Bussiness

Crypto Fear and Greed Index hits 74: What it means for Bitcoin

- The crypto fear and greed index recently hit 74, indicating extreme market greed.

- Bitcoin miner revenue soared over the past month.

The rally that Bitcoin [BTC] saw over the last few weeks, caused the price to surge and stagnate at the $68,000 level. However, new data indicated that the appetite of the bulls continued to increase.

Crypto fear and greed index tells you…

Data from Alternative.com showcased that the crypto fear and greed index was at 74, implying that the market was extremely greedy. During this period, the risk appetite for traders and holders increases as they are more likely to accumulate more BTC.

Even though BTC is close to its all-time high (ATH), the rising greed of traders indicates that there is an expectation for BTC to reach its previously attained ATH or even surpass it in the future.

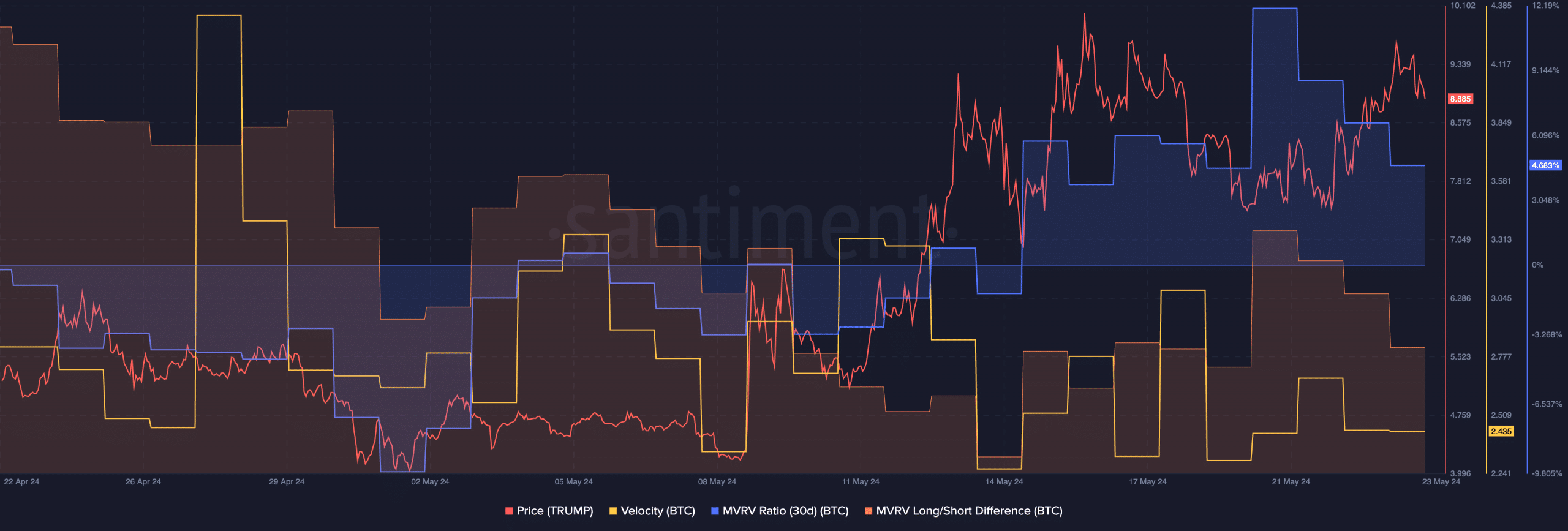

At press time, BTC was trading at $68,385.79. It would need an uptick of 7.21% to reach its previous ATH. The velocity at which BTC was trading at declined materially, implying that most addresses were keen on holding their BTC.

The MVRV ratio was relatively high, indicating that most holders were profitable at the time of writing.

High profitability can be a double-edged sword for BTC. On one hand, profitability can help improve sentiment around BTC.

On the other hand, some addresses maybe incentivized to indulge in profit taking causing selling pressure on BTC. The behavior of holders can provide an insight on whether these holders decide to sell their holdings.

The Long/Short difference declined over the past few days, suggesting that the presence of short-term holders (STH) was growing. These STHs are more likely to sell their BTC for profits which can cause volatility for the king coin in the long run.

Miners rejoice

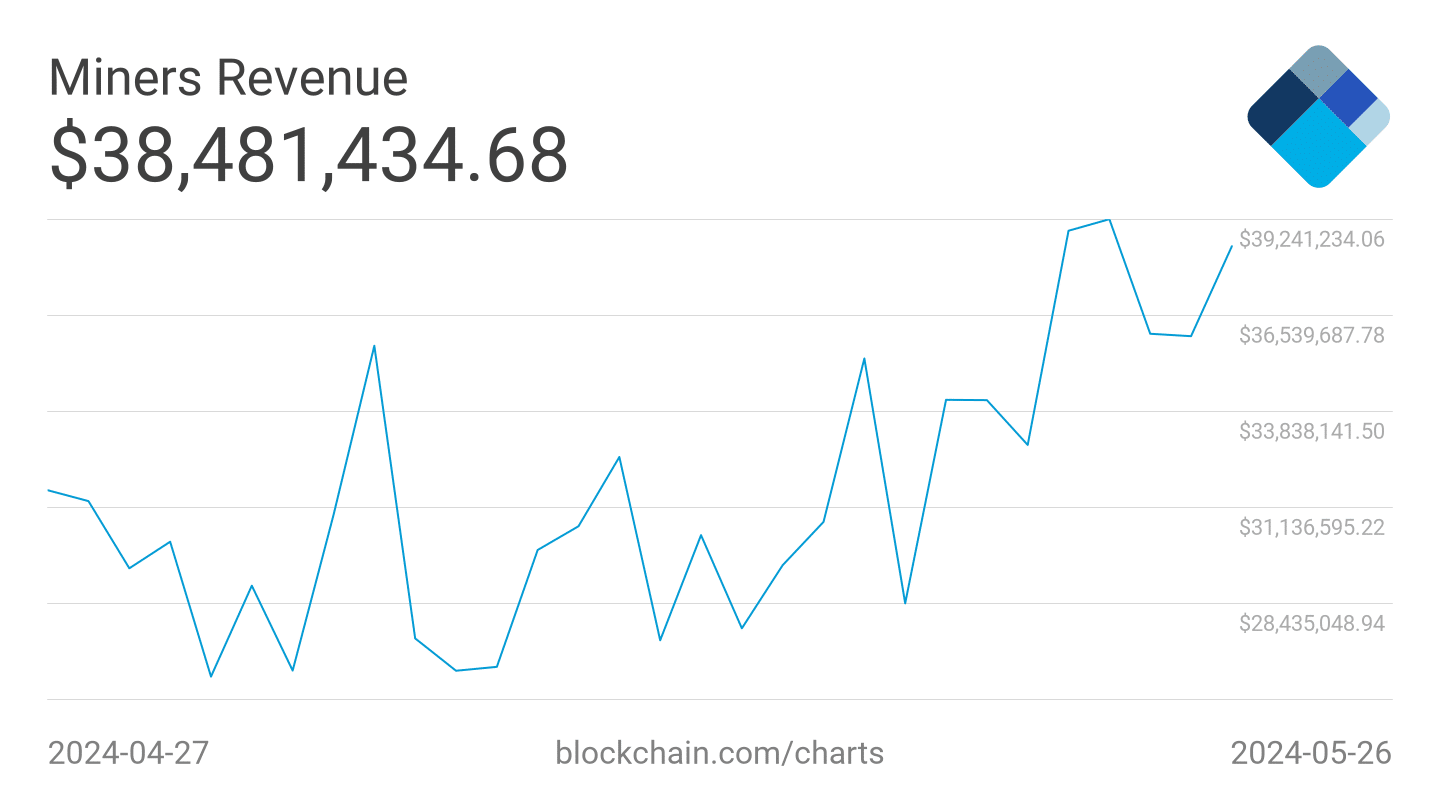

Another factor that can deeply influence selling pressure on BTC would be the state of miners. If miner revenues decline, miners are forced to sell their holdings to remain profitable which can cause problems for the price of BTC.

Is your portfolio green? Check the Bitcoin Profit Calculator

At the time of writing, things looked positive for miners. AMBCrypto’s analysis of Blockchain.com’s data revealed that daily miner revenue soared from $28,435,048 to $39,241,234 over the last few days.

Considering these factors, the chances of a BTC correction are low.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)