Jobs

Citi Sees AI Displacing More Bank Jobs Than Any Other Sector

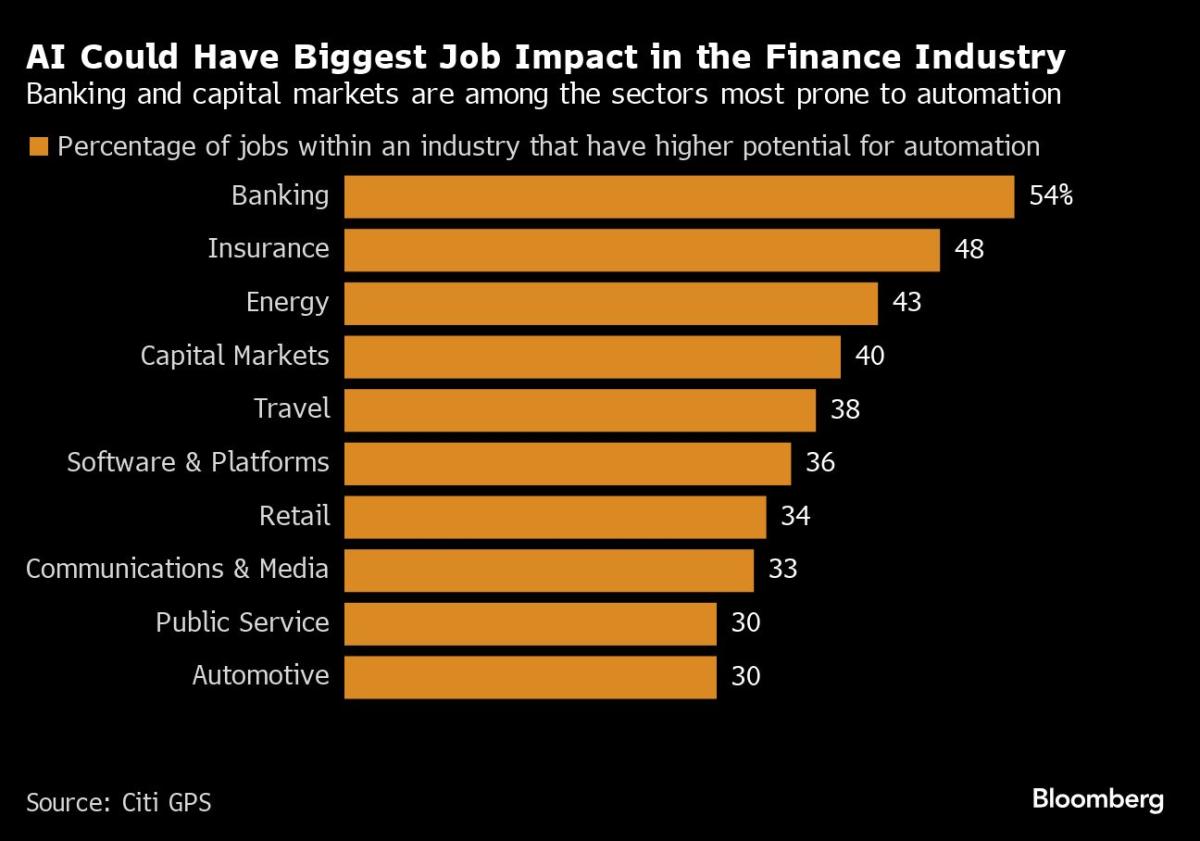

(Bloomberg) — Citigroup Inc. said artificial intelligence is likely to displace more jobs across the banking industry than in any other sector as the technology is poised to upend consumer finance and makes workers more productive.

Most Read from Bloomberg

About 54% of jobs across banking have a high potential to be automated, the bank said Wednesday in a new report on AI. An additional 12% of roles across the industry could be augmented with the technology, Citigroup found.

The world’s biggest banks have slowly begun experimenting more with AI over the last year, spurred by the promise that it will help them boost staffers’ productivity and cut costs. In its latest report, Citigroup found that the technology could add $170 billion to the banking industry’s coffers by 2028.

Citigroup has said it would equip its 40,000 coders with the ability to experiment with different AI technologies, and the company has said it’s used generative AI, which can produce sentences, essays or poetry based on a user’s simple questions or commands, to quickly comb through hundreds of pages of regulatory proposals.

“Our focus now is to taking it from the lab to the factory floor,” Citigroup’s Chief Executive Officer Jane Fraser said Thursday at the company’s digital money symposium, adding that the banking giant is also exploring using AI to offer custom investment recommendations for wealth clients and to improve its cybersecurity offerings.

JPMorgan Chase & Co. is scooping up talent and Chief Executive Officer Jamie Dimon has said he believes the technology will allow employers to shrink the workweek to just 3.5 days. Deutsche Bank AG is using artificial intelligence to scan wealthy-client portfolios. And ING Groep NV is screening for potential defaulters.

Generative AI “has the potential to revolutionize the banking industry and improve profitability,” David Griffiths, Citigroup’s chief technology officer, said in a statement accompanying the new report. “At Citi, we’re focused on implementing AI in a safe and responsible way to amplify the power of Citi and our people.”

Even if AI does replace some roles across the industry, Citigroup said, the technology might not lead to a drop in headcount. Financial firms will likely need to hire a bevy of AI managers and AI-focused compliance officers to help them ensure their use of the technology is in line with regulations.

Plus, new technologies haven’t always led to job cuts. In one example Citigroup offered, the number of human tellers soared between the 1970s and mid-2000s even after the introduction of automated teller machines.

Customer Service

One of the primary use cases for generative AI among financial technology upstarts and banking giants alike has been in customer service and support. Take Revolut Ltd.: the fintech is already using AI to capture more than 30% of all customer chats.

“That’s one area where the sky is the limit,” said Francesca Carlesi, who leads Revolut’s business across the UK. “I’m in no doubt in a couple years from now we might have 80% of the customer interaction. They are very efficiently managed through genAI.”

Rivals like Amsterdam-based Bunq or Stockholm’s Klarna have also embraced the technology in recent years. Klarna hailed the technology for helping the company reduce operating expenses by 11% in the first quarter, while Bunq recently launched a chatbot allowing users to query their own spending information with questions such as “How long will it take me to retire?” and “How much money did I spend on my trip to New York?”

Citigroup warned in its latest report that AI-powered chatbots do have some limitations. In some cases, chatbots struggle to understand slang and they often have difficulty comprehending ambiguous questions, the bank found.

“Since AI models are known to hallucinate and create information that does not exist, organizations run the risk of AI chatbots going fully autonomous and negatively affecting the business financially or its reputation,” the report said.

(Updates with CEO Jane Fraser’s comments in fifth paragraph, additional information from event starting in 10th paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)