Bussiness

Dogecoin price prediction – Look out for these short-term targets!

- Dogecoin’s price dropped by over 7% over the past week

- Sings of a trend reversal can be clearly seen though

Dogecoin [DOGE] investors have been having a hard time lately, especially on the back of the memecoin’s multiple price corrections on the charts. It might get worse though, with some datasets suggesting that investors might have to wait longer to see DOGE rise again.

Let’s have a closer look at what’s going on.

Dogecoin investors under pressure

CoinMarketCap’s data revealed that the world’s largest memecoin’s price dropped by more than 7% in the last seven days. In fact, in the last 24 hours alone, the memecoin’s price dropped by over 4%. At the time of writing, DOGE was trading at $0.1363 with a market capitalization of over $19.7 billion.

Thanks to the latest price decline, only 77% of DOGE investors now remain in profit, according to IntoTheBlock’s data.

In the meantime, KNIGHT $INJ TO 100$, a popular crypto analyst, recently revealed that the memecoin’s price is still in its accumulation phase. In doing so, the analyst hinted at a few more slow-moving weeks ahead. However, once the memecoin exits this phase, investors might witness a massive price surge on the charts.

If this analysis is to be believed, then a breakout above the accumulation zone might allow Dogecoin to touch $1 too.

Volatility might increase sooner

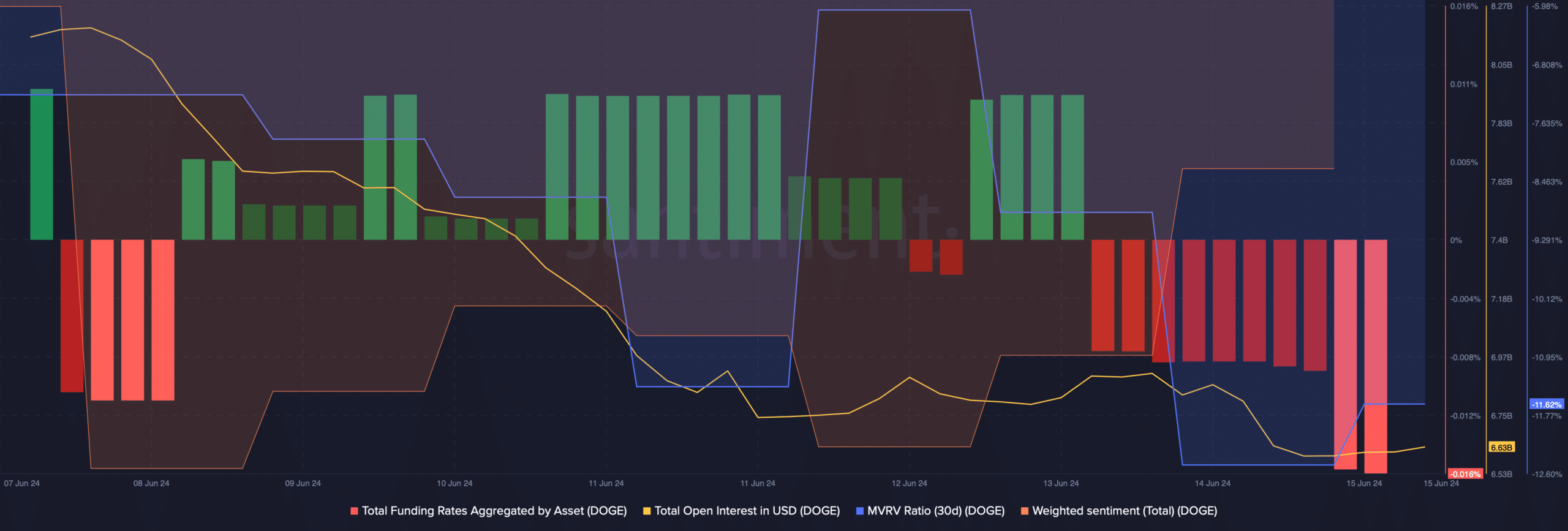

Though the aforementioned assessment suggested a few slow-moving days, AMBCrypto’s analysis of Santiment’s data revealed that the bulls might soon take over. For instance, DOGE’s funding rate has declined substantially in the last few days. Generally, prices tend to move the other way than the funding rate, hinting at a bull rally.

On top of that, DOGE’s open interest also dropped along with its price. A decline in this metric is a sign that the ongoing price trend might end soon. The memecoin’s MVRV ratio also registered a slight improvement on 15 June, indicating a possible trend reversal.

Apart from these, Dogecoin’s weighted sentiment graph also moved up – A sign of bullish sentiments outweighing bearish ones across the market.

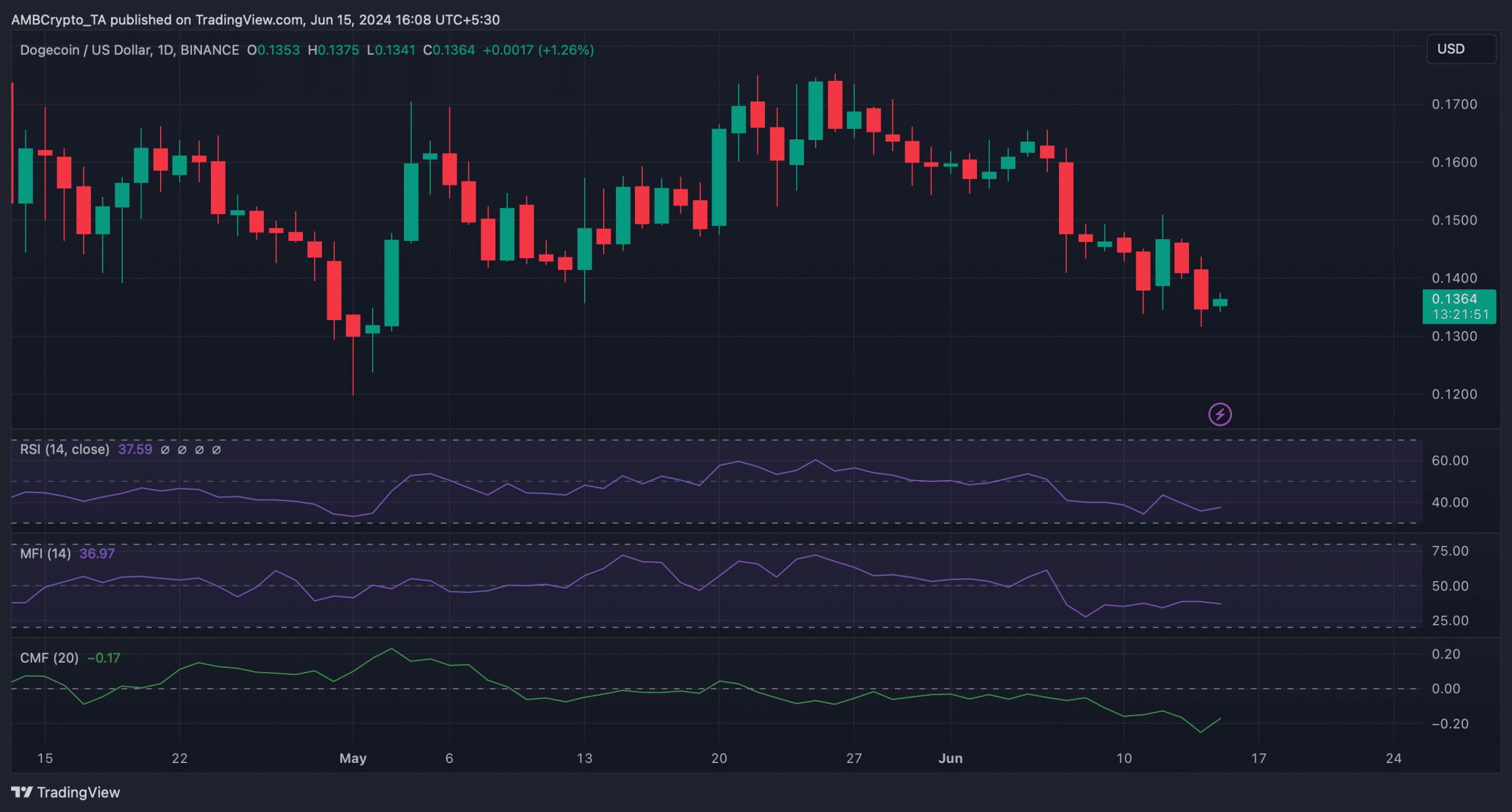

Like the aforementioned metrics, a few of the market indicators also looked pretty optimistic.

For instance, both DOGE’s Chaikin Money Flow (CMF) and Relative Strength Index (RSI) registered upticks, hinting at a price hike soon.

On the other hand, the Money Flow Index (MFI) remained bearish as it headed south on the charts.

Is your portfolio green? Check the Dogecoin Profit Calculator

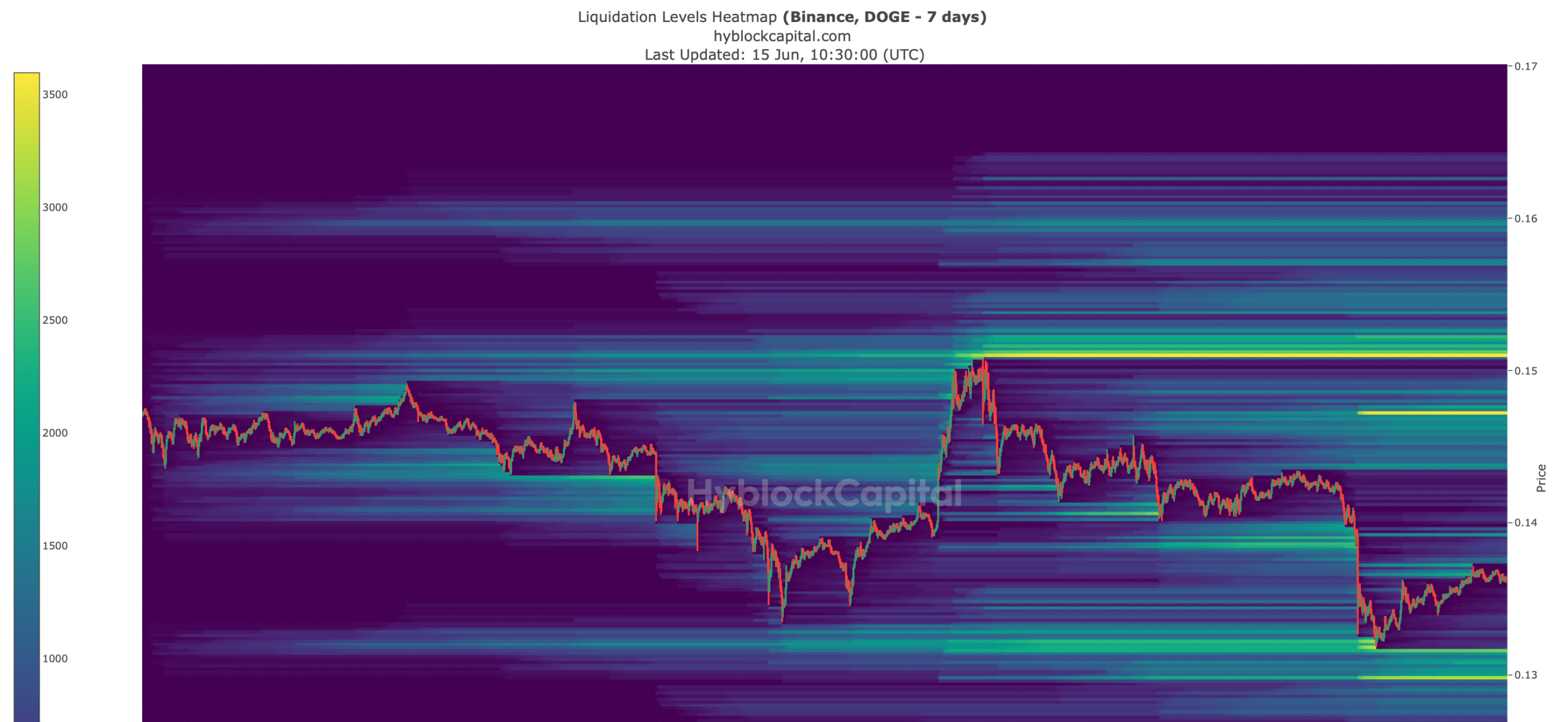

Finally, AMBCrypto’s analysis of Hyblock Capital’s data revealed that if DOGE turns bullish, then its price might first touch $0.147 as liquidations would rise.

A successful breakout above that level would allow DOGE to hit $0.15. Nonetheless, if the bearish trend continues, DOGE might drop to its support level near $0.131.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)