Bussiness

Predicting how ETH will react IF the SEC approves Ethereum ETFs

- Coinbase analyst sees a 30-40% chance of approval for Ethereum ETFs.

- Ethereum’s dominance and performance are at a low, suggesting a need for positive development soon.

It is generally believed that the U.S. SEC will not approve any applications for the spot Ethereum [ETH] ETF due to several factors pointing to the fact that the agency’s new crypto enemy is Ethereum.

But still, no real confirmation has been gotten from the agency itself on what it’s planning. So there is still a chance, no matter how slim, that the SEC would approve these ETFs.

However, if they do, is the market ready for that impact? How would Ethereum’s price react?

Approval odds for Ethereum ETFs

Coinbase institutional research analyst David Han suggests there could be a surprising upside.

In Coinbase’s monthly outlook report published on the 15th of May, Han mentioned that the odds of approval are between 30-40%.

Bloomberg ETF analyst Eric Balchunas has similarly set his approval odds at 35%. Meanwhile, the crypto community took a survey from Polymarket and the general estimate is 7% odds of approval.

Larry Fink, CEO of BlackRock, echoed the somewhat optimistic sentiment during an appearance on CNBC, saying that the SEC might approve spot ETH ETFs even if it does consider Ethereum a security

What does the data tell us?

Should the SEC approve an Ethereum ETF, the market could see an unexpected surge. However, Ethereum’s dominance and recent performance are trending toward their lowest point ever.

Its SEC-proclaimed status as a security has negatively impacted investment sentiment.

No one expects an approval, so Ether prices could likely see very little action in the near future.

Bitcoin’s [BTC] price hardly reacted to its ETF approvals earlier this year. And the community were actually looking forward to it.

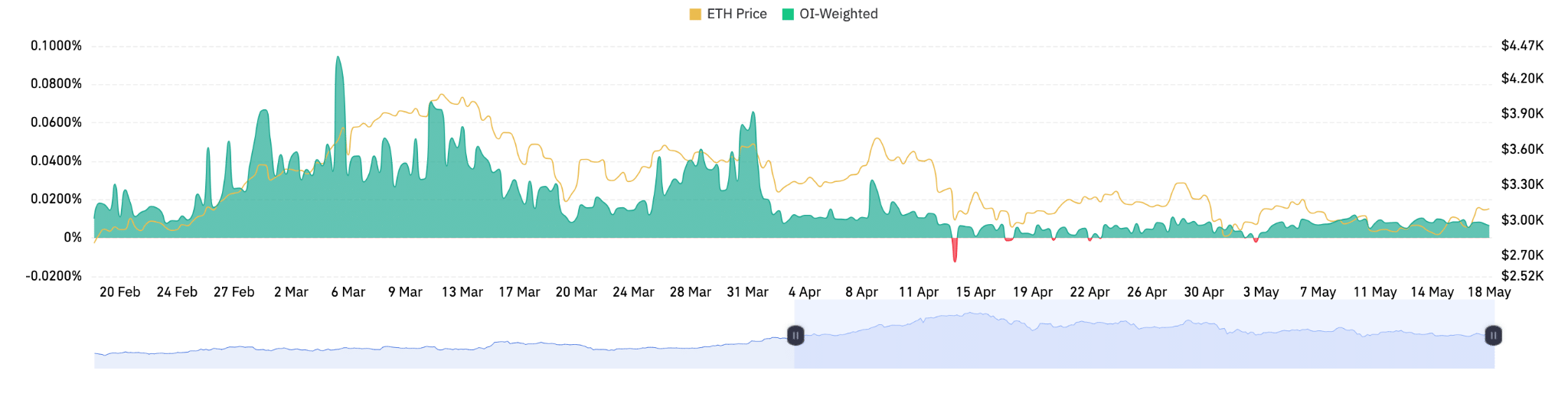

Recently, the Funding Rate has been relatively low or negative, which could imply a cooling off of bullish momentum or increased caution among traders, especially during price dips as it happened in mid-April.

Moreover, the increase in Open Interest despite lower trading volumes suggests that traders might be preparing for significant price moves ahead, as positions are being built up.

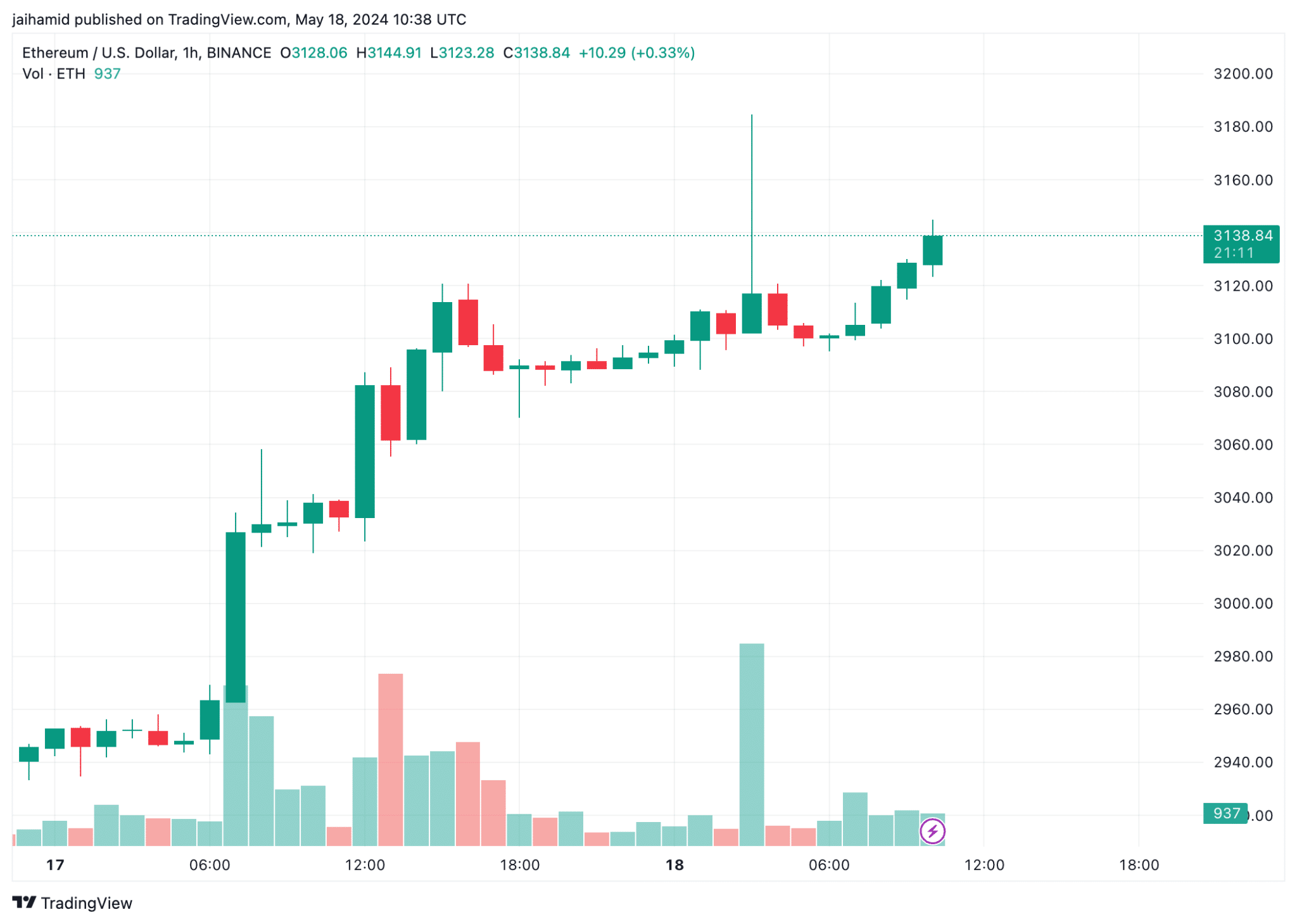

But Ethereum’s trading chart shows a consistent bullish trend over a two-day period. The highest price point just above $3,160 could act as a short-term resistance level.

Read Ethereum’s [ETH] Price Prediction 2024-25

Watching how the price reacts upon retesting this level could be critical for short-term investment strategies.

Given the strong upward momentum and successful price recovery post-retraction, if the market maintains its bullish sentiment, Ethereum could potentially break through the current resistance level.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)