Bussiness

Arbor Realty: Is Trouble Brewing With This 13% Yielder? (NYSE:ABR)

cherdchai chawienghong/iStock via Getty Images

I last wrote about Arbor Realty (NYSE:ABR) back in 2012. Back then, the stock was trading for about $5, and I viewed some recent insider buying and the yield as reasons to be bullish. I have not looked at this stock for a while, but a number of recent developments have piqued my interests again. This stock recently declined on some negative headlines and since I like to buy dips, I wanted to take a look at what bulls and bears seem to be focused on, so let’s take a closer look:

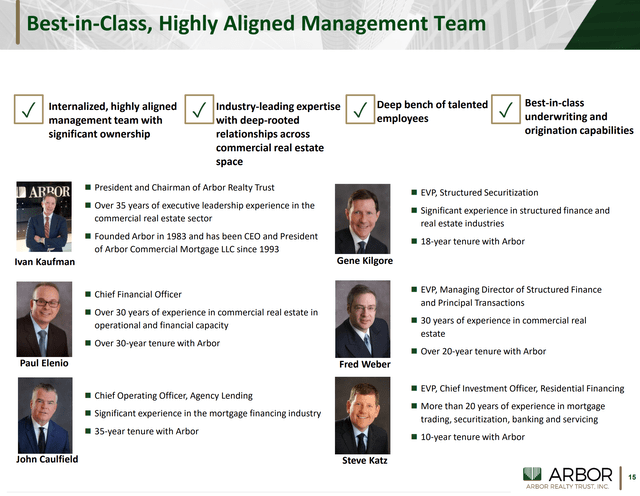

Arbor Realty is a popular mortgage real estate investment trust or “mREIT” that invests in a variety of real estate-backed loans. This allows it to provide an income stream that many shareholders find attractive. I appreciate that Arbor Realty’s management team has significant experience in this industry, and in particular, that Ivan Kaufman, Chairman and President of Arbor Realty Trust has been with this company since 1983, and has a significant ownership stake. As shown below, many of the other top level executives at this company have been there for 10, 20 and even over 30 years.

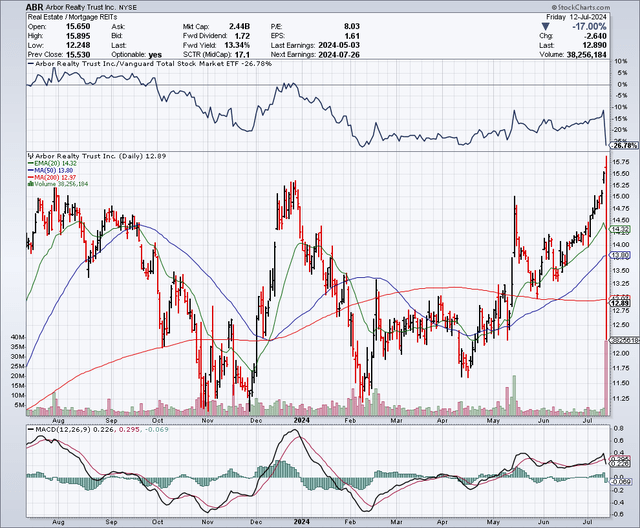

The Chart

As the chart below shows, this stock was in rally mode up until very recently. Arbor Realty shares bottomed out at around $11 in November and December of 2023. The stock has had some spikes in the past few months, seemingly when the market had hopes for interest rate cuts. These hopeful moments have mostly been dashed by the Federal Reserve’s continuing with a higher for longer interest rate policy. But, hopes are rising again that the Fed will cut rates, and that seems to have fueled the recent rally to nearly $16 per share. However, the stock has plunged once again back into the $12 range on some negative headlines.

The 50-day moving average is $13.80, and the 200-day moving average is $12.97. In June, a bullish “Golden Cross” formed on the chart, as the 50-day moving average crossed above the 200-day moving average. If this stock stays at current levels or sinks lower, this bullish chart formation will be in jeopardy. Right now, I don’t see the technicals as being as much of a factor as they might normally be because there is significant news that seems to be in control of the share price for the time being. However, over the past several months, this stock has bottomed out a number of times in the $11 per share range. So, I would not be surprised if this occurs again.

The Dividend

Arbor Realty pays a quarterly dividend of $0.43 per share, which totals $1.72 per share on an annual basis. This provides a yield of more than 13%, which is very attractive for income investors. However, the volatility in the share price is definitely not attractive for most income investors who typically seek stability. Another important factor for income investors is whether or not the dividend is safe. Based on current earnings estimates and the payout ratio, which is estimated by Seeking Alpha to be nearly 100%, I believe this company will have to start delivering stronger results if it wants to maintain this dividend level.

What Caused The Share Price To Plunge

In recent days, some reports have come out suggesting that Arbor Realty could be under investigation for its lending and disclosure practices. Some short sellers have alleged that this company has a problem with distressed loans and, as a result, that is potentially causing the value of its loan portfolio to be overstated. A recent news article detailed these concerns as well as the response by the company, and it stated:

“We routinely cooperate with regulatory inquiries and are very confident that we conduct ourselves properly,” Arbor said in a statement. “We look forward to our second-quarter earnings call.”

I completely see the potential for the shorts to be right about some loans possibly being non-performing and maybe the company needs to build or maintain current loan-loss reserves, but the company has a long history of working through and restructuring loans if needed. Plus, at this point, a lot of this is already potentially priced into the stock, after a big decline. In a best-case scenario, any potential investigations could end up validating Arbor Realty and its lending and disclosure practices. In what could be a worst-case scenario, I could see a potential investigation leading to a write-down of some loans and possibly a fine, as well as the need to settle any potential class action lawsuits from shareholders.

The Q2 Earnings Report And Guidance Is Expected on July 26

According to Earningswhispers.com, the company is expected to report Q2 earnings on Friday, July 26. Consensus estimates call for earnings of $0.42 per share, with revenues coming in at around $301 million. Arbor Realty beat consensus estimates for Q1, and I believe they can meet (or maybe slightly beat) expectations for Q2, but I don’t see current earnings as driving the stock price right now. I believe management guidance and commentary which addresses the negative headlines as being what will drive this stock up or down.

A Short Squeeze Could Occur

According to Shortsqueeze.com, there are nearly 70 million shares currently short. Based on recent average daily trading volumes of less than 4 million shares, I find this troubling, both for the longs and the short sellers as well. It’s clear to me that the shorts see something that the longs are not seeing, or at least acknowledging. It’s also clear to me that even if the short sellers are right, they could be vulnerable and help fuel a potentially major short squeeze.

What I Would Like To See Before Buying Arbor Realty Again

For now, I am going to be on the sidelines, and waiting for additional developments and hopefully clarity. I do think this stock will be volatile, and it could remain under pressure. If this stock drops further to the low $11 per share range, or if I see significant insider buying, I would consider buying a small position that I could build on over time. I believe the business model is solid; in my opinion, the only question is whether loan values have been too aggressive and if the company has taken enough loan loss provisions. Loan values are somewhat subjective, and both the shorts and the longs have to keep this in mind.

Potential Downside Risks

I think the risks are fairly equally weighted right now for the longs and the shorts. I see the longs as having potential downside risks coming from more negative headlines. I also see the potential for a wave of class-action lawsuits to be announced in the days and weeks to come. I believe that based on support levels over the past several months, this stock might re-test the low $11 level and that could suggest more downside risks for longs.

I also see plenty of downside risks for short-sellers. This trade appears very crowded now, and the stock has erased a significant amount of market capitalization which, in of itself, helps to address (by pricing in partially or maybe even fully) the potential need for a portfolio write-down. Shorting a stock can be very risky and many market participants now look to exploit the vulnerabilities that can result from stocks with heavy short interest. This can lead to a short-squeeze, even if the short sellers have a logical reason to be short.

It is possible that the shorts could be right that there are some potentially distressed or overvalued loans, but this could be looking in the rearview mirror because interest rates are likely to drop later this year. This could lead to higher values for the loans this company owns. A decline in interest rates could turn potentially distressed or non-performing loans back into the performing category.

In Summary

A drop in this stock from nearly $16 per share to less than $13 already prices in a significant amount of bad news. I believe that even if the short sellers are right, the bad news might already be priced in. What could come next is the fact that the Fed could start lowering interest rates later this year, and that would likely result in higher valuations for the portfolio assets that Arbor Realty holds. This could in effect reverse the need for any portfolio valuation issues that the shorts are alleging.

This has become a battleground stock, and it could result in a draw for shorts and longs at current levels as I see upside and downside risks as equally weighted for now. However, barring any bombshells, I see a stock where many shorts will have to cover at some point, and the potential for interest rate cuts to boost the portfolio value and operating results for this company. I believe this stock merits a hold rating for now, but it could become a buy in the future on additional declines or with additional clarity that could come from management when Q2 earnings and guidance are released later this month.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)