Bussiness

BNB faces profit-taking – Here’s what it means for you

- BNB’s price retracted by 4% after rallying to an all-time high on 6 June

- Altcoin’s market bulls, however, seemed ready to defend support level at $635

Binance Coin [BNB] faced resistance around the $712-price level as profit-taking activity commenced following the crypto’s latest rally on the charts.

In fact, AMBCrypto previously reported that the altcoin broke above the upper channel of its horizontal line on 4 June, climbing to an all-time high of $720 on 6 June.

However, as coin holders scampered to take profits, the crypto’s price declined by 4%. At press time, BNB was valued at at $688.

Bulls attempt to defend key support level

The uptick in BNB’s selling activity over the last few days has pulled the altcoin’s price towards the breakout level of $632. At press time, however, the bulls seemed poised to defend that level as support, with the same evidenced by traders’ ongoing accumulation.

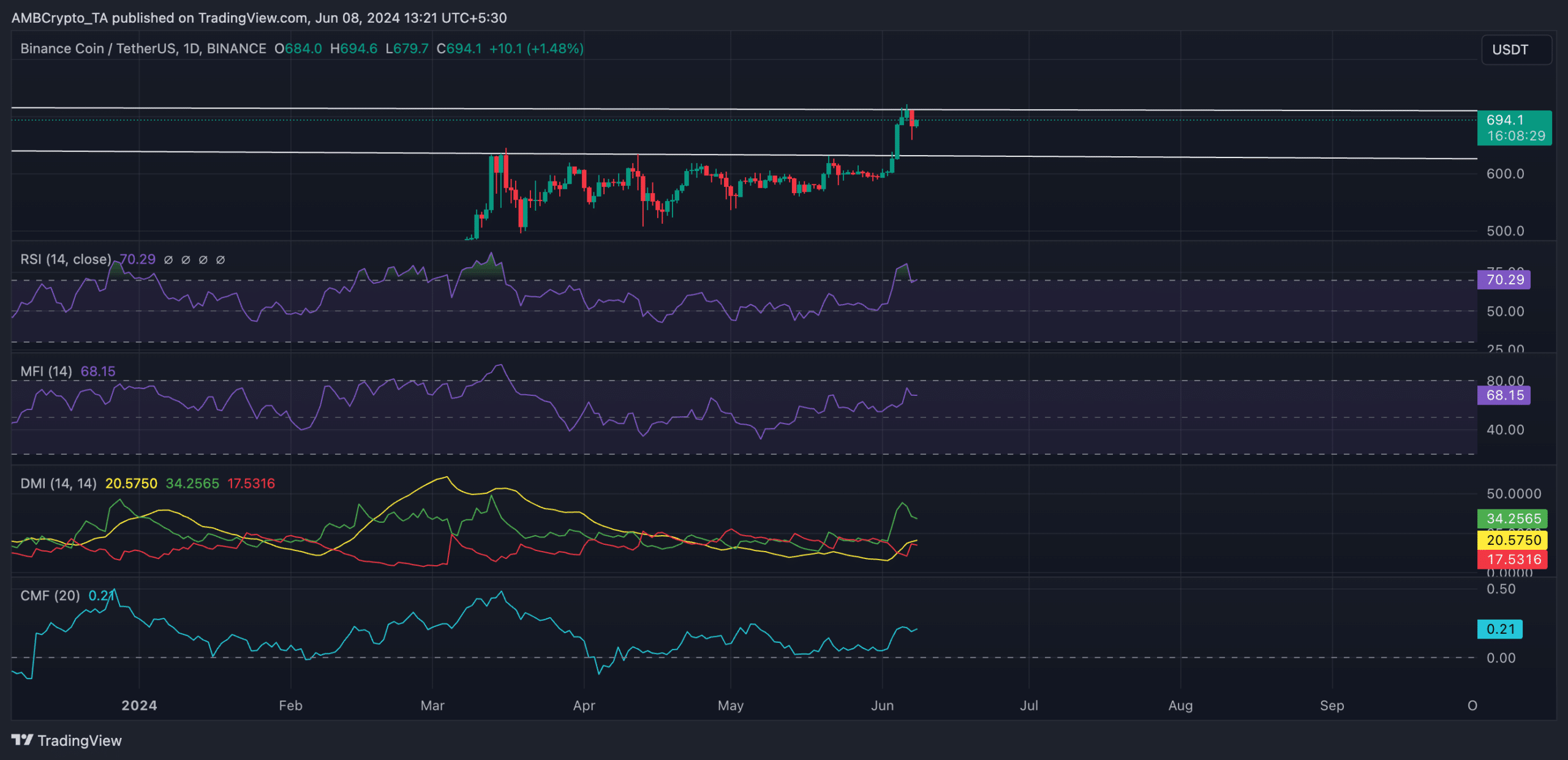

The values of the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) confirmed this. On an uptrend at press time, BNB’s RSI was 70.25, while its MFI was 68.15. This suggested that despite the strong selling pressure, buying momentum continued to outweigh it on the charts.

Additionally, readings from BNB’s Directional Movement Index (DMI) revealed its positive directional index (green) resting above its negative index (red). This is a bullish signal. This setup generally suggests that the strength of the bulls supersedes that of the bears, as buying activity remains high.

On an uptrend at press time, BNB’s Chaikin Money Flow (CMF) was 0.21. This indicator tracks how money flows into and out of an asset. A positive CMF value above zero is a sign of market strength – A sign of steady flow of liquidity into the asset in question. Again, a bullish signal.

Open interest climbed to a multi-year high

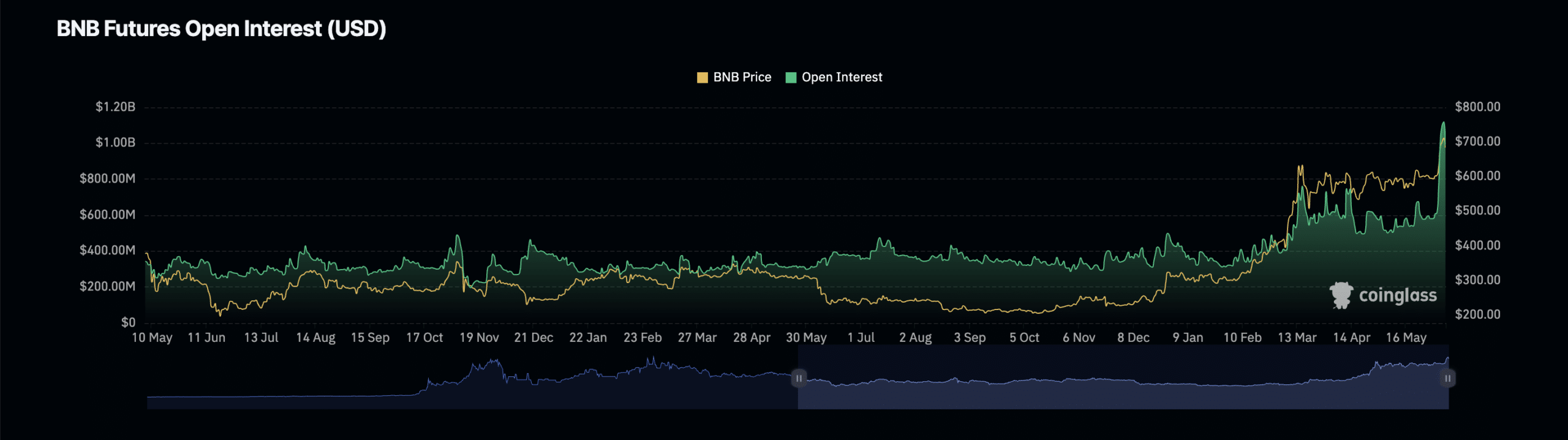

On 7 June, BNB’s Futures open interest climbed to a three-year high of $1.12 billion. The last time the coin’s open interest was that high was in May 2021, according to Coinglass. In comparison, since the beginning of the month, XRP’s Futures open interest has risen by 70% on the charts.

Realistic or not, here’s BNB’s market cap in BTC terms

BNB’s Futures open interest tracks the total number of outstanding Futures contracts or positions that have not been closed or settled.

When it rises, it signals a spike in market activity as more market participants take new positions.

The coin’s positive funding rate, recorded since 21 May, seemed to suggest that these new entrants have demanded long positions. This, after an extensive period of BNB accruing negative funding rates across cryptocurrency exchanges as traders placed bets against its price.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)