Bussiness

Top 5 Stocks if Donald Trump Wins the Election

franckreporter/iStock via Getty Images

Trump Rally

Secret Service rushed former President Donald Trump offstage during an assassination attempt this weekend during a Butler, Pennsylvania campaign rally. Trump reported he was “fine” following the event and that the bullet “pierced the upper part of my right ear” and is safe following a rally shooting, but elections and major political events can cause stock markets to react. As the U.S. presidential election draws near, Wall Street has speculated how a change in administration might impact the markets. Amid this weekend’s assassination attempt, the markets may experience some volatility as investors brace for a ‘Trump Trades’ haven rush.

The S&P 500 has increased 45% since President Joe Biden took office, led by energy, tech, and industrial companies. The energy sector (XLE) has risen a startling 102% under the Biden administration, followed by technology (XLK) +77% and industrials (XLI) +34%. With less than four months until election day, Wall Street analysts are speculating how a change in administration might impact the markets.

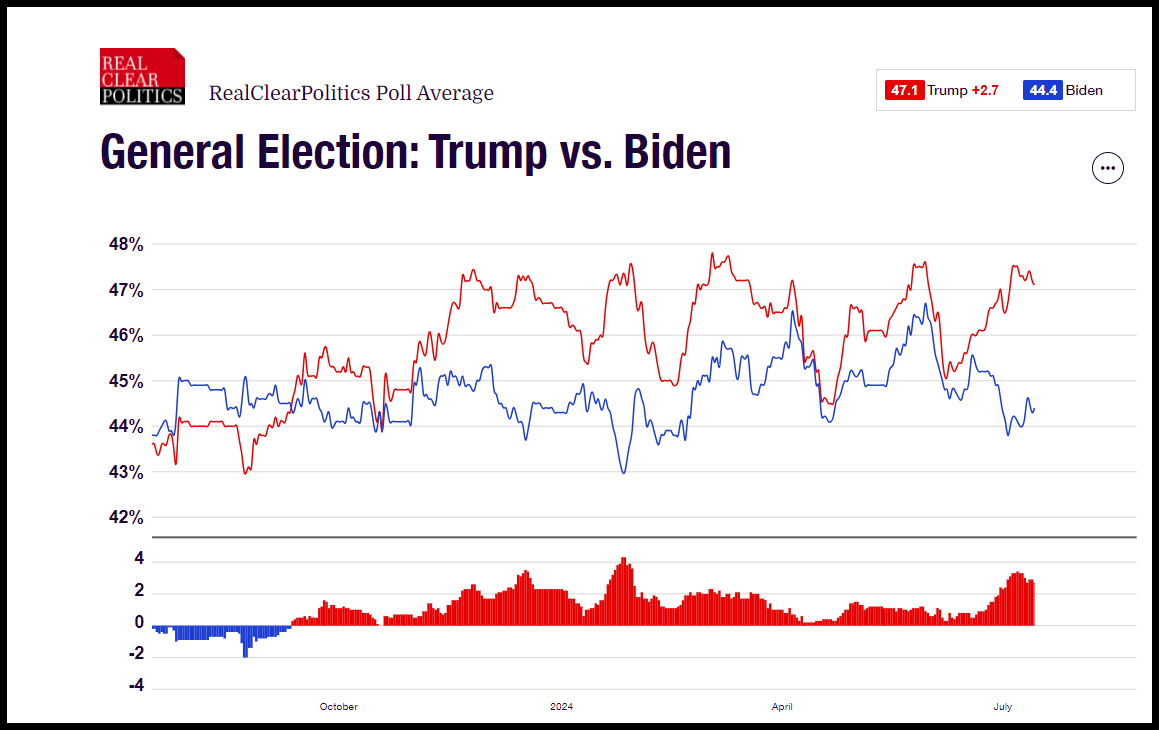

Trump vs. Biden Polls (Real Clear Polling (as of July 14, 2024))

Former President Donald Trump is leading Biden by ~3% on average in recent polling, and has gained momentum since the June 27 debate. Trump’s 2024 proposals and platform call for modernizing the military, boosting domestic manufacturing, and making the U.S. the dominant energy producer in the world. During his presidency, Trump overturned a significant number of government regulations, including restrictions on big banks.

“The extension of the 2017 tax cuts and potential deregulatory agenda of former President Trump are starting to get priced into the market,” said Raymond James analyst Ed Mills. “This particularly favors financials and there will be an expectation of more M&A approval in a Trump presidency.”

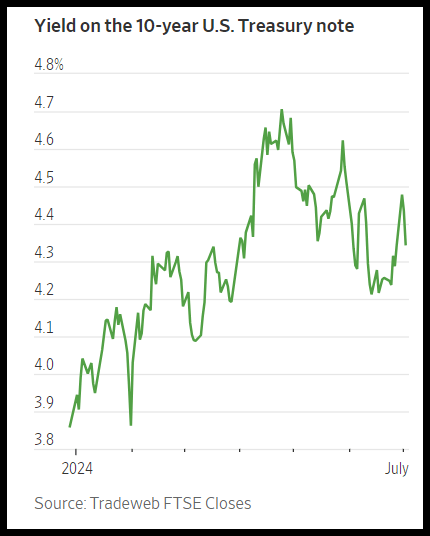

Following the June 28, 2024 debate between President Biden and former President Donald Trump, Treasury yields surged, and U.S. government bonds sold off as investors speculated about a Trump 2.0 Administration.

10-Year Treasury Yield (Wall Street Journal)

Encouraging inflation data and the 10-Treasury surging above 4.45% the first week in July, up from 4.287% before the Biden-Trump debate, added to the speculation of a potential “Trump trade,” which took place following the November 2016 election. Calvin Tse, head of macro strategy at BNP Paribas, highlighted:

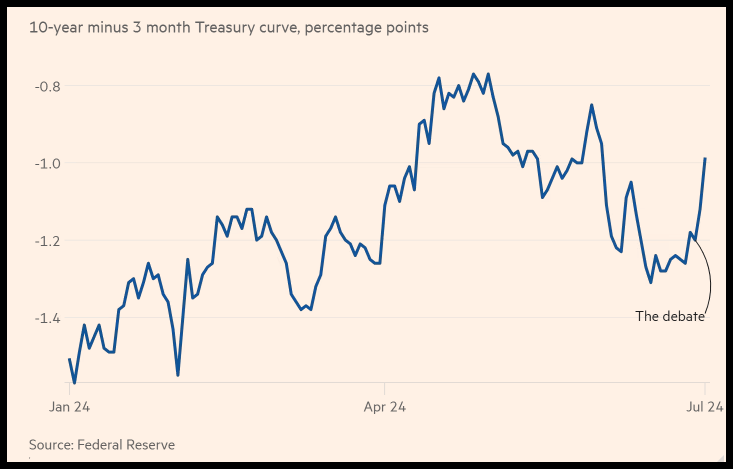

“The Trump trade is a US rates curve steepener. Trump’s policies are largely inflationary (tariffs, looser fiscal), while at the same time, he will probably appoint a more dovish-leaning Fed chair. After the debate last week, the curve steepened both on Friday and Monday – likely as a reflection of Trump’s probabilities of winning have gone up.”

10-Year minus 3 month Treasury (Financial Times)

While proposals pitched on the campaign trails may not translate into policy during a president’s tenure, the SA Quant Team identified five Strong Buy stocks within industries thematically aligned with a potential Trump 2.0 administration.

Top 5 Stocks

The November presidential election is nearing, so we’ve identified five American Strong Buy-rated stocks in the steel, diversified banking, energy, defense, and construction industries. Each possesses solid momentum and earnings growth potential, has market caps above $500M, and has meaningful growth data.

1. Carpenter Technology Corporation (CRS)

-

Market Capitalization: $5.43B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/12/24): 7 out of 281

-

Quant Industry Ranking (as of 7/12/24): 1 out of 27

Carpenter is a Pennsylvania-based corporation that produces specialty metals, including titanium alloys and stainless steels, primarily for the defense, medical, and industrial industries. Despite mixed Q3 2024 earnings that included an EPS of $1.19 beating by $0.25 and a revenue miss, Carpenter Technology was the top industrial gainer for the week ending May 3rd, +23.38%. Over the last year, the stock is up over 90% and +54% YTD. CRS is #1 among quant-rated Steel Stocks and #7 in the Materials sector, driven by an A+ grade in Growth, Momentum, and EPS Revisions.

CRS Stock vs. S&P 500 1Yr Return (SA Premium)

Carpenter has over 130 years of metallurgical and manufacturing expertise in developing highly-engineered products for critical applications. Additionally, CRS has a proven track record of delivering profitable growth in a highly-competitive market, including record adjusted operating income in the most recent quarter, up 129% YoY. Strong performance in its two largest business segments, aerospace/defense and medical, have been key growth drivers and have solid outlooks.

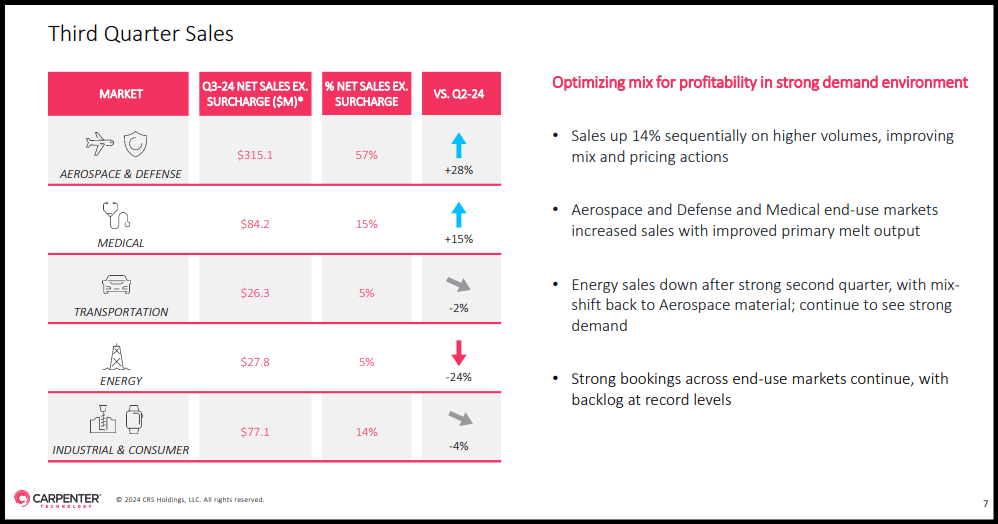

Q324 highlights:

-

Strong bookings across end markets and record-high backlog

-

Aerospace/defense and medical sales up on improved primary melt outputs

-

Product mix shift to higher value materials boosted operating profit

-

Solid demand in aerospace and defense market (57% of sales) amid supply shortages

CRS Stock 3rd Quarter Sales (CRS Stock Q3 Investor Presentation)

CRS significantly outperforms the sector in nearly every growth metric for an A+ Growth grade, with revenue TTM up 15% YoY to $2.72B. EBITDA growth FWD is at 81%, and EPS forward long-term growth rate (3-5Y CAGR) is an eye-opening 91%. CRS profit margins are in line with peers but ROE of 9% and ROTC of 8% beat sector medians by 57% and 64%, respectively. CRS Valuation is a D+ but PEG FWD, a heavily weighted metric, is 0.26, an 80% discount to the sector. CRS FY24 EPS is projected to grow 292% to $4.47 and revenue +8% to $2.78B, according to consensus estimates.

2. Western Midstream Partners, LP Common Units (WES)

-

Market Capitalization: $15.48B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/12/24): 4 out of 241

-

Quant Industry Ranking (as of 7/12/24): 1 out of 55

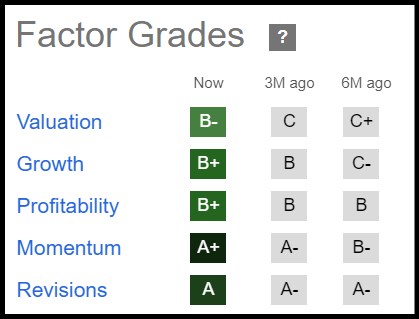

WES is a Texas-based midstream energy operator focused primarily in the U.S. Up more than 50% in the past year, the #1 quant-rated Oil and Gas Storage and Transportation stock and #4 in the Energy sector is engaged in processing and transporting natural gas, natural gas liquids (NGLs), and crude oil. Its core operating assets are in the Delaware and Denver Basins. WES showcases A’s in Momentum and EPS Revisions and B’s in Valuation, Growth and Profitability.

WES Stock Factor Grades (SA Premium)

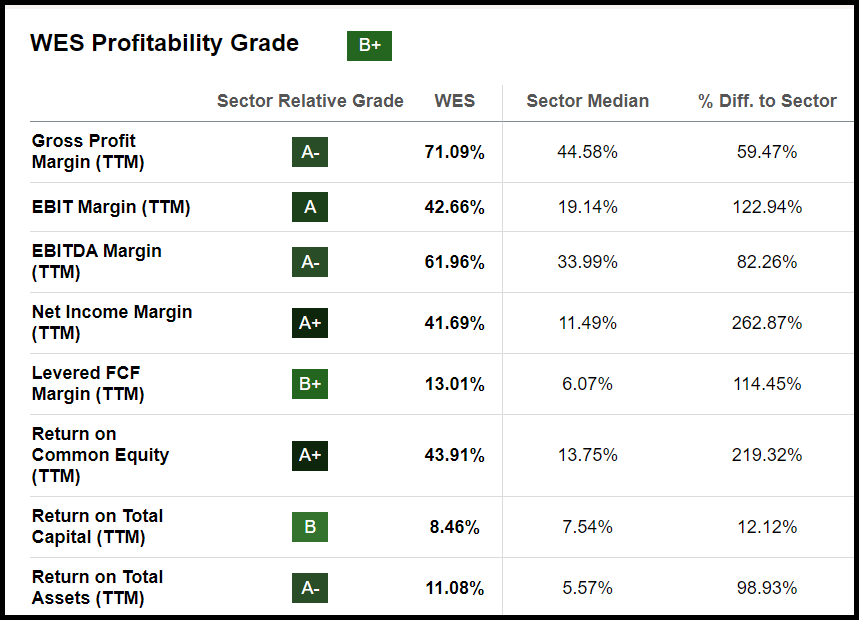

WES’s strong production activity and higher levels of system operability drove throughput and profitability increases in the first quarter, which resulted in a $26 million increase in adjusted gross margin for Q1 compared to Q4 2023. WES expects increased throughput and higher profitability to continue based on producer forecasts. WES EBIT margin TTM of 42% and EBITDA margin of 61% crushed the energy sector medians. WES recorded a net income margin of 41% vs. the sector’s 11% and posted levered FCF margin of 13% and ROE of 43%.

WES Stock Profitability Grades (SA Premium)

Western Midstream Partners trades in line with the sector, as highlighted by its C+ Valuation grade. Although some of its underlying valuation metrics indicate a premium relative to the sector, WES’s all-important forward PEG of 0.99x is at a 48% discount. Wes has had eight upward revisions in the last three months and offers a handsome forward dividend yield of 8.60% with 10 consecutive years of payouts.

3. Argan, Inc. (AGX)

-

Market Capitalization: $964.85M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/12/24): 14 out of 627

-

Quant Industry Ranking (as of 7/12/24): 3 out of 32

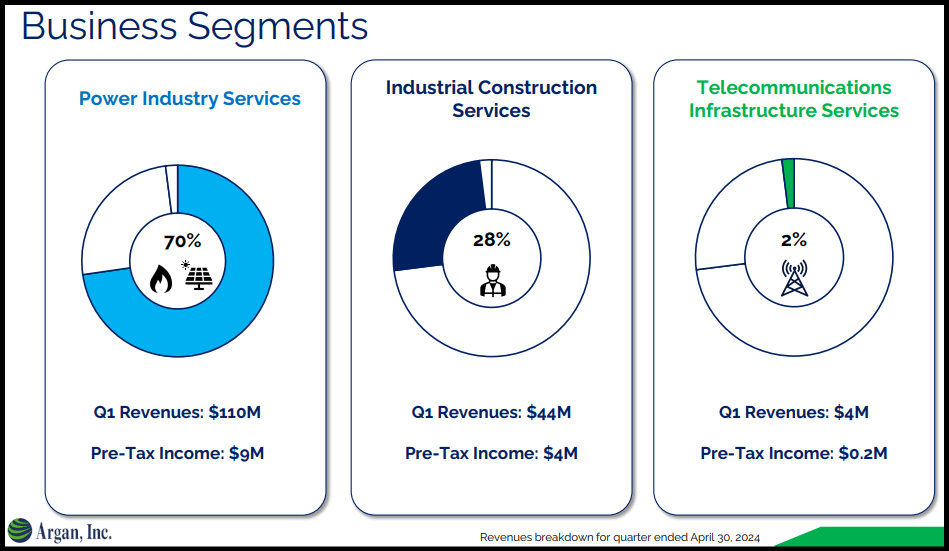

Argan is the #3 quant-rated Construction and Engineering stock, up 76% in the past year and +54% YTD, with A’s in Momentum and Revisions and a B+ in Profitability. Argan has three primary business segments: power industry services, industrial construction, and telecommunications/ infrastructure services. Argan is uniquely positioned to expand involvement in developing power and infrastructure solutions amid a 50-year-high in onshoring of manufacturing operations, driven by federal grants and tax incentives.

AGX Stock Business Segments (AGX Stock Investor Presentation)

In addition to its business segment expansion, Argan had a $824M project backlog at the close of Q1, including nearly $300M in renewable projects.

“First quarter 2025 backlog reflects both sequential growth compared to backlog of $757 million at the end of the fourth quarter of fiscal 2024 and year-over-year growth compared to backlog of $806 million in the first quarter of fiscal 2024. Additionally, at April 30, 2024, our balance sheet reflected $416 million of cash in investments, net liquidity of $247 million and no debt,” said David Watson, President & CEO of Argan during the Q1 2025 earnings call.

AGX revenue rose an impressive 36% YoY, EPS +40%, and levered FCF over 2,730%. Revenue growth FWD is at +24%, EBITDA FWD +20%, and EPS FWD +28%. AGX has shown solid profitability with levered FCF margin of 17%, ROE of 13%, and cash per share of $15.56 vs. the sector’s $2.17. AGX exceeded earnings expectations in FY25 Q1 EPS of $0.58 beat by $0.06 and revenue of $157.68M beat by $22.93M. Argan’s EPS for FY25 is projected to grow 64% to $3.92 and revenue +35% to $778.65M.

4. Wells Fargo & Company (WFC)

-

Market Capitalization: $209.74B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/12/24): 5 out of 683

-

Quant Industry Ranking (as of 7/12/24): 1 out of 67

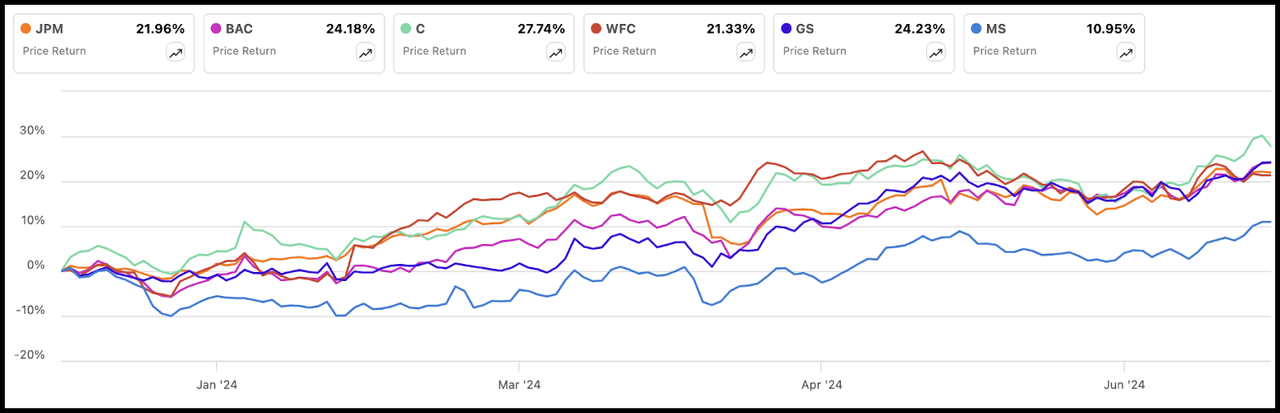

One of the biggest stock movers on Friday following its Q2 2024 earnings, Wells Fargo slid 7% following lower-than-expected net interest income, despite EPS of $1.33 beating the $1.28 consensus and revenue topping expectations, offering a potential buy-the-dip opportunity. Wells Fargo is the #1 quant-rated Diversified Bank stock and rated #5 in the Financials sector. Up over 30% in the past year and +21% YTD, UBS analysts see big banks like Wells Fargo benefitting from less stringent capital and liquidity rules under a Trump 2.0 administration. In addition to easing inflation, the prospect of lower borrowing costs has helped drive up the S&P 500 Banks index by nearly 20% in 2024.

YTD Price Return of Six Major Banks (as of 7/11/24)

YTD Price Return of Six Major Banks (as of 7/11/24) (SA Premium)

WFC exceeded earnings targets in Q224 and raised its dividend by 14%. WFC has an A+ in Growth that is underpinned by EPS growth of +33% YoY and EPS long-term FWD at 13% vs. 9% for the sector. WFC’s A+ Profitability grade is driven by a net income margin of 24%, ROE of 10%, and $96.31 cash per share vs. the industry median of $6.79. Although Wells Fargo’s valuation grade is a D+, WFC showcased a forward PEG ratio of 0.87x, 26% below the sector’s 1.15x. In addition, 20 Wall Street analysts have revised estimates up in the last three months and Wells Fargo offers 24 consecutive years of dividend payments.

5. L3Harris Technologies, Inc. (LHX)

-

Market Capitalization: $43.69B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/12/24): 50 out of 627

-

Quant Industry Ranking (as of 7/12/24): 7 out of 58

L3Harris is a top quant-rated defense stock focused on U.S. national security, offering a portfolio of space, air, sea, land, and cyber technologies to militaries worldwide. Boasting consecutive top and bottom line beats, LHX’s strong Q1 results were driven by strong operational performance and revenue increases in its Space Systems and Intelligence & Cyber divisions. The U.S. government and its agencies are L3Harris’ largest customers and a potential beneficiary of escalated Pentagon spending. Based in Florida, LHX has 50K employees and recorded $20.16B in revenue over the trailing twelve months (+15% YoY). L3Harris derives revenue from four business segments:

-

Space and Airborne Systems

-

Integration Mission Systems

-

Communication Systems

-

Aerojet Rocketdyne

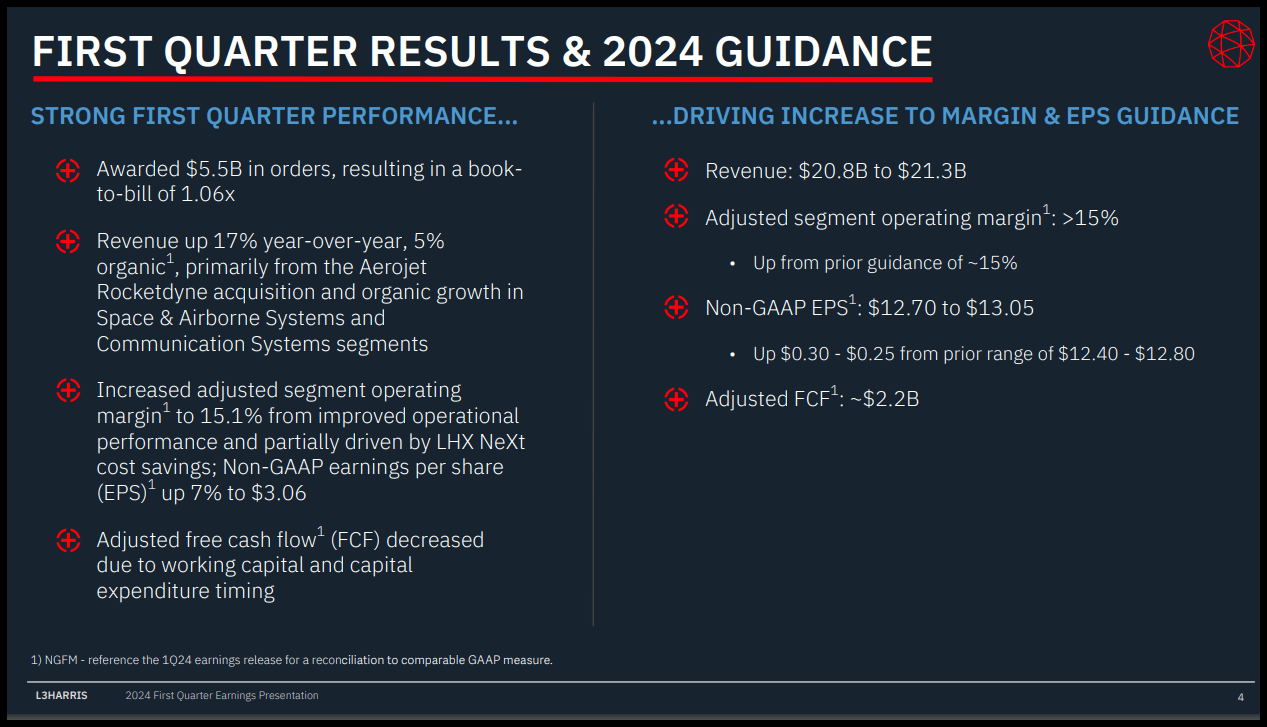

LXH EPS of $3.06 beat by $0.15 and revenue is up nearly 17% YoY and EPS +28%. LHX kicked off the first quarter of 2024 strong, with $5.5B in orders and capitalizing on its Rocketdyne acquisition.

LXH Stock Q1 Results (LHX Q1 2024 Investor Presentation)

LHX has beaten EPS expectations for 8 straight quarters and has 19 up revisions compared to one down revision in the last three months.

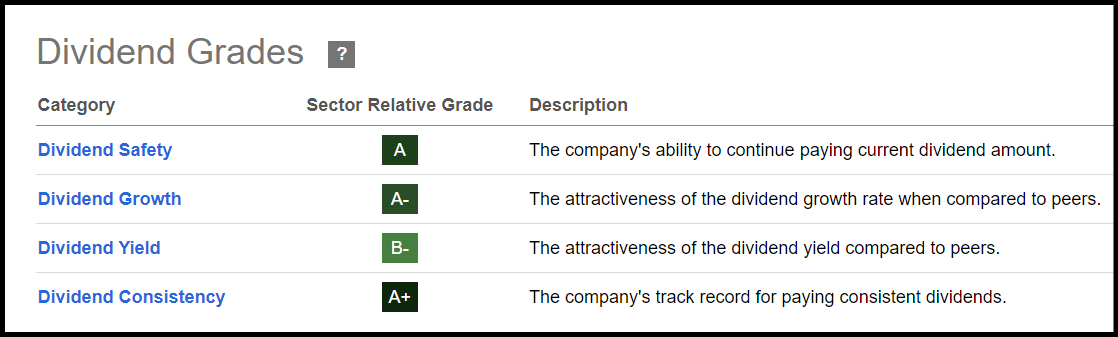

LHX Stock Dividend Grades (SA Premium)

Internationally, L3Harris has an incredible pipeline of geographically diverse opportunities to help sustain its strong dividend scorecard, which includes a dividend with a 2.05% yield, a 5Y growth rate of 6.8%, 34 consecutive years of payments, and 22 straight with growth. The Department of Defense has granted L3Harris supplemental funding, specifically for Ukraine, and in April Biden signed a foreign aid package with $67 billion for key defense programs. During the Q1 Earnings Call, L3Harris Chair and CEO Christopher Kubasik said, “Given the strong start to the year, we are raising our 2024 margin EPS and revenue guidance while reaffirming our free cash flow commitments.”

Other Top Trump Trade Stocks

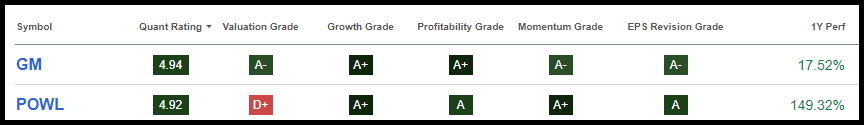

Other similar top quant-rated Strong Buy U.S. stocks we’ve covered this year include General Motors (GM), one of our Top 10 Stocks For H2 2024, and Powell Industries, Inc. (POWL).

Other SA Quant Trump Trade Stocks (SA Premium)

There are many more top stocks that you can choose from. Or, if you’re seeking a limited number of monthly ideas from the hundreds of top quant Strong Buy-rated stocks, consider exploring Alpha Picks.

Concluding Summary

Politics can play a big role in stock markets, and the recent assassination attempt on former President Donald Trump is prompting Wall Street to speculate on how a change in administration might impact the markets. Stocks have soared ~+45% since President Joe Biden took office, but traders are bracing for potential volatility on Monday’s market open, as Wall Street considers ‘Trump Trades.’ Ex-President Donald Trump embraces more oil drilling, deregulation, military spending, and protectionism. The Quant Team identified five stocks in industries thematically aligned with investor sentiment on a Trump 2.0 administration. The five stocks are up by an average of 55% in the past year, showcasing solid earnings potential and upward revisions from Wall Street analysts.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Consider using Seeking Alpha’s ‘Ratings Screener’ tool to help find stocks that achieve diversification into desired sectors you like. Or, if you’re seeking a limited number of monthly ideas, consider exploring Alpha Picks.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)