Travel

4 Airline Stocks to Invest Now as Air Travel Demand Surges

Solid recovery in air travel demand, both domestic and international, has been aiding the Zacks Airline industry post the easing of COVID-19 travel restrictions and the reopening of the global economy. People are again booking flights, thereby leading to higher passenger revenues, which contribute to the bulk of most airlines’ top line.

We believe that the current summer season is likely to see a further surge in passenger revenues, in turn aiding airlines’ top lines. Per Airlines for America, U.S. airlines are anticipated to carry 271 million passengers from Jun 1 to Aug 31, 2024. The projection marks an all-time high.

Further, the bullish projection for 2024 by the International Air Transport Association (IATA) confirms airlines’ buoyancy. Owing to the buoyant air travel demand scenario, IATA now expects the industry to generate a net profit of $30.5 billion in 2024 compared with $25.7 billion estimated in December 2023. Net profit in 2023 was $27.4 billion. The top line in 2024 is now anticipated to be $996 billion compared with the previous estimate of $964 billion. The revised revenue forecast, a record high, indicates a 9.7% increase from the 2023 actuals.

Passenger revenues are the biggest driver of the rosy projection for 2024. Per IATA, passenger revenues in 2024 are now anticipated to be $744 billion compared with the previous estimate of $717 billion. The revised revenue forecast indicates a 15.2% increase from the 2023 actuals. Per IATA, a record 4.96 billion people are likely to take to the skies in 2024.

The buoyancy in the industry is further confirmed by its Zacks Industry Rank #97, which places it in the top 39% of more than 250 Zacks industries.

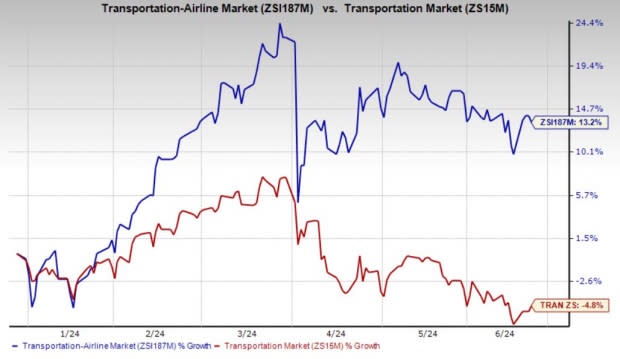

Notably, the Zacks Airline industry has risen 13.2% so far this year, outperforming the 4.8% decline of the broader Zacks Transportation sector.

Image Source: Zacks Investment Research

Investing in Airline Stocks: A Prudent Idea

Given this encouraging backdrop, we present four airline stocks, Copa Holdings, S.A. (CPA), SkyWest, Inc. SKYW, United Airlines Holdings, Inc. UAL and Alaska Air Group, Inc. ALK, which investors can bet on.

The aforementioned stocks have a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a VGM Score of A or B. The stocks have also witnessed upward estimate revisions in the past 90 days. Additionally, the aforementioned stocks have a strong trailing four-quarter average earnings surprise history. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2, offer the best investment opportunities for investors. The selected companies seem compelling investment propositions at the moment.

Each of the companies has a market capitalization of more than $1 billion.

Copa Holdings: This Panama City-based company provides airline passenger and cargo services.

Upbeat air travel demand has been aiding Copa Holdings’ revenues. Management expects the current-year load factor (percentage of seats filled by passengers) to be 87%, assuming that the rosy traffic scenario continues. For 2024, the company expects consolidated capacity or available seat miles to register 10% growth year over year. Operating margin is projected in the 21-23% band.

Copa Holdings flaunts a Zacks Rank #1 and has a VGM Score of A. The Zacks Consensus Estimate for CPA’s 2024 earnings per share (EPS) has moved up 3% in the past 90 days. CPA has a trailing four-quarter earnings surprise of 20.19%, on average.

CPA has a market capitalization of $3.77 billion.

Copa Holdings, S.A. Price and EPS Surprise

Copa Holdings, S.A. price-eps-surprise | Copa Holdings, S.A. Quote

SkyWest: This Saint George, UT-based company engages in the operation of a regional airline in the United States.

SkyWest flaunts a Zacks Rank #1 and has a VGM Score of A. The Zacks Consensus Estimate for SKYW’s 2024 EPS has moved up 6.9% in the past 90 days. Its expected growth rate for 2024 is more than 100%. SKYW has a trailing four-quarter earnings surprise of 128.09%, on average.

SKYW has a market capitalization of $3.28 billion.

SkyWest, Inc. Price and EPS Surprise

SkyWest, Inc. price-eps-surprise | SkyWest, Inc. Quote

United Airlines: This Chicago, IL-based company provides air transportation services in North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America.

United Airlines currently carries a Zacks Rank #2 and has a VGM Score of A. The Zacks Consensus Estimate for UAL 2024 EPS has moved up 2.2% in the past 90 days. UAL has a trailing four-quarter earnings surprise of 32.34%, on average.

UAL has a market capitalization of $16.08 billion.

United Airlines Holdings Inc Price and EPS Surprise

United Airlines Holdings Inc price-eps-surprise | United Airlines Holdings Inc Quote

Alaska Air: This Seattle, WA-based company operates airlines. Anticipating air-travel demand to be rosier given the presence of the summer holiday period, ALK issued bullish EPS guidance for second-quarter 2024 after posting a loss in the first quarter of 2024. ALK expects second-quarter EPS between $2.20 and $2.40. To meet the upbeat demand, ALK is boosting capacity. The company expects available seat miles (a measure of capacity) to increase in the range of 5-7% in the second quarter of 2024 from second-quarter 2023 actuals. Adding to the bullishness, management lifted its 2024 EPS between $3.25 and $5.25 (earlier guidance was in the $3-5 range).

Alaska Air presently carries a Zacks Rank #2 and has a VGM Score of B. The Zacks Consensus Estimate for ALK’s 2024 EPS has moved up 1.5% in the past 90 days. Its expected growth rate for 2024 is 3.53%. ALK has a trailing four-quarter earnings surprise of 22.68%, on average.

ALK has a market capitalization of $5.27 billion.

Alaska Air Group, Inc. Price and EPS Surprise

Alaska Air Group, Inc. price-eps-surprise | Alaska Air Group, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

:max_bytes(150000):strip_icc()/roundup-writereditor-loved-deals-tout-f5de51f85de145b2b1eb99cdb7b6cb84.jpg)