Bussiness

Billionaires Are Buying These 2 Artificial Intelligence (AI) Stocks Hand Over Fist

It seems every investor today is talking about Nvidia (NASDAQ: NVDA). Over the last five years, shares have risen in value by 3,400%. Over the past 12 months alone, the stock tripled in price.

This sudden rise has everything to do with artificial intelligence (AI). Nvidia’s chips are widely accepted as the best on the market for this technology. There’s a good chance the AI future will be powered by the company’s products.

But it isn’t the only AI company attracting huge interest. Billionaire investors are pouring huge sums of cash into other AI businesses. The two companies below look especially promising.

Even Nvidia’s CEO loves this emerging AI stock

Jensen Huang, CEO of Nvidia, has most of his $100 billion fortune tied up in the company’s stock. But he has put money to work in several other AI businesses. That’s because Nvidia itself has put money into smaller AI start-ups at his direction.

One of those companies is SoundHound AI (NASDAQ: SOUN), a $1.6 billion business with huge potential.

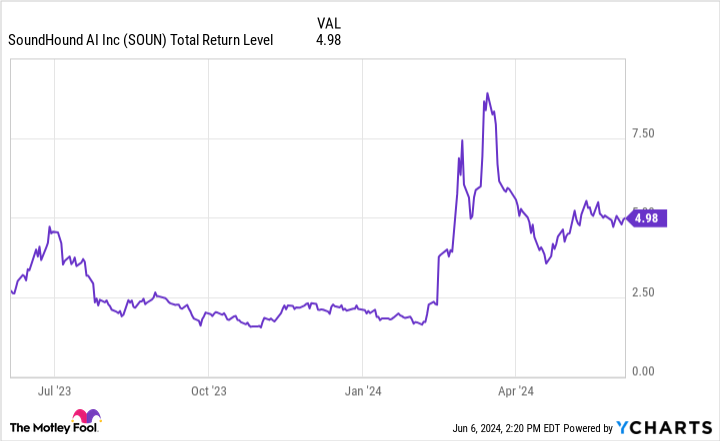

Investors learned about Nvidia’s investment in SoundHound from a 13F disclosure that Nvidia filed earlier this year. It was a relatively small investment — only a few million dollars — but that didn’t stop shares from tripling in value from the news.

SoundHound’s stock price has pulled back a bit since, and there’s a lot to love about the investment thesis from here. That’s especially true given that another billionaire, the value investor Seth Klarman, recently revealed he owns 1.1 million shares in SoundHound.

The company is focused on the auditory side of AI. As Fool contributor Joe Tenebruso explains it: “Conversational AI is cutting-edge technology that enables machines to understand and respond when humans speak. SoundHound offers some of the best voice AI available at a time when businesses are racing to adopt this innovative tech.”

This is a competitive space, with Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) and Amazon developing their own voice AI systems. But SoundHound doesn’t tie customers to these closed ecosystems, something customers like Hyundai, Oracle, and White Castle apparently appreciate.

Trading at 23 times sales, SoundHound isn’t cheap from a conventional standpoint. But with analysts anticipating a 53% jump in sales this year, that premium valuation could prove a bargain years down the road.

And the next AI stock being targeted by billionaire investors arguably has drawn even more interest.

Will Alphabet become an AI powerhouse?

A recent Motley Fool analysis of 16 prominent billionaire investors found that Alphabet, the parent of Google, was one of the most popular picks, regardless of industry.

The long-term viability of Google’s search business — the primary contributor to revenue and profits — could be threatened given AI’s potential. Why google something and manually search for the answer when AI can get you the answer directly in far less time?

Right now, there are limitations to AI’s ability to replicate Google’s effectiveness at sorting through the vast amount of information stored on the web. It could take many years for AI to supplant the usefulness of Google’s platform.

In the meantime, the company can invest huge sums of money (more than nearly any of its competitors) in not only augmenting its current offerings with AI, but also building new tools that could ultimately become its main source of profit in the decades to come.

One of Google’s biggest advantages is its access to proprietary data accumulated from its search engine and from other Alphabet properties like YouTube and Google Maps. AI models need to be trained on data to function, and there’s currently a battle over how platforms like OpenAI trained their systems. The New York Times Company, for example, is suing OpenAI for effectively stealing its copyrighted material.

Whether Google is able to transition to an AI-powered future remains to be seen. But that hasn’t stopped billionaire investors from piling into the company.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, Oracle, and The New York Times Co. The Motley Fool recommends the following options: short July 2024 $45 calls on The New York Times Co. The Motley Fool has a disclosure policy.

Billionaires Are Buying These 2 Artificial Intelligence (AI) Stocks Hand Over Fist was originally published by The Motley Fool

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)