Bussiness

Cardano’s long-term price will depend on THESE factors

- Cardano’s price consolidated around $0.37, with fluctuations indicating bearish momentum

- Uptick in new adoption pointed to growing interest in upcoming upgrades

Cardano is expecting a significant network upgrade soon, one which could lead to a price surge for ADA. In fact, the latest report from Cardano’s parent company, Input Output Hong Kong (IOHK), highlighted advancements in smart contracts, wallet services, core technology, and more.

Hence, the question – Is ADA set for a breakout now?

Market sentiment and price trends

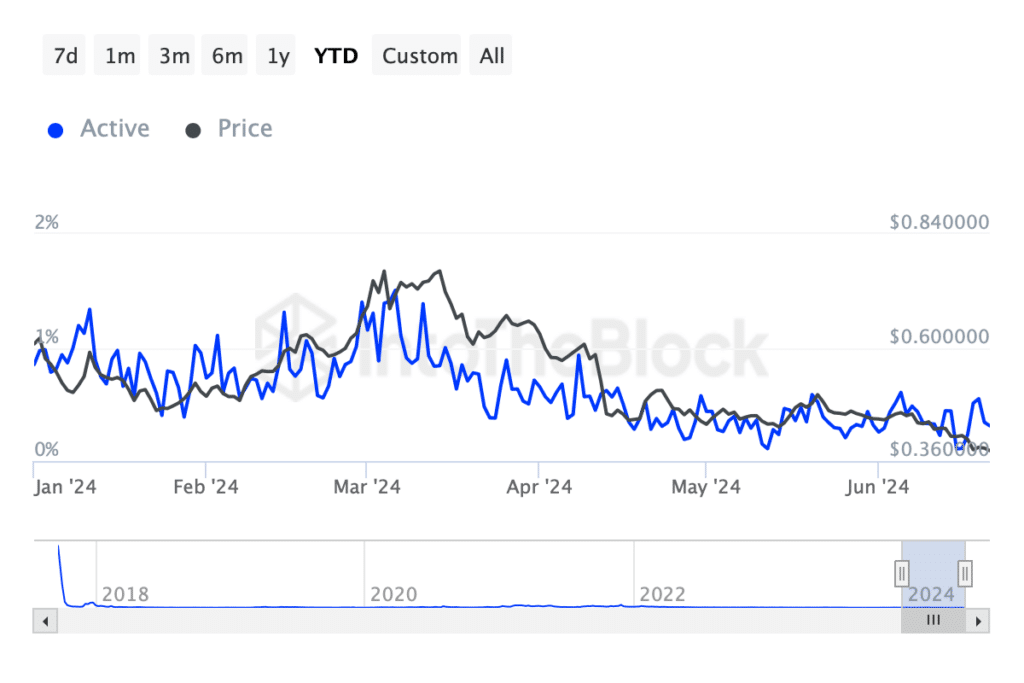

Since January, Cardano’s active address percentages have been declining, while the price remained relatively stable until a sharp decline in May.

The hike in zero balance addresses starting around late March correlated with the declining price. It implied that more holders have been liquidating or abandoning their positions as the price fell on the charts.

The new adoption rate peaked in early February, but it saw a major decline soon after, inversely related to the price movement, until a sharp hike in new adoption in June. This uptick is obviously related to the upcoming updates, with many in the community excited as expected too.

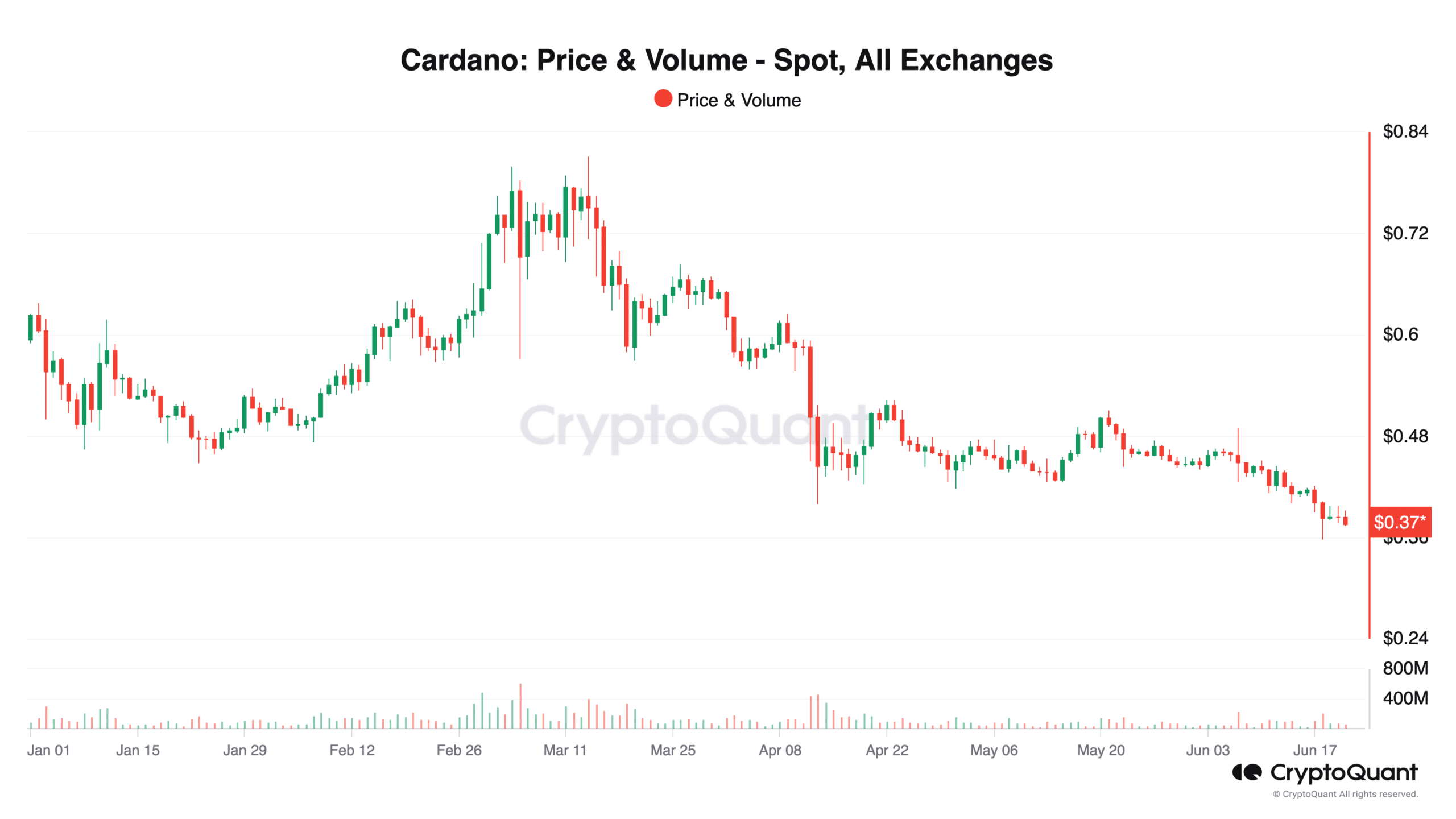

Now, while ADA has recovered on the charts, it has failed to sustain its upward momentum. This is a sign of an ongoing bearish run and a cautious or even negative investor response.

Additionally, ADA’s price has shown a tendency to consolidate around the $0.377-level, with minor fluctuations indicating a lack of strong directional momentum.

The 50-period moving average (red line) seemed to be acting as a resistance around the $0.385-level, while the 200-period moving average (blue line) around $0.376 served as the short-term support.

The MACD line and the Signal line flashed multiple crossovers too. These crossovers were relatively close to the zero line on the charts, indicating that the momentum, whether bullish or bearish, has not been particularly strong.

Here, it’s worth noting that as ADA fell on the price charts, it was accompanied by an increase in volume – Contributing to an uptick in selling pressure.

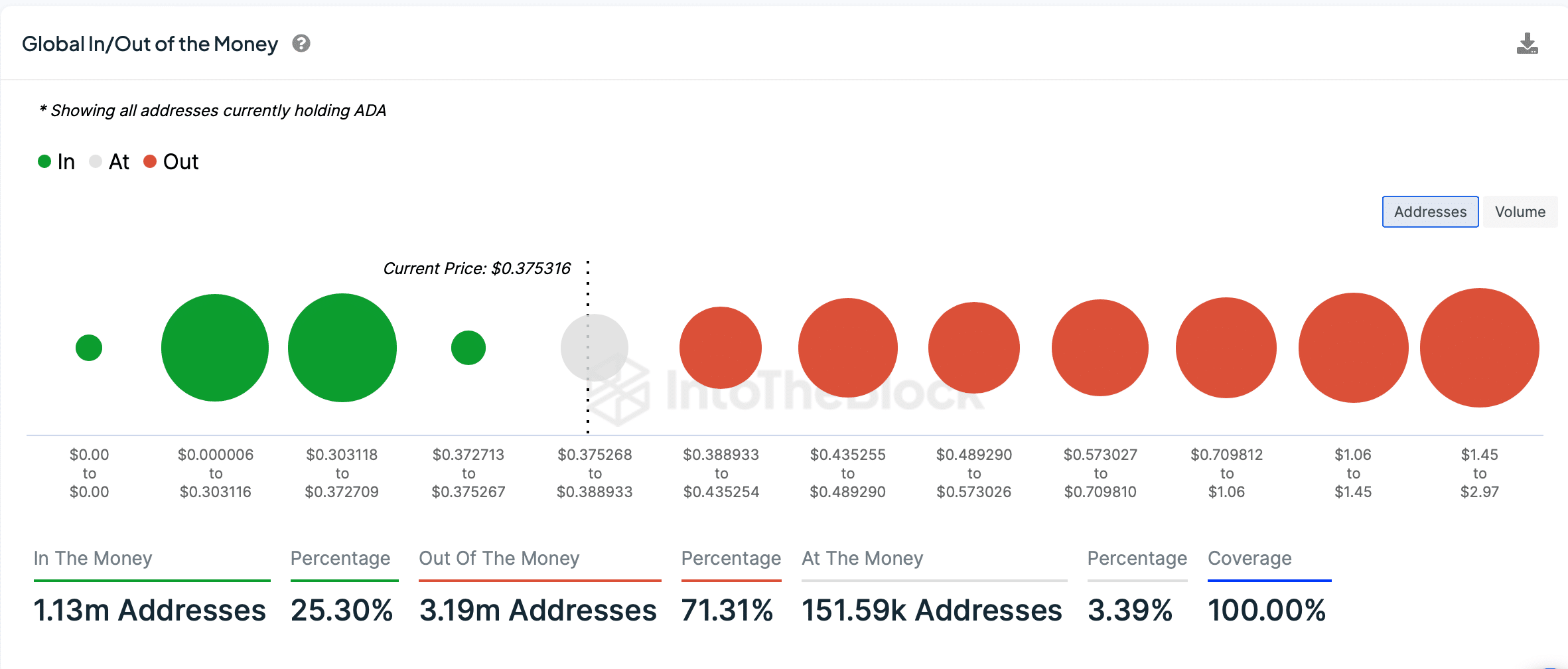

Finally, the high percentage of addresses out of the money is a sign of widespread bearish sentiment and pressure on the price. Especially if holders decide to sell to cut losses as the price rises close to its entry points.

If the upcoming upgrades improve ADA’s performance and utility, they could shift these proportions, moving more addresses into the “in the money” category. In doing so, it could possibly drive up the price as confidence in Cardano’s future returns.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)