Bussiness

Bitcoin’s low funding rate is a ‘welcome signal,’ but BTC needs more

- The funding rate indicated a bullish signal, however, the Coinbase Premium Index might resist the uptrend.

- BTC might have hit a local top, hence, its rise to a new high could be delayed.

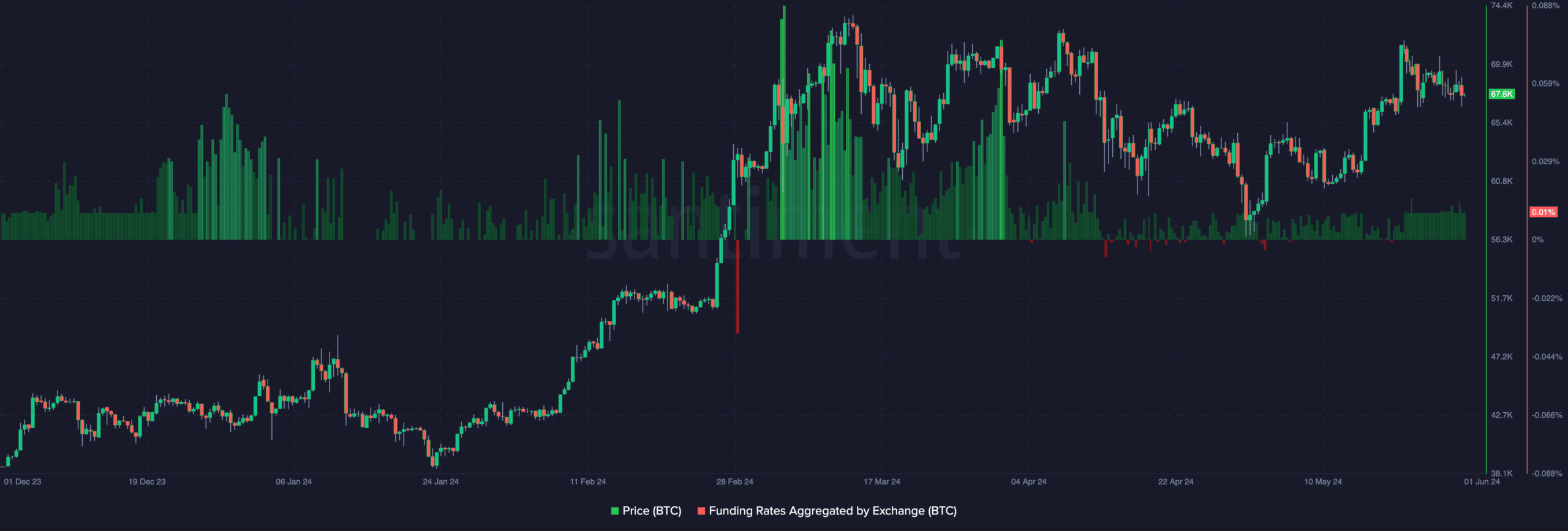

Bitcoin’s [BTC] funding rate has been low since mid-May, AMBCrypto confirmed. Though this implied low investor expectations, it could be good for BTC’s price.

Funding rate is the cost of holding an open contract in the market. When the reading is positive, it means that the perp price is trading meaningfully above the index value

Lower optimism, higher BTC prices?

On the other hand, a negative funding rate suggests that the spot price is higher than the contract price. At press time, Bitcoin’s funding rate was $0.01%.

But despite being positive, this was a lower reading compared to what it was a few weeks ago. From a trading perspective, the low funding rate alongside the declining price indicates that perp buyers were fading Bitcoin’s move.

However, it also means that spot traders were becoming aggressive. If this continues, Bitcoin could revisit $70,000 within a short period.

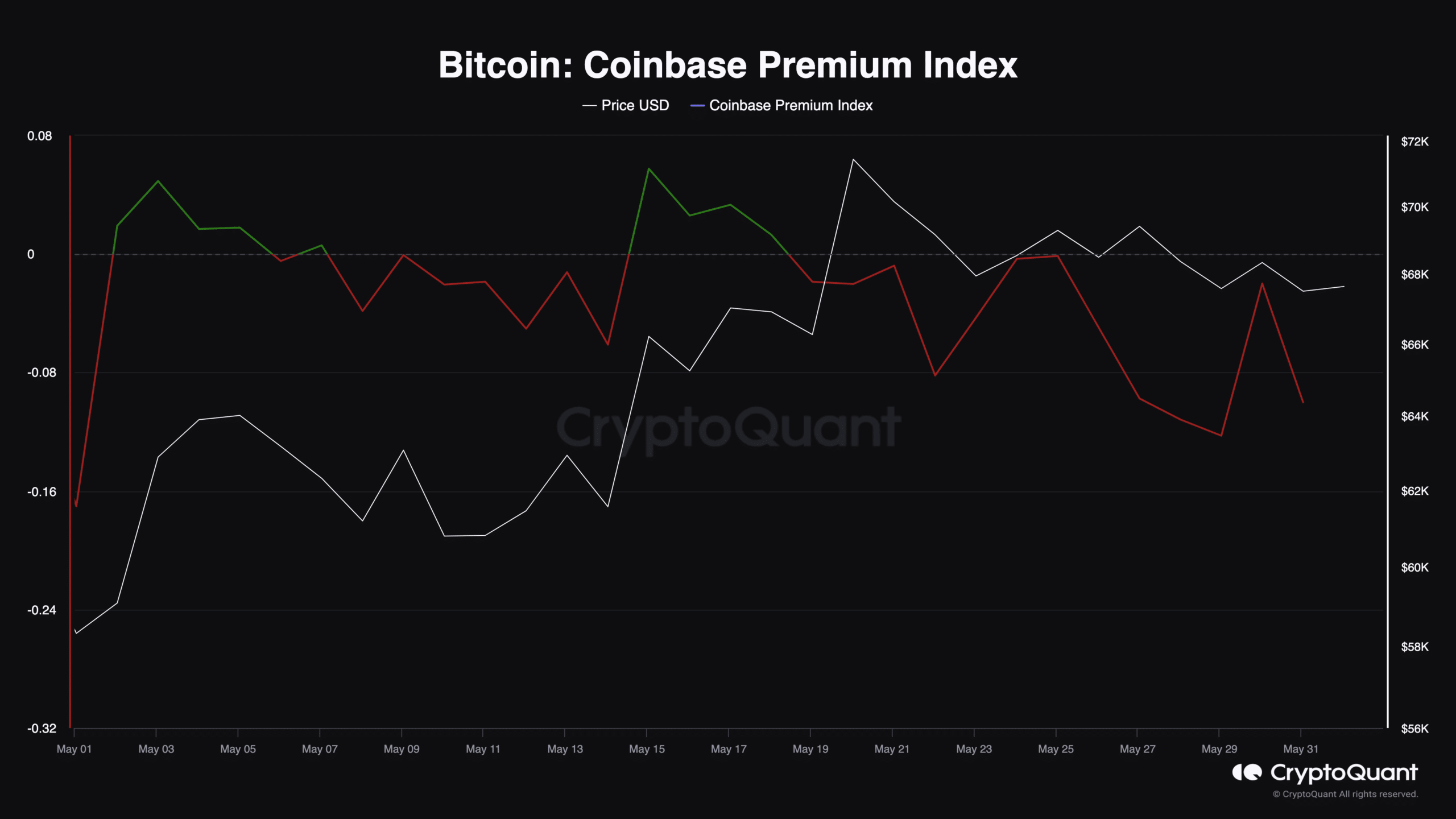

But the revival might not be quick. This is because of the condition of the Coinbase Premium Index. The index is the difference between BTC’s price on the Coinbase exchange and the value on other exchanges.

If the value of the index is high, it means that U.S. investors are buying a lot of BTC, thereby putting good pressure on the price. However, a decline in the metric indicates an increase in sales of Bitcoin by investors in the country.

As of this writing, the Coinbase Index Premium was -0.10, indicating that selling pressure was intense. From the chart below, AMBCrypto noticed that this decrease was one of the reasons Bitcoin kept getting rejected.

Bearish forces are still at work

However, if the reading increases, it could trigger a breakout for BTC. Analyst TraderOasis also agreed with this in his analysis on CryptoQuant, noting that,

“As a result, when the price reaches the daily gap, the increase in the Coinbase Premium Index indicator will be our signal.”

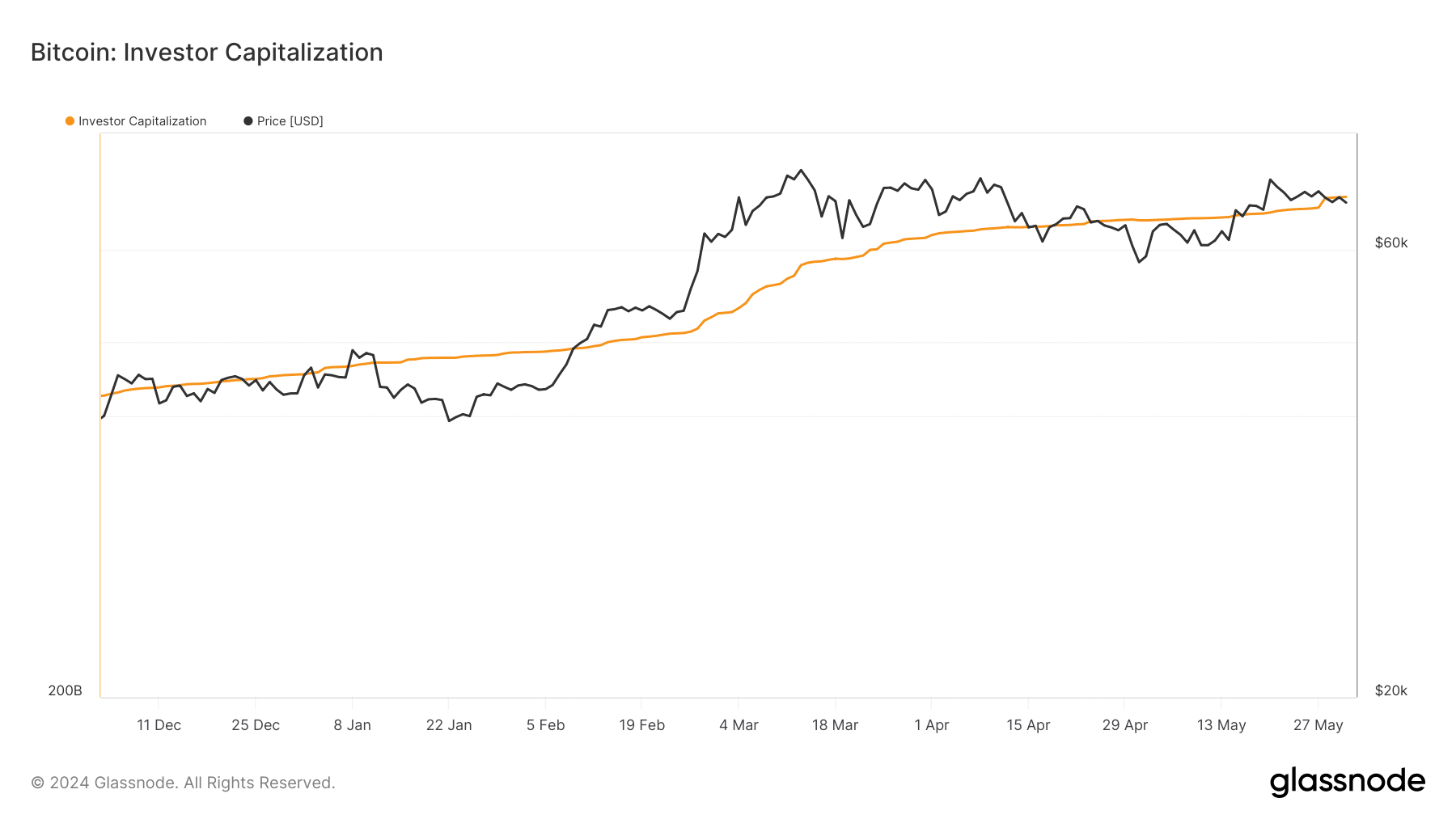

Furthermore, AMBCryto examined the investor capitalization provided by Glassnode. Investor capitalization can tell if BTC is close to the bottom or has hit a local top.

At press time, the metric was around the same spot as Bitcoin’s price, indicating that the coin was in a critical area. Should the metric rise above BTC, then it would indicate a local top and force a correction.

Conversely, if the price of Bitcoin jumps much higher than it, the value might appreciate, and it might retest $70,000.

Is your portfolio green? Check the Bitcoin Profit Calculator

However, volatility around BTC remained low at press time. This indicates that the price might keep swinging in a tight range for some time.

Moving on, there is a chance that the metrics mentioned above could switch to the positive sign. If this is the case, the price of the coin could attempt to surpass its all-time high before the end of June.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)