Bussiness

All about Litecoin’s 8-year cycle and the path to $100K

- Litecoin’s price increased by 3% in the last 24 hours.

- Market sentiment around the coin remained bullish.

Litecoin [LTC], like most other cryptos, had a hard time last month as it lost a substantial amount of its value. In fact, if the latest data is to be considered, then LTC might be in an 8-year cycle, which at first glance looked concerning.

However, there’s more to the story.

What’s going on with Litecoin?

CoinMarketCap’s data revealed that Litecoin’s price witnessed more than a 22% correction in the last 30 days alone. The declining trend didn’t end in the past week, as it was down by 13%.

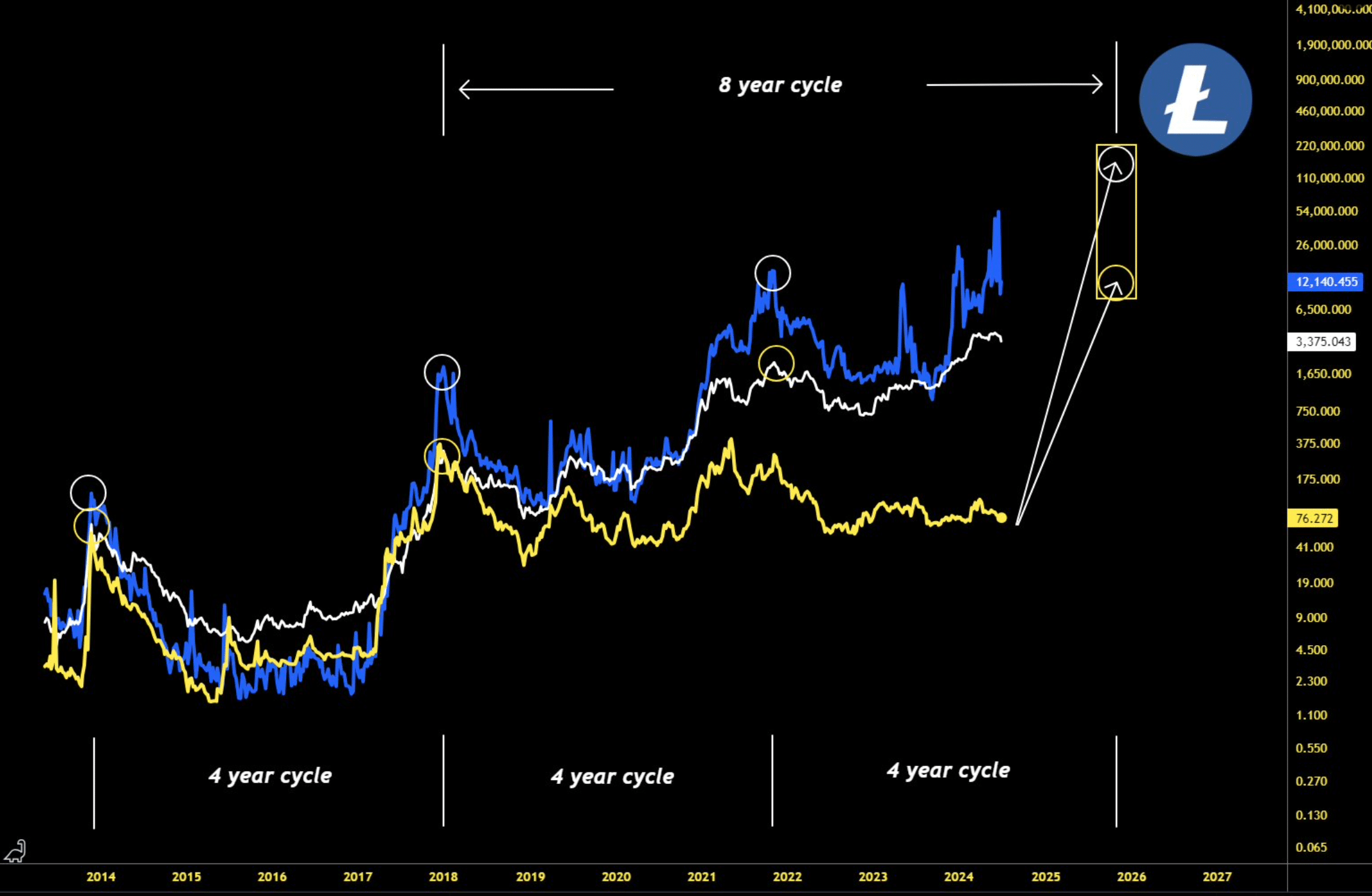

Though this was concerning, the latest analysis from Master, a popular crypto analyst, revealed a different picture. As per the tweet, Litecoin is in its 8-year cycle now.

If that is true, then investors will witness LTC reaching a peak in October 2025. Historically, during each 4-year cycle, LTC has reached a peak. To be precise, during the years 2014, 2018, and 2022.

If history repeats itself, then LTC might range from $65k to over $100k during its next peak.

This can be expected in the short term

Since looking at the 2025 peak is a little too early for now, AMBCrypto planned to check the coin’s current state to see what can be expected in the near term.

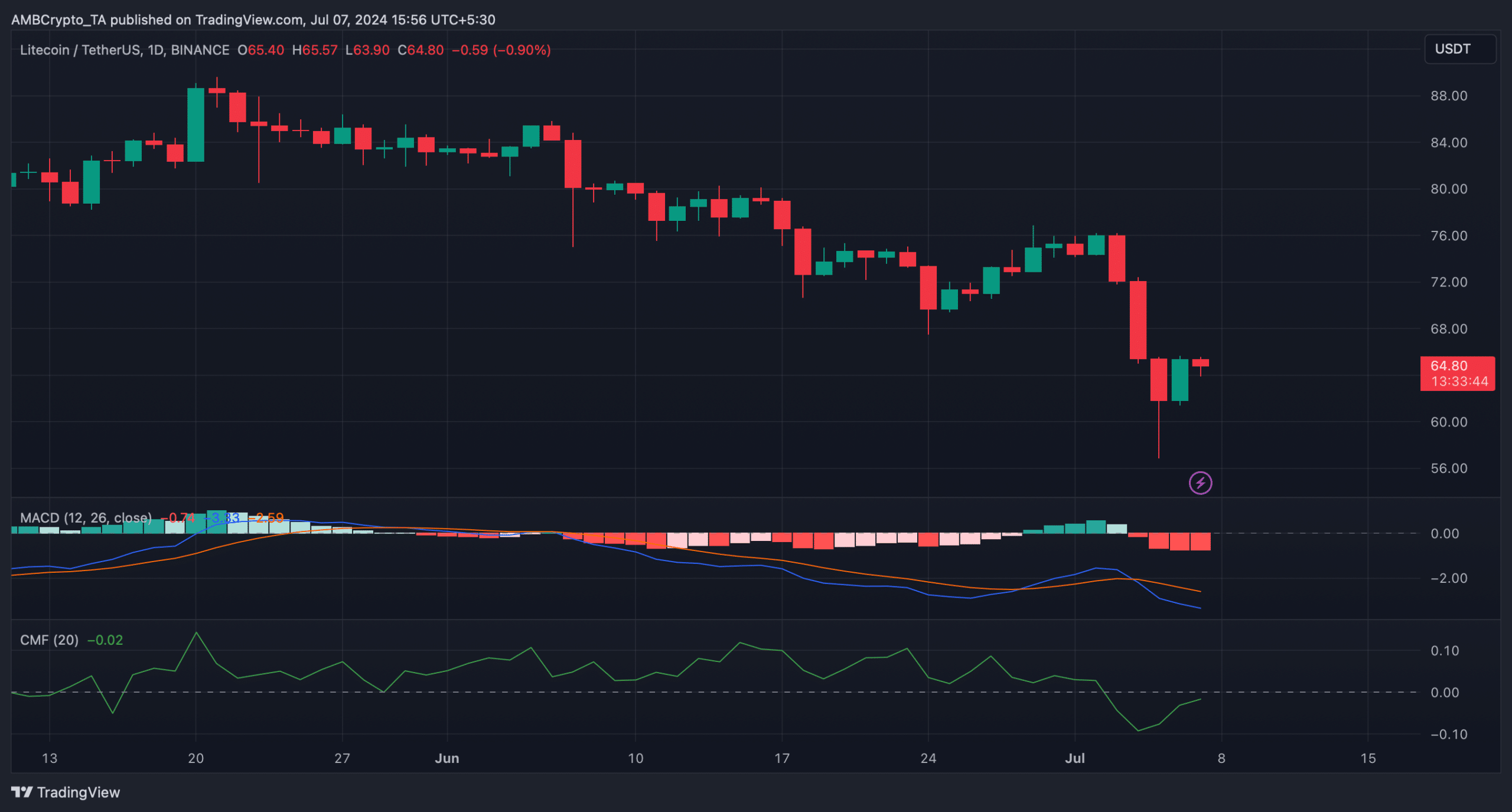

The good news was that, like several other cryptos, LTC also gained bullish momentum in the last 24 hours as its price surged by more than 3%.

At the time of writing, LTC was trading at $64.73 with a market capitalization of over $4.8 billion, making it the 21st largest crypto.

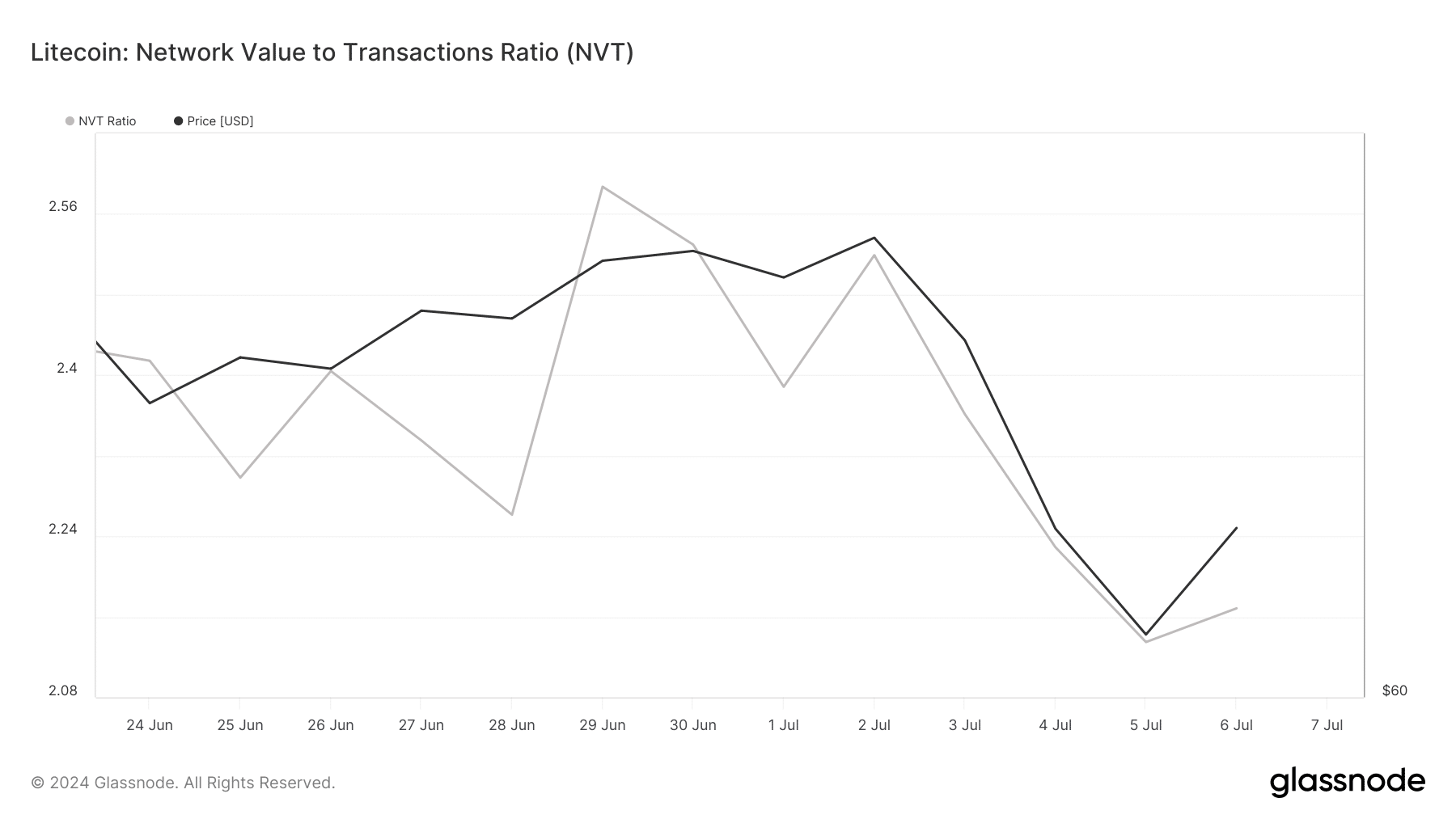

Things can get even better soon, as the coin’s NVT ratio dropped last week. A decline in the metric means that an asset is undervalued, hinting at a price surge.

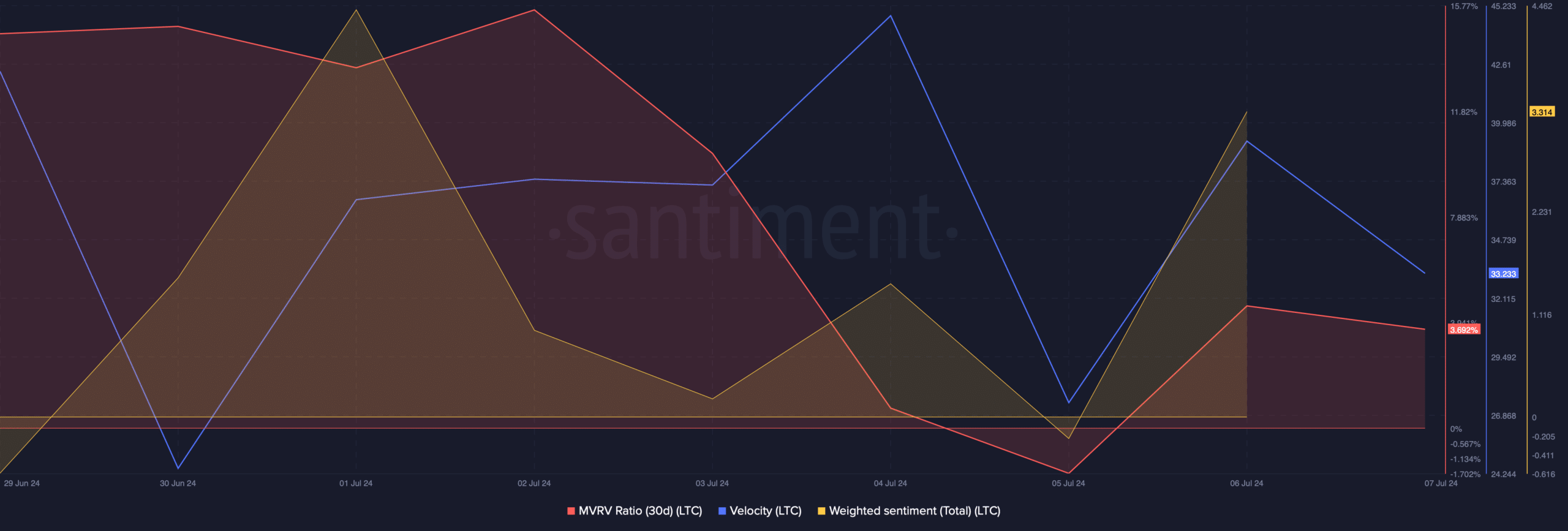

Investors’ confidence in the coin also seemed to have improved as its weighted sentiment went up. This clearly meant that bullish sentiment around the coin was dominant in the market.

Nonetheless, not every metric was optimistic. For instance, the MVRV ratio registered a decline. Its velocity also dipped in the last few days, meaning that LTC was used less often in transactions within a set timeframe.

Is your portfolio green? Check the Litecoin Profit Calculator

Our analysis of Coinglass’ data revealed that its long/short ratio also dipped, meaning that there were more short positions in the market compared to long positions.

The coin’s MACD displayed a bearish upperhand in the market. Nonetheless, nothing can be said with utmost certainty as the Chaikin Money Flow (CMF) registered an uptick, indicating a continued price rise.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)