Bussiness

Crypto market’s weekly winners and losers – LDO, ENS, WIF, NOT

- Pendle, Lido DAO, and Ethereum Name Service were the biggest winners of the past week.

- zkSync, dogwifhat, and Notcoin were the biggest losers of the week.

Pendle [PENDLE] saw the market swing in its direction as it emerged as the top gainer in a turbulent week for cryptocurrencies.

Meanwhile, zkSync experienced a challenging debut, quickly feeling the impact of market forces in what could be described as its “baptism of fire.”

Biggest winners

Pendle [PENDLE]

PENDLE began the week positively, although its progress wasn’t entirely smooth. It opened at approximately $5.6 and closed the week around $6.0.

Data from CoinMarketCap indicates that PENDLE gained 15.48% over the past week, positioning it as the week’s top gainer.

AMBCrypto’s analysis revealed that Pendle’s price fluctuated throughout the week, dipping to $4.8 and peaking at $6.2.

As of this writing, it was trading at approximately $6.1, showing a modest increase from its closing price last week.

Its market capitalization was around $947 million, with a trading volume of about $57 million. Notably, its volume has declined by 26% in the last 24 hours.

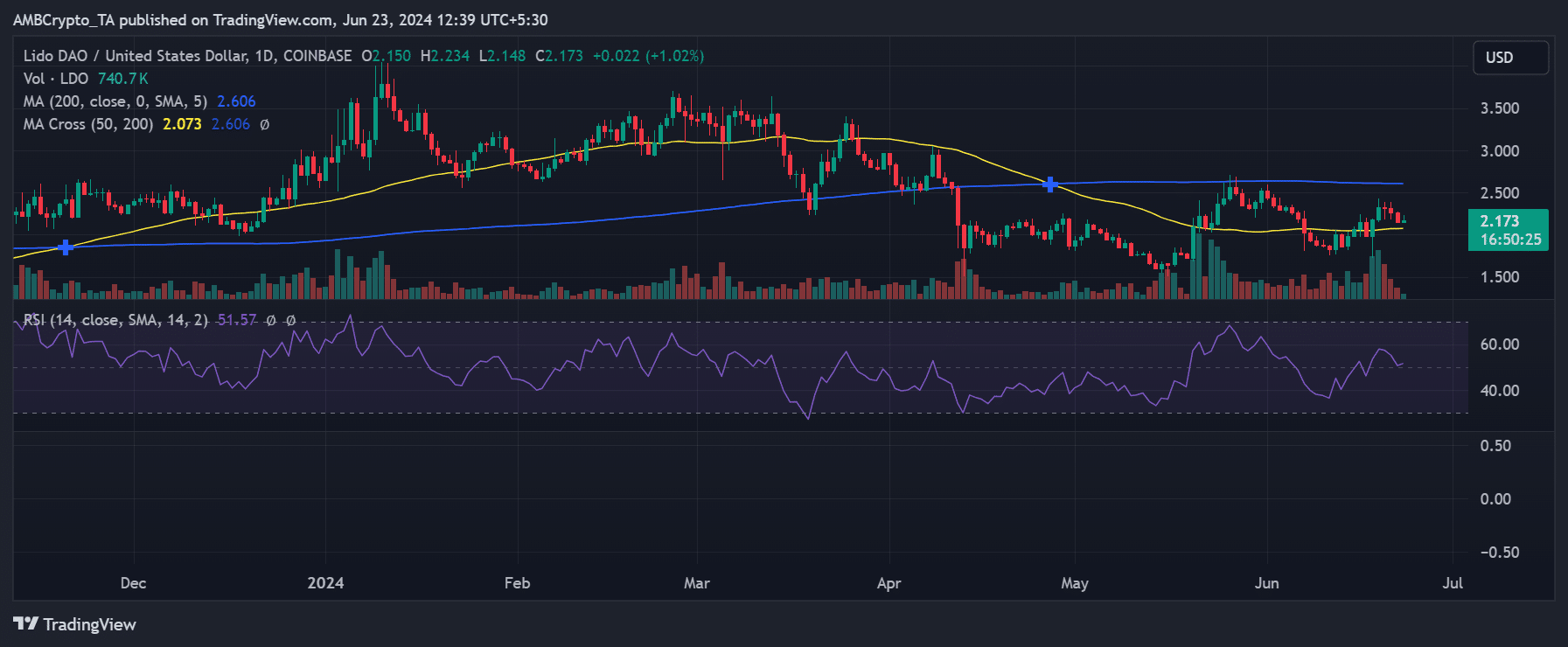

Lido DAO [LDO]

AMBCrypto’s look at Lido DAO [LDO] on a daily time frame revealed that it started the week with a 3.81% increase, raising its price from approximately $2 to $2.15.

It then experienced a significant drop of over 7% on the 17th of June, bringing its price down to around $1.9. However, subsequent rises of approximately 10% and 6.5% helped it recover, pushing its price above $2 to around $2.3.

The chart indicated that LDO ended the week with a 4.9% decline. Yet, it managed to keep its price above $2, trading at around $2.1.

Despite experiencing significant losses during the week, LDO finished as the second-highest gainer according to data from CoinMarketCap, which recorded a 7.86% gain for the week.

Lido DAO’s Relative Strength Index (RSI) indicated that it remains in a bull trend despite its recent declines. As of this writing, the RSI was above the neutral line, resting on it.

This suggests that while Lido DAO is still in a bull trend, the trend is relatively weak.

As of the latest update, Lido DAO’s market capitalization stood at approximately $1.9 billion, having experienced a decline over the last 24 hours.

Additionally, its trading volume in the past 24 hours was around $106 million, which also saw a reduction of about 24%.

Ethereum Name Service [ENS]

Ethereum Name Service [ENS] began the week with a price of approximately $24.3, starting on a positive note with an initial gain. However, it soon faced a major setback, dropping to around $22.7 the following day.

Despite this, ENS experienced significant increases after that, and by the 21st of June, it was trading at around $26.8.

Despite facing a major decline towards the end of the week, with its price dropping to around $25, ENS still managed to close the week with a 7.7% gain.

This performance made it the third-biggest gainer of the week, according to data from CoinMarketCap.

As of the latest update, the market capitalization of Ethereum Name Service (ENS) was approximately $788 million, and its trading volume stood at around $79 million.

Over the last 24 hours, the market cap had declined by over 2%, and the trading volume had decreased significantly by over 40%.

Biggest losers

zkSync [ZK]

During its debut week, zkSync [ZK] emerged as the highest loser, according to data from CoinMarketCap. The data indicated that it started the week at around $0.27 but experienced rapid declines throughout the week.

The market forces did not provide the favorable reception anticipated. By the week’s end, its price had dropped to approximately $0.18.

According to data from CoinMarketCap, ZK concluded the week with a significant decline of over 37%.

As of the latest update, its market capitalization stood at approximately $673 million, having increased by over 2% in the last 24 hours.

Its trading volume was around $181 million, which had decreased by over 38% in the last 24 hours.

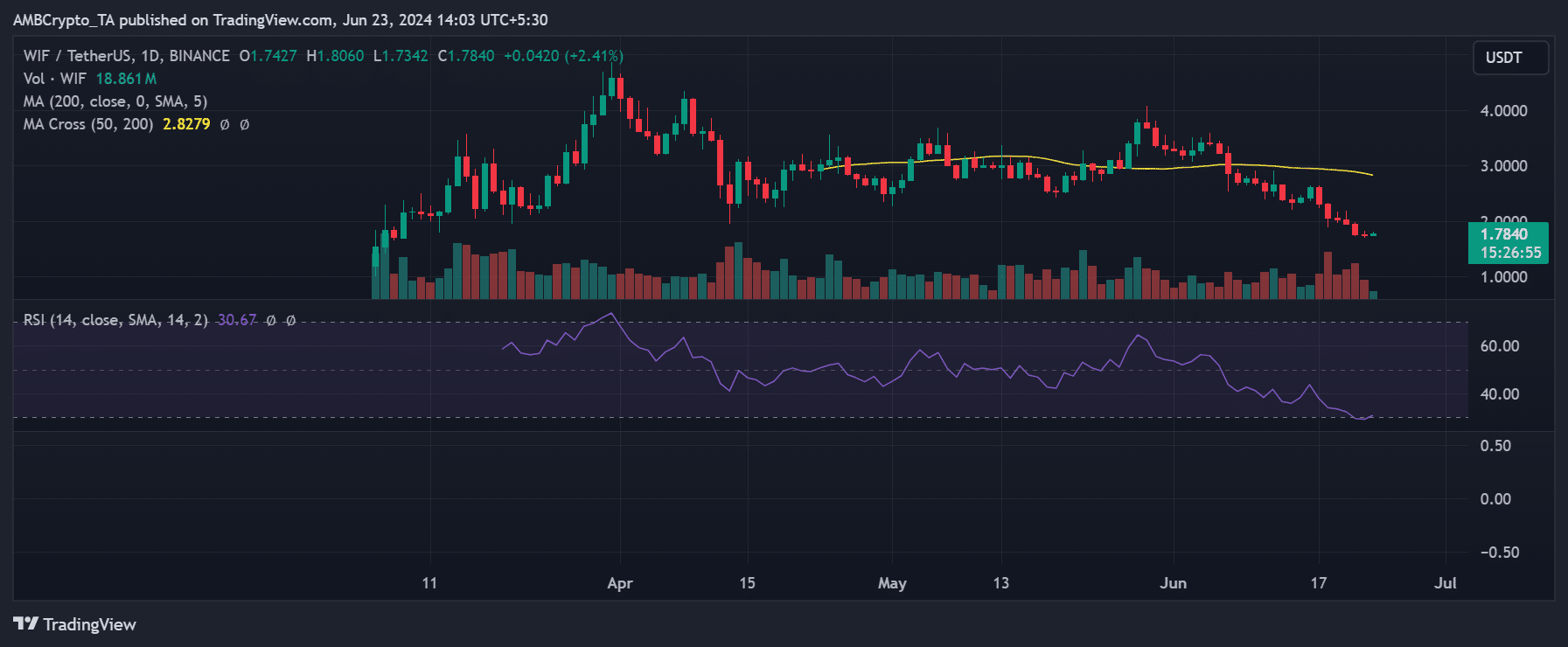

Dogwifhat [WIF]

AMBCrypto’s examination of Dogwifhat [WIF] revealed that it started the week with a rise of over 7%, trading at approximately $2.6.

However, this increase was merely a brief interruption in the downward trend it had been experiencing from the previous week.

Following the initial rise on the 16th of June, it faced consecutive declines. By the end of the week, Dogwifhat was trading at around $1.74.

According to data from CoinMarketCap, the memecoin was the second-biggest loser of the week, experiencing a decline of over 28%.

Its Relative Strength Index (RSI) indicated that it was entrenched in a strong bear trend.

The RSI was barely above 30, highlighting the intensity of the bearish momentum and indicating that it was very close to entering the oversold zone.

As of the latest data, the market capitalization of the memecoin stood at approximately $1.7 billion.

Its trading volume was around $240 million, which had decreased significantly, showing a decline of over 40% in the last 24 hours.

Notcoin [NOT]

According to data from CoinMarketCap, Notcoin [NOT] was the third-biggest loser of the week, experiencing a decline of over 25% over the past week.

AMBCrypto’s analysis of NOT indicated that it started the week with a price of around $0.02 but began to decline right from the start. By the end of the week, its price had dropped to approximately $0.015.

At press time, its market capitalization was $1.5 billion, having increased by over 3%. However, its trading volume, which was around $321 million, has declined by over 30% in the last 24 hours.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making any investment decisions is best.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)