Jobs

3 Things To Watch Out For In The June 2024 Jobs Report

Khaosai Wongnatthakan

Ahead of the Bureau of Labor Statistics (‘BLS’) posting the non-farm payroll report on Friday, July 5, 2024, stock markets will observe Independence Day. Markets will close on Thursday, July 4, and Friday at 1:00 p.m. The shortened trading week will weaken the market’s reaction to the June BLS report. Expect the market to delay its reaction to the report to the following week.

What should investors expect from the report? Investors have three things to consider ahead of Friday’s data release.

1/ Weekly Claims

On Thursday, June 27, the Labor Department reported initial jobless claims fell by 6,000 to 233,000. However, claims increased by 3,000 on a 4-week moving average measure. 1.84 million Americans collected unemployment benefits, the eighth straight week of increase.

Last month, employment increased in seven states and was unchanged in 43 states. In the last year, NFP increased in 30 states and was mostly unchanged in 20 states. The BLS reported that gains occurred in Texas (+316,700), Florida (+222,200), and California (+207,700).

The Federal Reserve started the interest rate hike cycle in March 2022. Interest rates peaked at 5.6% by July 2023. It intended to slow down inflation and the hot labor market. On Friday, the personal consumption expenditures price index eased, unchanged from the prior month. On a Y/Y basis, the PCE price index at 2.6% is headed toward the Fed’s 2.0% target.

Unfortunately for investors, May 2024’s job report weakened the chances of a rate cut. JP Morgan said in its outlook that the 272,000 jobs added underscored the labor market as too hot for the Federal Reserve.

2/ Expected Job Increases in June

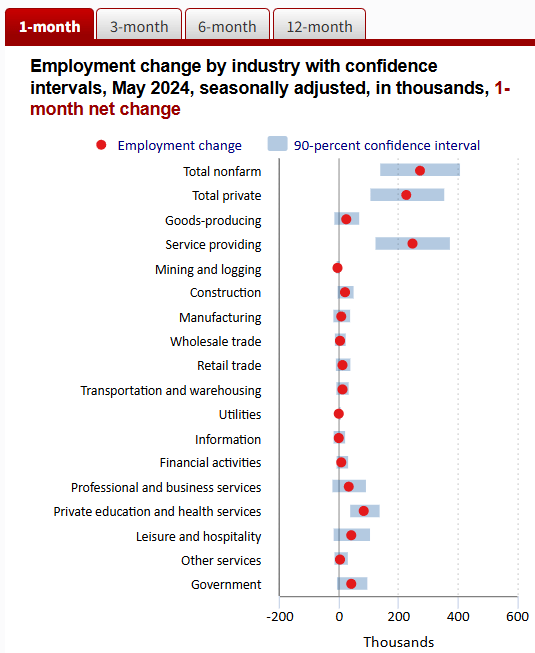

Readers should expect most of the positive employment in May to repeat itself in the upcoming report. In May, job increases were most notable in government, leisure and hospitality, private education and health care services, and professional and business services.

BLS

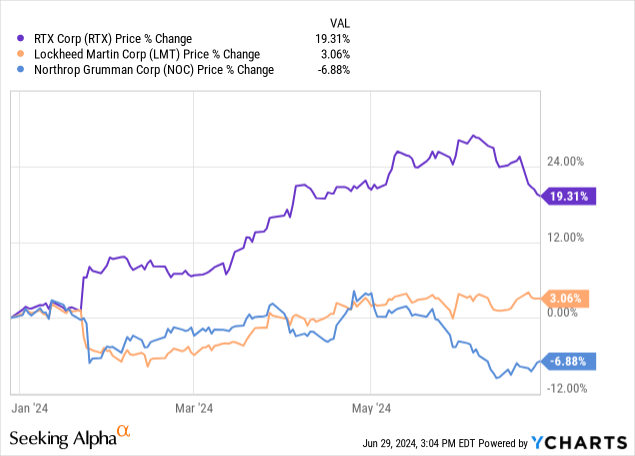

In most of my past NFP preview articles, I associated the need for an increase in government jobs to support the defense and aerospace industry. The U.S. Army announced a $4.5 billion multi-year contract with Lockheed Martin (LMT). Lockheed will supply its Patriot Missile air defense system. Northrop Grumman (NOC) won a $119.6 million repair contract to support E-2 aircraft. On June 22, RTX (RTX) announced that it won a defense contract worth $264.6 million. It will support the U.S. Air Force on the DB-110 and MS-110 Reconnaissance Pod programs.

Above: RTX led the military economy stocks higher YTD. NOC stock is lower.

In the education and health services sector, expect employment to increase. The healthcare industry is struggling to fill job positions to keep up with its expansion. In May, the sector added 26,279 jobs. Job growth will continue regardless of the Fed’s interest rate policy or changes in inflation rates.

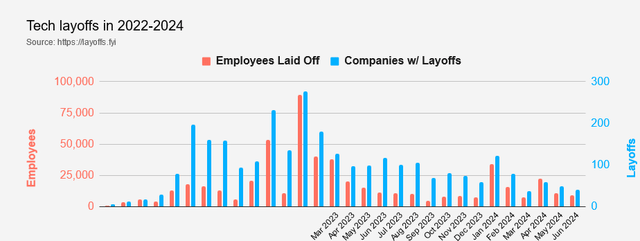

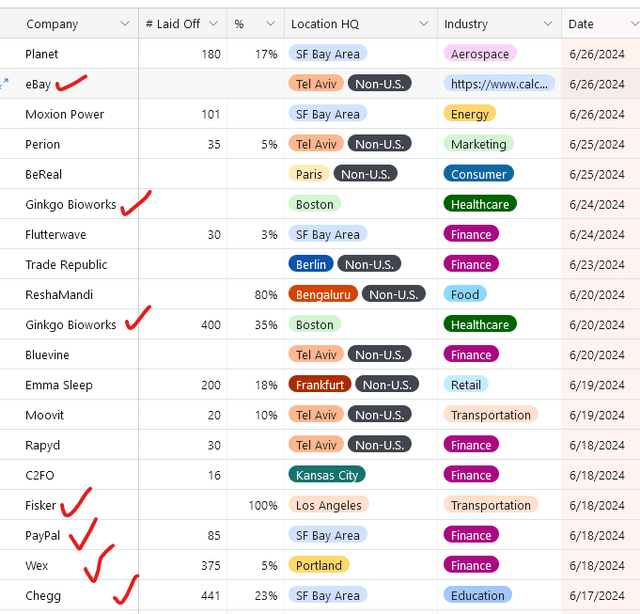

The June report should report an increase in technology jobs. In May, the professional and business services, which included tech jobs, increased by 33,000. This growth would contradict reports of big technology firms cutting jobs. According to layoffs.fyi, the 41 companies in the industry cut 9,197 jobs in June.

Some of the companies cutting jobs will not show up in the NFP report. For example, eBay (EBAY) is cutting jobs in Tel Aviv. Firms that cut jobs have serious cost overruns that exceed their revenue. Ginkgo Bioworks (DNA) will cut as many as 400 jobs in Boston.

DNA stock cratered after Ark Invest (ARKK) sold 41.6 million shares. Ark’s investors took the loss when the fund bought the shares for over $ 11 and sold them for around $0.30.

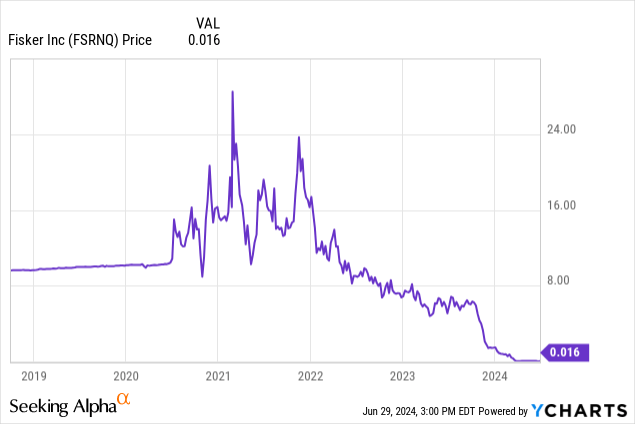

Fisker (OTC:FSRNQ) filed for bankruptcy on June 19, 2024.

Posted last Nov. 2023, Fisker is one of four electric vehicle stocks at risk of falling to zero.

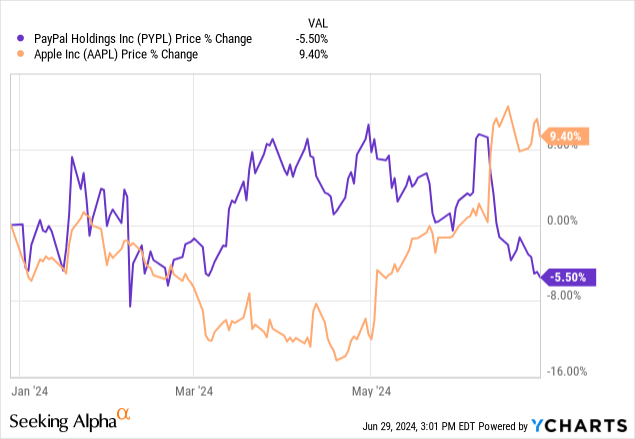

Investors are selling shares of PayPal (PYPL) after Apple (AAPL) introduced new financial products. Its Apple Pay online and Apple Wallet’s Tap to Cash will hurt PayPal’s transaction volumes.

Above: Investors bet on Apple’s strong prospects in fintech and sold PYPL shares.

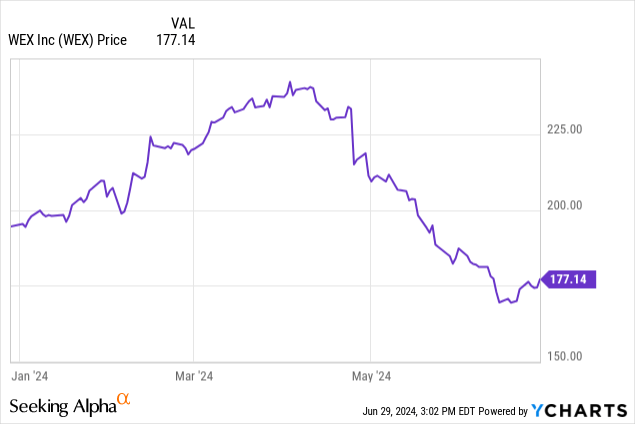

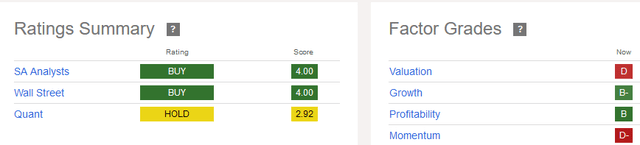

Wex (WEX), a financial technology provider, cut jobs. It said that its business continues to evolve to support innovation. Wex’s peers include Nuvei (NVEI) and Shift4 Payments (FOUR).

To advance its technology transformation, it is streamlining its organizational structure. Wex shareholders should be wary of holding the stock. It has weak SA Quant scores for valuation and momentum.

In the learning platform segment, Chegg (CHGG) has troubling headwinds ahead. Students are using artificial intelligence chatbots to learn and search for answers. To cut costs, Chegg cut 23% of its global headcount and 441 positions in the San Francisco Bay area.

3/ Expected Job Declines

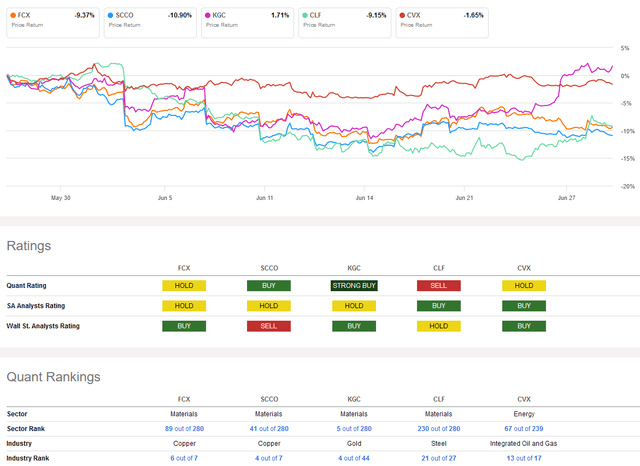

In May, employment slowed negligible changes in the resource sector such as mining and quarrying, oil and gas extraction, and construction. However, ahead of the report, the returns on shares of mining firms are mixed. Freeport-McMoRan (FCX), Southern Copper (SCCO), Cleveland-Cliffs (CLF), and Chevron (CVX) are down in the last month.

Only Kinross (KGC) is up by 1.71% in that time. The gold miner also scores a strong buy on the quant rating.

Your Takeaway

The monthly NFP report has a far less impact on stock markets. The S&P 500 (SPY), Nasdaq (QQQ), and Russell 2000 (IWM) trade close to all-time highs. Furthermore, the Fed already indicated at least one rate cut this year. The upcoming job report will only reaffirm the Fed’s monetary policy decision.

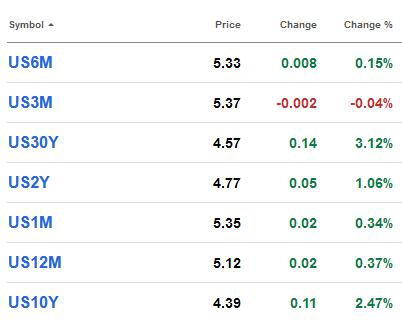

The higher markets rise, the more investors should watch bond yields. The 30-year Treasury (US30Y) gained the most on Friday. This sent both the 20+ year Bond (TLT) and 7-10 year ETF (IEF) lower.

Seeking Alpha

Chances are low that the economy added too many jobs in June. Still, investors should position their portfolios by avoiding sectors sensitive to inflation and high interest rates. Strong employment only fuels both. The plunge in shares of Nike (NKE) and Walgreens Boots (WBA) in the last week are examples of stocks to avoid.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)