Bussiness

Ethereum’s bullish surge cools off – How much longer for $4k?

- Ethereum shows signs of consolidation amid ETF hype, indicating no strong market direction.

- Overall sentiment and technical indicators suggest that the consolidation phase has already begun.

Coming off the high of spot ETF hype, Ethereum’s [ETH] rally seems to be slowing down by the minute. What was an increase of 17% last week has turned to less than 1% this week. Is the world’s second-largest cryptocurrency at risk of consolidating?

Let’s take a look.

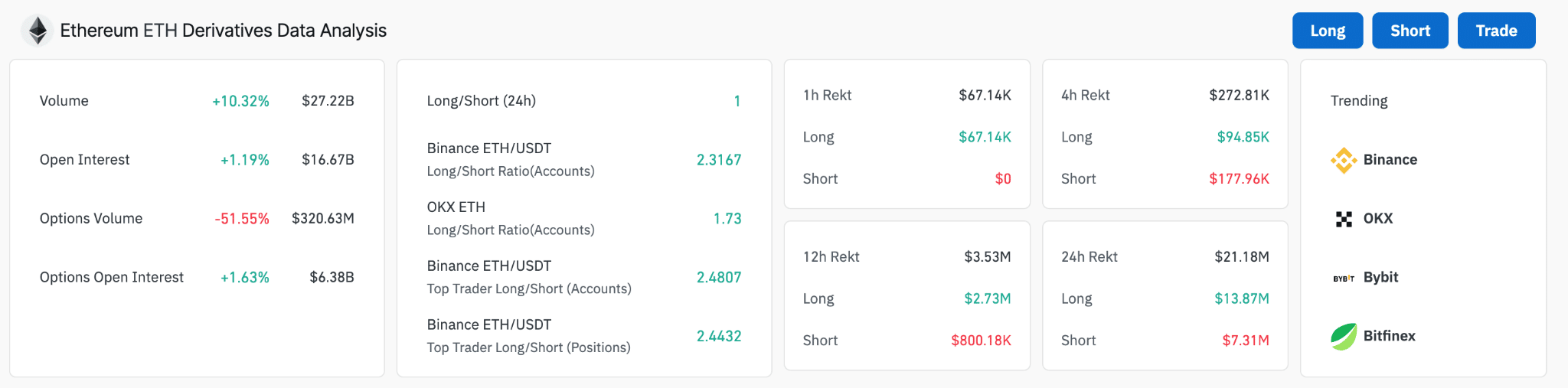

The Ethereum derivatives data presents a mixed sentiment, potentially indicating a slowdown in Ethereum’s rally. The increased trading volume by 10.32% and open interest by 1.19% shows that traders are still quite active with ETH.

Looking at the long/short ratios, we see a predominance of long positions over shorts, indicating that despite the slowdown, many traders are still betting on Ethereum’s bull run as ETFs get ready to start trading next week.

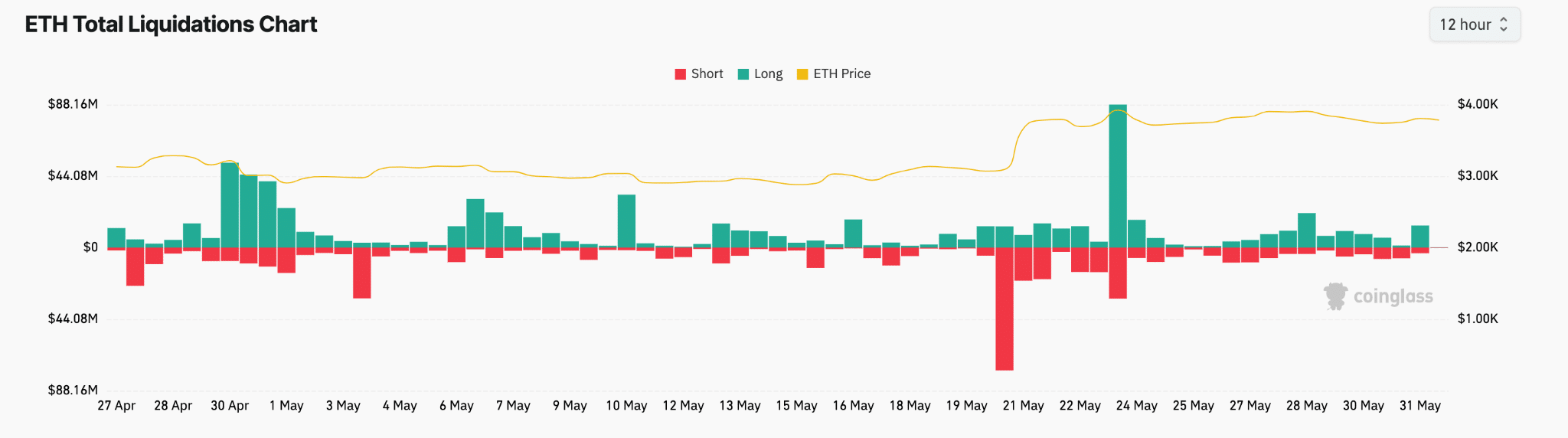

Ether’s current liquidation pattern could signal that despite the predominant bullish sentiment, ETH is facing increased market caution. This typically precedes a short-term consolidation, as was seen from Bitcoin after breaking all-time highs earlier this year.

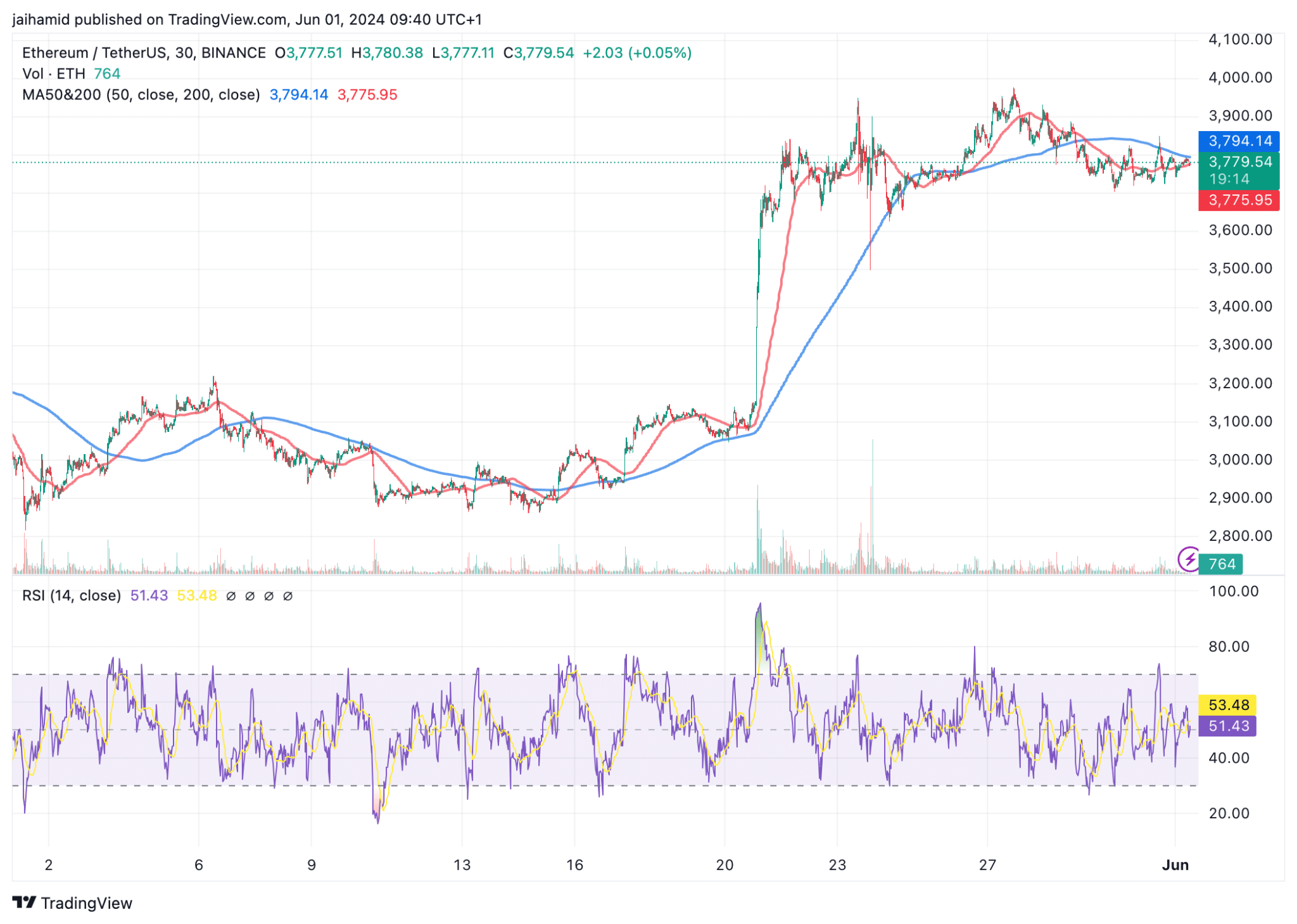

The ETH/USDt chart shows an incoming consolidation even more. After peaking around $3,980, Ethereum faced resistance and has since formed a consolidation pattern, generally fluctuating between $3,770 and $3,900.

The Relative Strength Index (RSI) currently reads at 51.43, indicating a neutral momentum that aligns with the ongoing price consolidation.

This suggests neither overbought nor oversold conditions, providing no strong bias towards either bullish or bearish momentum in the near term.

From a technical analysis perspective, the key support level to watch is around $3,770, marked by several touches over the past few days, which have prevented further declines.

On the upside, resistance is set near $4,000, where Ethereum has struggled to sustain upward movements.

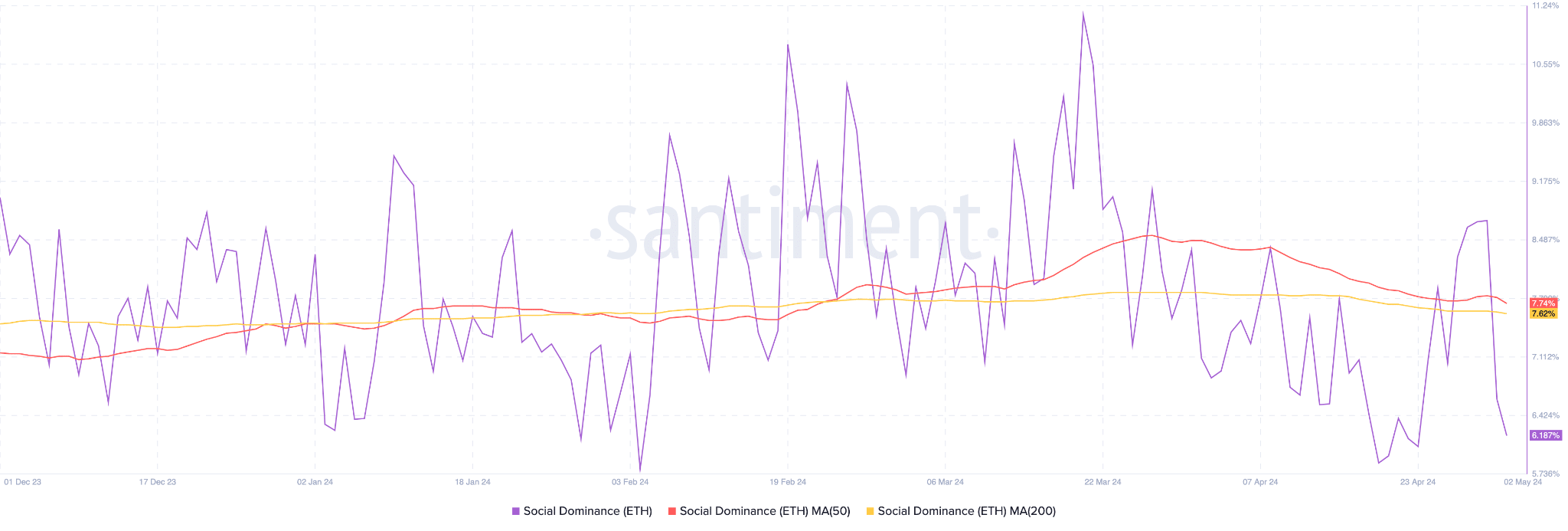

Meanwhile, a notable peak in social dominance suggests a recent surge in discussions or interest around Ethereum, which is clearly driven by the ETF hype.

Is your portfolio green? Check the Ethereum Profit Calculator

The moving averages, however, show a downward trend in the long term, predicting an overall decreased interest level in Ethereum.

All in all, Ethereum is not at risk of consolidation. It is already consolidating.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)