Travel

Behind Lagardère Travel Retail’s ‘Travel Experience Voices’ – industry themes and trends

INTERNATIONAL. “Based on these interviews and online survey, we see a lot of opportunity to help the industry grow. It confirms that we are only at the beginning of an exciting evolution.”

So says Lagardère Travel Retail Asia COO and Global Chief Strategy and Development Officer Séverine Lanthier about the release earlier this month of ‘Travel Experience Voices’, the third trend report in an annual series from the travel retailer.

Titled ‘Transforming today to step into tomorrow’, this edition homes in on three key themes that are high on the agenda for industry stakeholders: the role of hybrid concepts, implementation of sustainable practices and collaboration through data-sharing.

The report is based on face-to-face interviews with airport and brand executives, a quantitative online survey taken by 58 airports and 150 brands across 27 countries, plus contributions from subject-matter experts.

Through testimonies and case studies, the report showcases how industry stakeholders and airports are preparing for the future while championing sustainability.

Conducted between January and March 2024, the interviews and the online survey provide a comprehensive snapshot of the industry’s current landscape and future trajectory, said the company.

Reflecting on the impact of the report, Lanthier says: “We have built some exciting and interesting pilots and partnerships based on inspiration from these reports [over the past three years]. They have generated a lot of interest internally and externally.

“Sharing the report helps us engage further with airports and brands and also helps us plan spaces with our partners in advance to create the best outcomes.

“We don’t only interview airports that are partners currently; we want to make it as exhaustive as possible and attract a wide range of views.

“The key point is that collaboration is key. This is a service to the industry and we know that only together can we be stronger.”

Here we focus in more detail on the key findings.

Blending retail and dining

The ‘Travel Experience Voices’ report reveals that airports are keen to invest and develop further hybrid stores, with technology as a key enabler. Among airports surveyed, 76% consider hybrid concepts – blending retail and food & beverage – as a long-term trend. Of all respondents 24% said such concepts are becoming more popular as they help enhance the customer experience.

The report states: “To successfully deliver a hybrid shop, spaces are being designed for consumers to browse and shop while having the option to dine and enjoy refreshments within the same space. One of the key benefits of hybrid concepts in sought after locations in an airport is that it can help the overall area thrive, having a ripple effect on all other retailers within the space and driving more activity and buzz.”

The industry is increasingly committing to such concepts, noted Lagardère Travel Retail.

“Investments are being made by airports to ease the journey for passengers through streamlining check-in and security processes, so customers can have more dwell time to shop and dine. This creates an upside for customers who relax and enjoy this experience, and for retailers there is an increased potential for impulse purchases and deeper customer engagement through sampling and activations.

“A key focus when it comes to design and productivity metrics per square metre in hybrid settings is paramount, where every square meter must be optimised to reflect the evolving needs of travellers.

“Hybrid spaces are meticulously designed to showcase not only mainstream, but also small designers and niche brands, emphasising the significance of a robust concept and a well-trained sales force.”

Airports and brands highlighted an ‘efficient store layout’ as the most important feature of hybrid stores, followed by a diversified offer and omnichannel integration.

The report noted that more lifestyle brands see the benefit of amplifying their brand through food & beverage collaborations, citing EL&N, Dior and Prada as examples.

On implementing hybrid concepts, 23% of airports and brands cited brand/concept collaboration as the biggest challenge with a further 23% citing B to C concept positioning and understanding.

Airports said they consider space optimisation as the main challenge when creating masterplans that include multiple activities.

The report also leaned on external voices to reinforce its findings. Altavia Travel Retail Managing Director Hugo Vanderschaegh says: “The traditional model of segmented activities, where separate business lines, spaces, and operators function in silos, is gradually giving way to a more integrated approach.

“Modern airport master plans are increasingly crafted to foster lifestyle-driven zones, acknowledging that passengers vary in their needs, expectations, and aspirations. Consequently, terminals are designed to accommodate diverse lifestyle preferences by curating retail, F&B, leisure and entertainment offerings into destinations.

“Beyond catering to passenger preferences, these hybrid spaces offer additional revenue benefits. F&B outlets typically enjoy higher conversion rates than specialty retail stores. By strategically planning the layout to encourage flow towards F&B areas, foot traffic is naturally directed toward adjacent retail establishments. In essence, passengers seeking their coffee fix seamlessly explore specialty shops. This symbiosis thrives when the offerings complement each other coherently.”

He also noted: “These innovative hybrid concepts challenge the traditional revenue-sharing model between airports and retail operators. Concession rates for F&B transactions differ from those for retail transactions, and shoppers may engage with brands in-terminal but make purchases online.

“As a result, new contracts, characterised by flexibility and recognition of values beyond sales figures, will be necessary to adapt to the evolving landscape of airport retail.”

Summarising the key messages under the hybrid concepts theme, Séverine Lanthier says: “Based on the interviews, we see that airports want to go into more experiential spaces, and are open to finding more spaces that blend categories. One of the barriers is how to frame the tenders for this format, which can be complex. Therefore planning ahead for hybrid spaces by the airport is so important.

“The size of the airport is not seen as a barrier to hybrid concepts, given technological advances. Broadly we see an acceptance hybrid stores as a part of the future. It is positive that airports and brands are willing to accelerate this concept.”

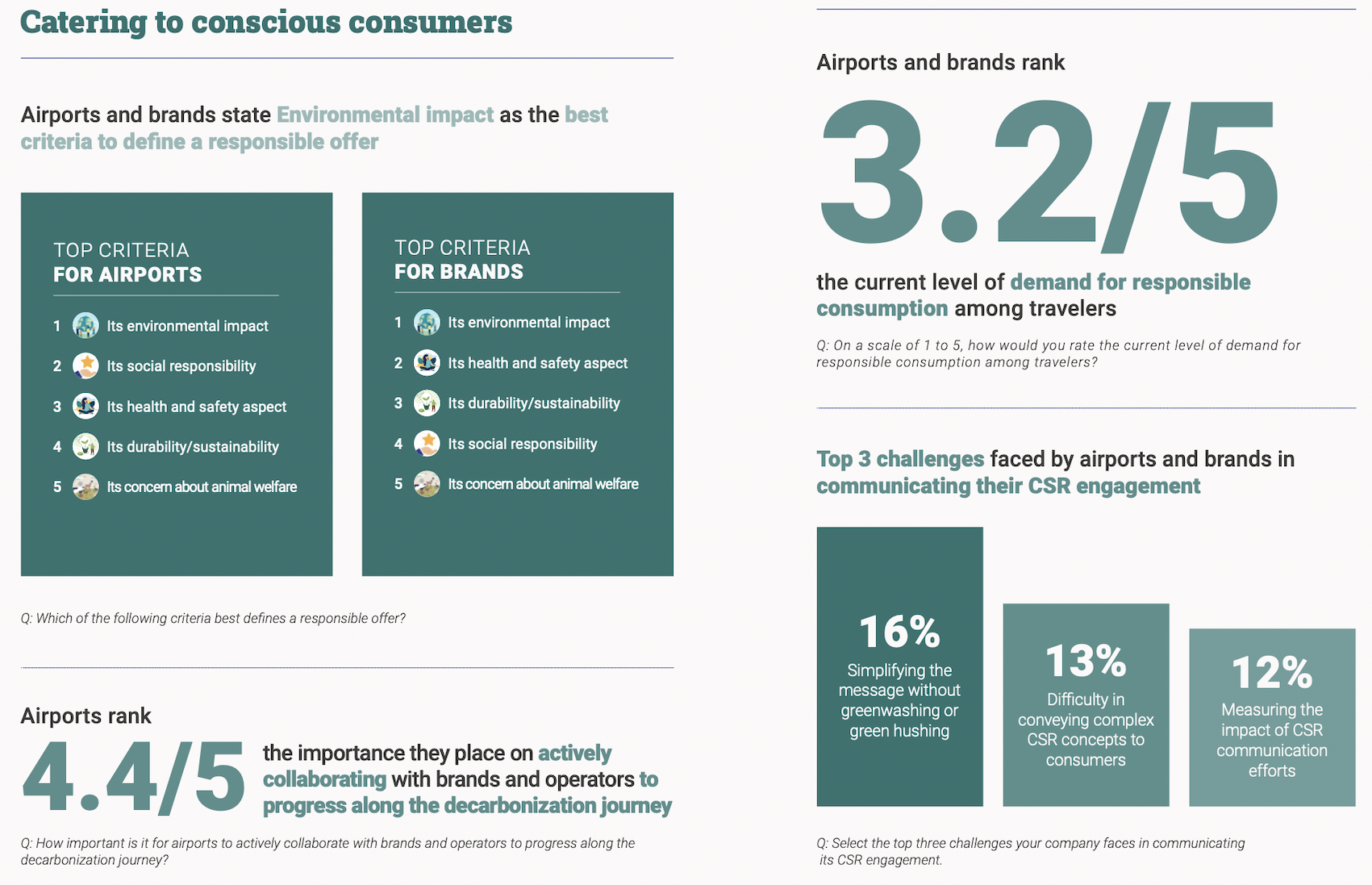

The conscious consumer

The ‘Travel Experience Voices’ report also underscores the need for collaboration within travel retail as mandatory to making progress in decarbonisation.

Lagardère Travel Retail says that raised consciousness about sustainability among travellers means we have reached a “pivotal moment to adapt and innovate” as an industry.

“The dialogue around CSR transcends mere regulatory compliance or marketing strategy; it is about forging genuine connections with the eco-conscious travellers and educating those less aware of their environmental footprint. Transparency becomes the cornerstone of consumer trust.”

The level of demand for responsible consumption among travellers is rated as 3.2 out of 5 by airports and brands.

The online survey revealed the main hurdle faced by airports and brands is simplifying CSR messaging without falling into the trap of ‘greenwashing’. Conveying often complex messages around CSR and measuring the impact of communication in this area are also difficult, respondents said.

More action can be taken to commit to carbon-cleansing and making eco-pledges that can serve as aspirations to drive direct action.

A further external view is provided in the report by Utopies Associate Director Sophie Labbé. She says: “Retailers must transition from simply supplying demand to curating an offer that reflects a deeper understanding of quality—one that encapsulates environmental and social considerations.

“This journey demands that retailers retrace their value chains and build expertise on foundational issues—from sustainable agricultural practices to packaging eco-design—that were once beyond the buyer’s remit.

“Defining what constitutes a responsible product is also key. It’s not about achieving perfection but about setting objective criteria and KPIs. Relying on third-party certifications and labels can help build credibility and confidence in the approach. However, setting standards is only part of the equation. Retailers are also expected to make deliberate choices, even ban certain practices—like off-season vegetables and fruits or frequent fashion drops—to align actions with convictions.”

She adds: “At the forefront of change, retailers have a unique opportunity to lead. Financially supporting suppliers to adopt more sustainable practices, influencing consumption through transparent marketing, and ensuring affordability of responsible products are all part of the transformative toolkit.”

Summarising the key messages under this conscious consumerism theme, Séverine Lanthier says: “The report reinforces the need for collaboration by all of the Trinity players in this area.

“What was surprising to me was how communication to the consumer was at the heart of many responses. It is important of course but we need to see more action day to day from all parts of the industry.

“We try to focus on the responsible offer and see that consumers are aware of the environmental impact of the offer. As operators we have a role in building the offer and pushing our brand partners to do even more. It is what consumers want to see.”

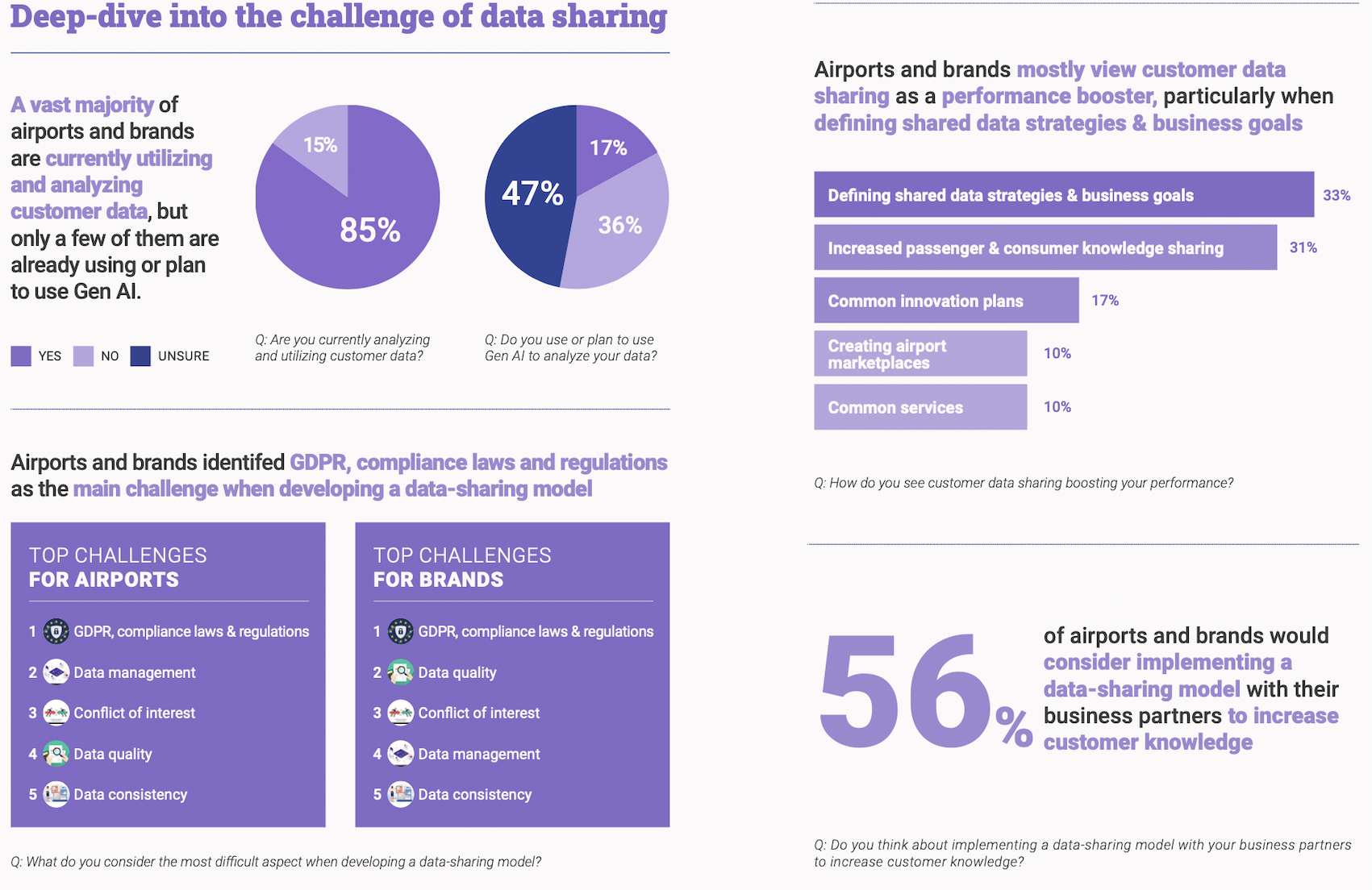

The data-sharing challenge

The ‘Travel Experience Voices’ report underlines how data sharing is recognised as a potential performance booster, especially in supporting shared strategies and business goals.

Lagardère Travel Retail presents a vision of what might be possible if industry agendas are aligned.

“Imagine stepping into a store where every offer or promotion feels perfectly tailored to your preferences or buying habits. By sharing and carefully analysing customer data, retailers have the power to deliver tailor-made customer experiences, elevating the shopping journey to new levels and leaving the customer coming back for more.”

Airports and brands said they face challenges in the implementation of data-sharing models across the industry, with GDPR, compliance laws and regulations representing the main hurdle.

Meanwhile a perhaps surprisingly low 56% of those surveyed said they would consider data partnerships to increase knowledge of the consumer.

The report notes: “For data sharing to be mutually beneficial, it’s essential that all involved reach a consensus on its purpose and use. A cultural shift towards a mindset that values data sharing and its role in informing business decisions needs consideration.”

Offering an external perspective, notably on the power of technology, Armilla Head of AI Products & Insurance Jerry Gupta says: “Becoming a data-driven organisation entails a cultural shift where data is not just viewed as a by-product of operations but as a strategic asset that drives growth and innovation. This transformation requires commitment from leadership to foster a data-centric mindset throughout the organisation.”

He adds: “By embracing a data-driven culture, aligning analytics initiatives with business objectives, and prioritising data privacy and ethics, organisations can harness the full potential of data to gain a competitive edge and thrive in an increasingly complex and dynamic business environment.”

Séverine Lanthier says: ““Data is a key pillar of our strategy and it is one we continue to strengthen as we seek to better know and serve our customers.

“Based on the survey, we are not there yet. Only 56% of those who responded are willing to consider implementing data-sharing models. At just over half that strikes me as relatively low when we know how important data-sharing is.

“It seems that everyone is busy managing their own data needs and are maybe not ready for sharing or interfacing. There is the question of alignment technologically, of data governance and for airports understanding how they can create value for themselves and for the industry. Many organisations are strengthening their data capability, but mostly internally – sharing and aligning ourselves better is the next step.

“Our intent should about growing the pie, not just sharing the pie. But what this does show is that we are coming from a low base on data-sharing, which means there is a lot of potential.” ✈

*This article first appeared in The Moodie Davitt eZine for May. Click here to access the latest edition.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)