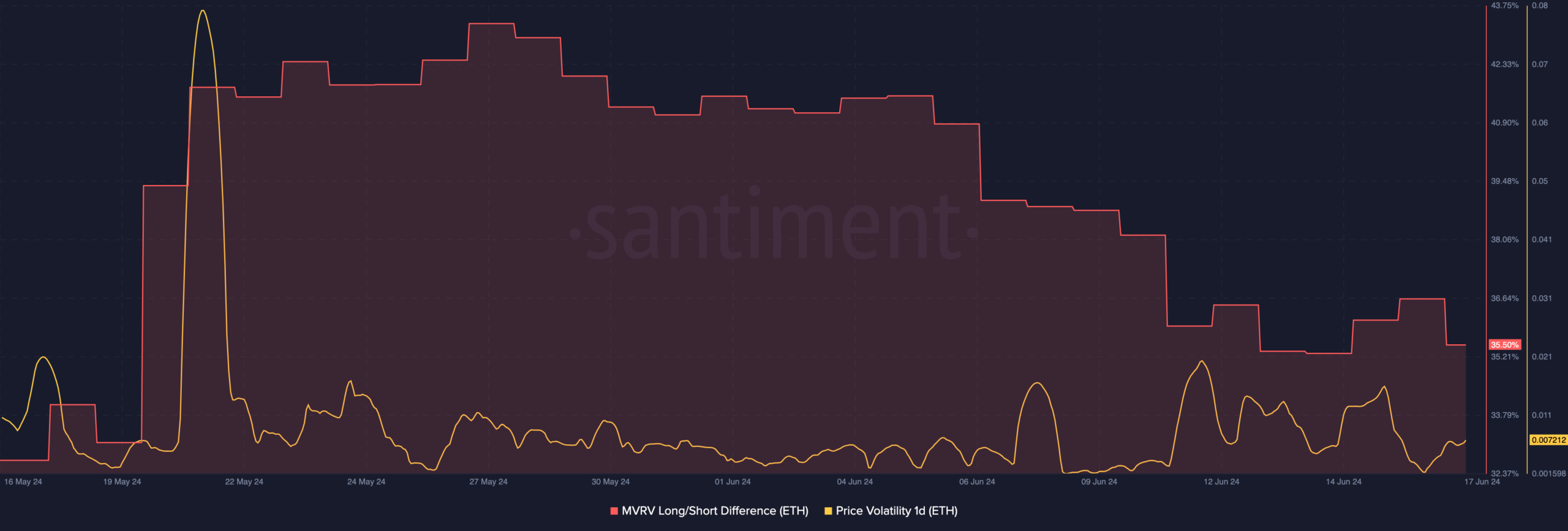

The Market Value to Realized Value (MVRV) Long/Short Difference is another metric that can tell if ETH is in a bear zone or not.

When the reading of the metric falls into the negative region, it means that a cryptocurrency might have dropped to the bear market.

But as long as the metric remains positive, the cryptocurrency is in a bull phase. At press time, AMBCrypto observed that the MVRV Long/Short Difference was 35.50%.

While this was a decrease from the reading last month, it was a sign that ETH has not succumbed to the bear zone. However, one cannot deny that it implies that ETH’s price might fall.

But if it does, the value of the cryptocurrency is unlikely to slide below $3,000. If this remains the case, ETH might have a chance at retesting $4,000 and beyond.

Meanwhile, the one-day volatility has begun to increase. Volatility measures how rapid price can move in different directions. When volatility increase with buying pressure, price can jump to incredible figures.

Read Ethereum’s [ETH] Price Prediction 2024-2025

On the other hand, high volatility will selling pressure leads to correction. For ETH, it remains uncertain where the price would head next.

However, something seemed almost certain, holders might not give in to bearish demand that drive the price lower than expected.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)